Colombia Leads the Gender Bond Market in Latin America & the Caribbean

Colombia is one of the countries in Latin America and the Caribbean (LAC) that has seen the most rapid progress in terms of sustainable investment, pushing key regulations and leading truly innovative transactions in both form and substance. Several examples could be cited. However, the celebration of Women's History Month gives us the opportunity to focus on a still nascent asset class in which Colombia is leading the region: gender bonds.

This type of social bond is an innovative instrument to help close gender gaps, yet it has not been fully used to date. Out of the more than $300 billion issued in sustainability-linked debt, only about $35 billion (less than 12%) carry the gender label, according to Bloomberg data. Gender bonds fall under the umbrella of Gender Lens Investing (GLI), a type of investment that, in addition to financial returns, seeks to generate social returns by advancing gender equality.

These lenses may come in three different forms: a first lens focuses on investing in companies that promote women's leadership in their own organization, from the workforce to management and/or the board; the second lens invests in businesses or companies that are owned and/or managed by women; and the third lens seeks to invest in companies that create or develop products and services that improve women's lives.

Gender bond issuances are still taking their first steps. Since the first transaction was launched in Japan in 2013, only 30 issues took place, two-thirds of which were since 2020. In terms of private sector issuance, Canada and Australia were the pioneers—developed countries whose objective was to promote the first lens, i.e. female leadership in companies.

In emerging countries, the issuance has been more focused on the second lens, promoting access to finance. From an issuer standpoint, it should be noted that a few have even launched more than one deal: the Asian Development Bank (ADB) (4), Impact Investment Exchange IIX (3), Mexico's Fonacot (2), and the World Bank (2).

The first gender bond issuance in the region took place in Panama in 2019. IDB Invest supported Banistmo, Bancolombia's subsidiary in Panama, during the issuance process and fully subscribed the bond. Banistmo raised $50 million to expand financial access to companies led/managed by women.

Only twelve months later, Colombia launched the second one. In this case, Davivienda issued the world's first gender bond with incentives and raised $100 million fully subscribed by IDB Invest to support women-led or -owned companies and the purchase of social housing. Other issues supporting women microentrepreneurs have followed: Banco W in November 2020 ($40 million fully subscribed by IDB Invest), Bancamía in June 2021 ($32 million with partial guarantee by BBVA Colombia) and Mibanco a few weeks ago ($28 million with IDB Invest as anchor investor mobilizing nine additional ones, which are mainly local institutional investors).

Banistmo’s transaction and Panama’s leadership set the stage for other countries in the region to follow: Mexico, with Fira (2020), IDB Invest (2021) and Fonacot (June and September 2021); Chile, with Fondo Esperanza (2021) and Santander Chile (2021); and Peru, with Caja Arequipa (2020).

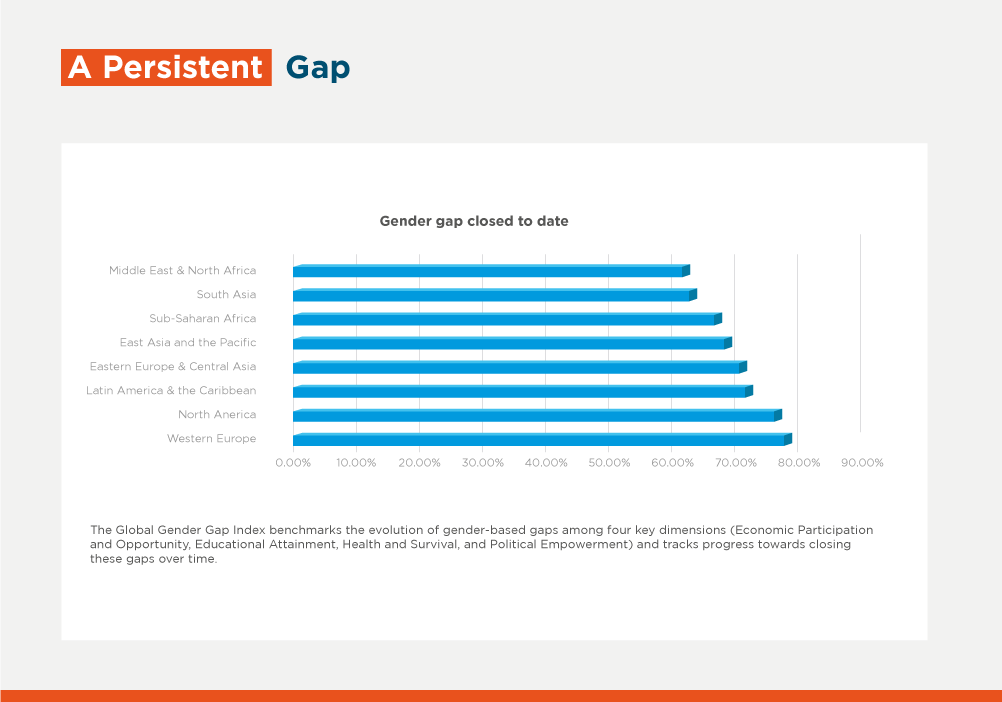

All this has made Colombia a regional leader in gender bonds. Unsurprisingly, the country has advanced considerably in all sustainable finance-related aspects, although progress in gender equality has stagnated during the pandemic, as evidenced in other emerging countries and the region itself, according to the latest Global Gender Gap Report of the World Economic Forum in 2021.

Compared to other countries in the region, Colombia would rank in the middle (position 15 out of 26) in terms of gender gap. In the area of economic opportunities for women, the gap to be closed in Colombia is 29%—a favorable figure vis-à-vis the 36% LAC average. In the labor market, women hold 53%-54% of law-making, senior official, manager and technical worker positions. They are well represented in mid-management levels, and this will help them take a leap forward to higher positions, where today they are barely present —13.5% at boards of directors and 18.9% in top management.

In entrepreneurship, however, women stand out over men: 66.3% of small businesses are women-owned and -led, versus 33.10% which are led by men, according to data from the Women’s Entrepreneurship Report 2020/21. They have an entrepreneurial spirit, but access to financing remains a challenge for them, according to the 2021 Global Microscope for Financial Inclusion report, prepared by The Economist Intelligence Unit in collaboration with IDB Lab.

While Latin American women, in general, and Colombian women, in particular, are entrepreneurs, they are most likely driven by survival. They are the ones who open most businesses, but also the ones who need to close them, especially now as a result of the volatility and crisis provoked by the pandemic. They need more and better access to financing to reverse this high business mortality and grow, while maintaining and strengthening the positive impact their business has on the local communities in which they operate. It is important to find adequate resources and live up to their aspirations, skills and dreams, as these women work hard to achieve a better future for themselves and for all those around them.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe