A Few Very Good Reasons to Protect the Integrity of Gender Bonds

Over the last 5 years, Latin America and the Caribbean (LAC) has seen a 2% decrease in the gender gap, according to the Global Findex 2021. However, the region still faces considerable disparity challenges. From a business perspective, only one third of MSMEs are women-owned or -led companies, with an estimated financing gap amounting to nearly $100 billion.

Several investment vehicles can be used to close this gap, including private debt funds, exchange traded funds (ETF), private debt loans and bonds. Of all these, the fixed income market has the largest available pool of capital, representing a critical path to promote gender equality.

Related content

- Switching Lenses for Development: How to Use Gender-Lens Investment for Equality

- Inclusive Procurement 101: How to Integrate Women into Supply Chains

Gender bonds offer a promising capital market solution to mobilize funds towards projects that help accelerate parity. In line with the best market practices and financial regulations, gender bonds follow the social bond principles established by the International Capital Markets Association, contribute to the United Nations Sustainable Development Goal 5 (SDG 5), and are verified by independent entities, known as second-party opinions.

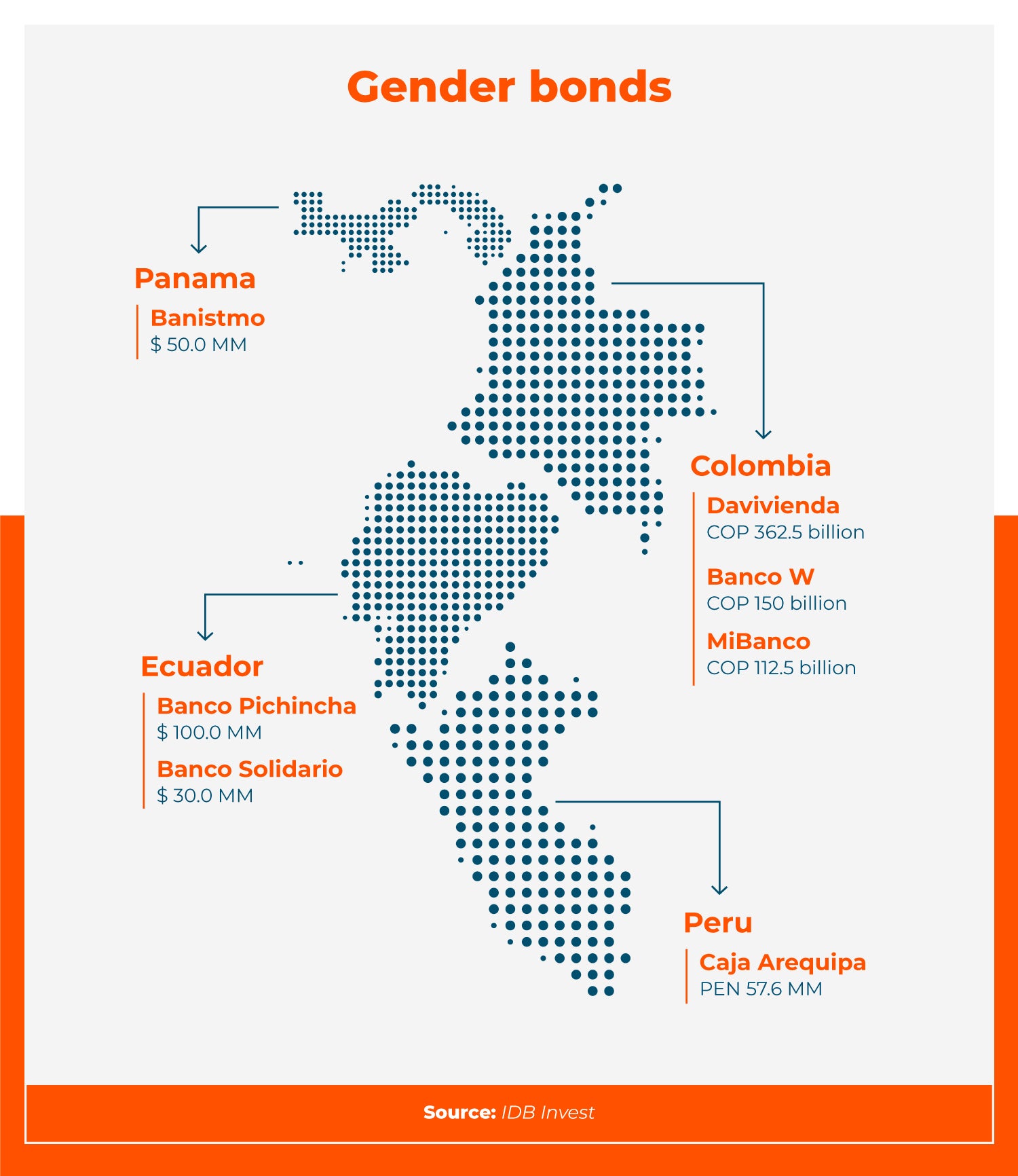

Latin America and the Caribbean has become a leading region in gender bond issuance aimed at bolstering women’s empowerment. In 2019 Banistmo issued the first gender bond in the region, to finance women-led MSMEs in LAC. On the following year, Davivienda issued the world’s first gender bond with outcome-based incentives.

By the end of 2023, LAC had 26 gender bonds amounting to $2.25 billion, with Mexico, Chile and Colombia as leading markets. IDB Invest has accelerated the growth of the gender bond market by supporting the first issues with technical assistance, engaging in several investment initiatives, mobilizing additional investors and promoting best practices, and even structuring its own issuance in Mexico.

IDB Invest has supported seven issues in the region, mobilizing more than $350 million towards women-led MSMEs.

Preventing "pinkwashing"

Although still in their infancy, gender bonds can create a great opportunity to close gaps. To this end, these financing instruments should remain standard-compliant and provide certainty and transparency, while mitigating the “pinkwashing” risk (false or misleading statements about the social benefits of women-focused projects).

According to the Luxembourg Stock Exchange, there were 169 gender-focused bonds globally at the end of 2022. However, 50% of them allocated no funds to women initiatives and only 40 were fully earmarked for women.

Any violation of social integrity could have devastating consequences for the emerging gender bond market. One way to mitigate this risk is by introducing financial policies that provide a certain level of clarity to the market, such as Mexico’s Sustainable Taxonomy, the first global public financial policy tool that encourages investments in gender equality initiatives. Another measure that can help investors mitigate this risk is to target specific segments, as it facilitates reporting and makes information clear.

IDB Invest promotes the development of a gender bond market that prioritizes women-focused initiatives and follows the best market practices. We provide advisory services and support to help issuers create robust frameworks, navigate regulatory compliance issues, taxonomies and market requirements, and design risk management systems as well as gender and diversity strategies.

By prioritizing gender equality, organizations can differentiate themselves, meet their social goals and satisfy the growing demand for investors in this area. Gender bonds are ideal to meet these financing needs.

To maximize the impact of gender bonds and mitigate the “pinkwashing” risk, a market focused on advancing equity and based on robust transparency standards needs to be developed. Let us not forget that achieving gender equality is a fundamental development goal for LAC that concerns all people.

Latest posts

- Sharing knowledge, key to transition to a sustainable economy: our experience in Mexico

- How Can We Advance Gender Equality in the Private Sector? Financial Incentives May Help

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe