Advancing Gender Equality with Incentives that Work

You heard of Google, right? The company is remarkably successful at retaining talent by offering its employees a wide array of incentives, including one that may come as a surprise: if an employee dies, his or her partner keeps getting half the salary each year for a ten-year period.

While this may seem an extraordinary example, social science theory suggests that bonuses, awards and incentives increase employee performance and commitment to corporate goals. What about you? If you were offered an incentive package for completing an assignment differently or try a new approach, would you do it? According to a study, performance incentives are directly related to employee’s productivity and to drive demand; that’s why they are widely used today, and in the world of development finance we are no exception.

Incentives play a particularly important role in solving market failures, such as market inertia. Inertia in that sense is the reluctance to change in an organization, resulting from doing business the same way as “always” because it has worked rather than thinking about alternatives that might deliver even better outcomes. This mindset is likely to slow down gender equality in Latin America and the Caribbean.

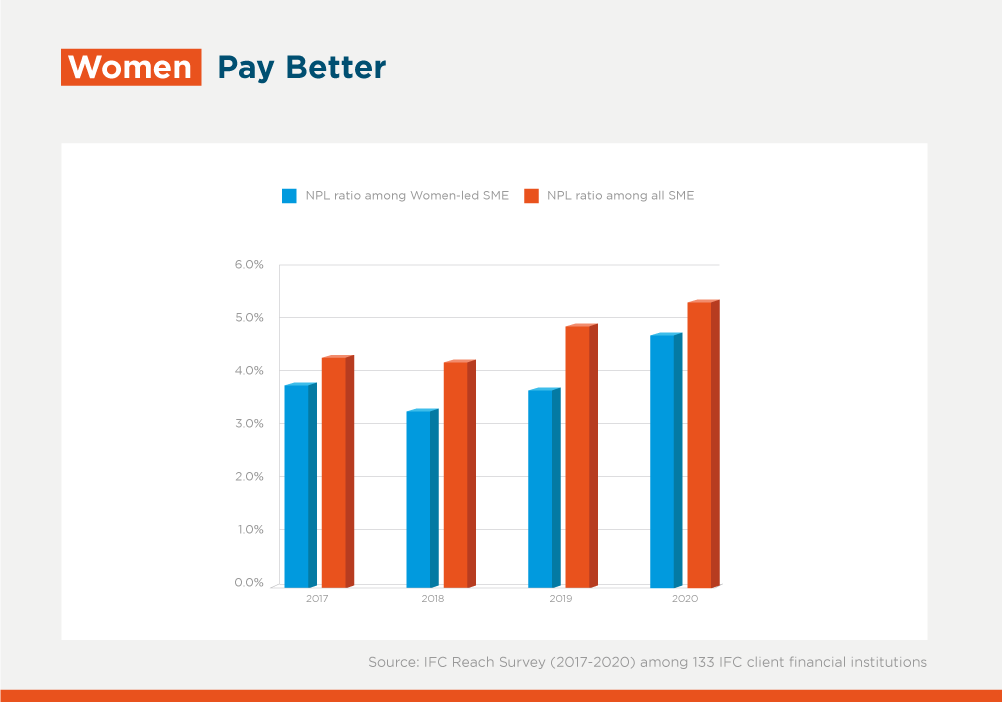

When it comes to banking many studies suggest that women do better in terms of default rates and tend to be loyal customers and cautious investors. According to a study conducted by Financial Alliance for Women and a World Bank division, women exhibit higher saving capacity, are more loyal and present a smaller non-performing loans (NPL) ratio on their debt repayment obligations. Another study among 133 financial institutions found that, despite the impact of Covid-19, women small and medium sized enterprises (SMEs) presented a lower NPL ratio than men (4.6 vs 5.3).

Despite this, and when it comes to women as potential clients some financial institutions still place women at a disadvantage due to their historical lack of collateral, credit history and risk profile, as well as potential unconscious bias in the credit application process.

Another market failure that concerns us with regards to gender equality is information asymmetry, i.e., market players that possess different levels of information about how to successfully tap into the women SME segment. For financial institutions, this knowledge gap on how to attract women-led businesses and turn them into clients can result in missed business opportunities due to the lack of understanding of the financial and non-financial products and services that women need. That’s why advisory services that fill this knowledge gap are crucial to help overcome these information asymmetries.

Since 2019, IDB Invest has been offering clients an investment package that includes performance-based incentives and advisory services to increase the number of women entrepreneurs with access to financing with the support of the We-Fi initiative (Women Entrepreneurs Finance Initiative). As a result, we have structured eight transactions with commercial banks, corporates and fintechs so far. Our experiences in combining incentive and advisory services demonstrate that our clients are (a) motivated to try new ways to expand their women SME segment, hence, overcoming market inertia and (b) willing to listen and learn from their (potential) clients to offer better products. This can contribute to closing the information/knowledge gap.

Why the combination of incentives and advisory services is still necessary to help improve gender equality becomes evident as we come across cases like the one published by the Financial Times. During the pandemic, an entrepreneur named Patricia applied for a bank loan to keep her coffee shop afloat in Chile, while Juan, an entrepreneur in a similar situation, also applied for a loan for the same amount. The loan officer at the local bank reviewed both applications. Who stood a better chance of approval? Juan did, just because he was a man.

This experimental IDB study, involving actors and actresses, as well as surveys among loan officer, shows that gender gaps still have profound implications not only for women entrepreneurs in one of the hardest-hit regions by Covid-19, but also for banks’ and investors’ profitability. The study showed that male-female differences in approval rates can be up to 32 percent larger.

Identifying access gaps and understanding women’s financial needs (product types, terms, sectors, geographic areas) are key to design relevant value propositions for women entrepreneurs. Advisory services include recommendations to address the segment positioning and integrate metrics and goals in the portfolio monitoring plan, as well as training workshops to help executive, commercial and risk teams provide unbiased service to women entrepreneurs who approach the institution. Together with the gained knowledge from the advisory services the incentives can provide a powerful motivation to our clients to offer more and better financial and non-financial services to women entrepreneurs.

There is still a long way to go in terms of achieving greater equality in women's access to financing, but as a poet once wrote, “with every step you build the path.”

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe