Innovation Boosts Productivity, Wages, and Sales in the Caribbean

If innovation is so important, why do many economies in Latin America and the Caribbean underinvest in it?

The 2023 Global Innovation Index shows that nine Latin American and Caribbean countries perform below expectations on innovation, and even the leading country ranks 49th out of 132 economies. In terms of innovation and developing innovation ecosystems, the Caribbean, in particular, lags behind other regions of the world.

Boosting private sector innovation in the Caribbean calls for a better understanding of what drives firms to innovate and what holds them back from doing so. A recent study by IDB Invest and FinDev Canada does just this by analyzing data from over 1,000 firms across seven Caribbean countries collected through Compete Caribbean’s Innovation, Firm Performance, and Gender survey in 2020, in the midst of the pandemic. The study also explores the link between innovation and firm performance and how innovation shaped firm responses to the disruptions brought by the crisis.

To start, who are the innovators, and how are they innovating?

Perhaps unsurprisingly, large firms are more likely to innovate than their smaller counterparts. Likewise, firms in the services sector tend to be more innovative than those in manufacturing.

Only 20% of firms in the sample innovated, meaning they introduced a new or significantly improved product, service, process, method, or distribution channel. Introducing new products (16%) and new production or distribution techniques (15%) were the two most frequent ways for businesses to innovate.

Approximately half of these companies developed their own innovations, while about one-third adopted market-ready innovations. Similarly, roughly half of companies funded their own innovations. Finally, businesses led by women were just as likely to innovate as their male-led counterparts.

Next, the study looked at how innovation affects firm performance.

Echoing the wide body of evidence on this topic, the results confirm that investing in innovation pays off in terms of higher productivity, wages, and sales.

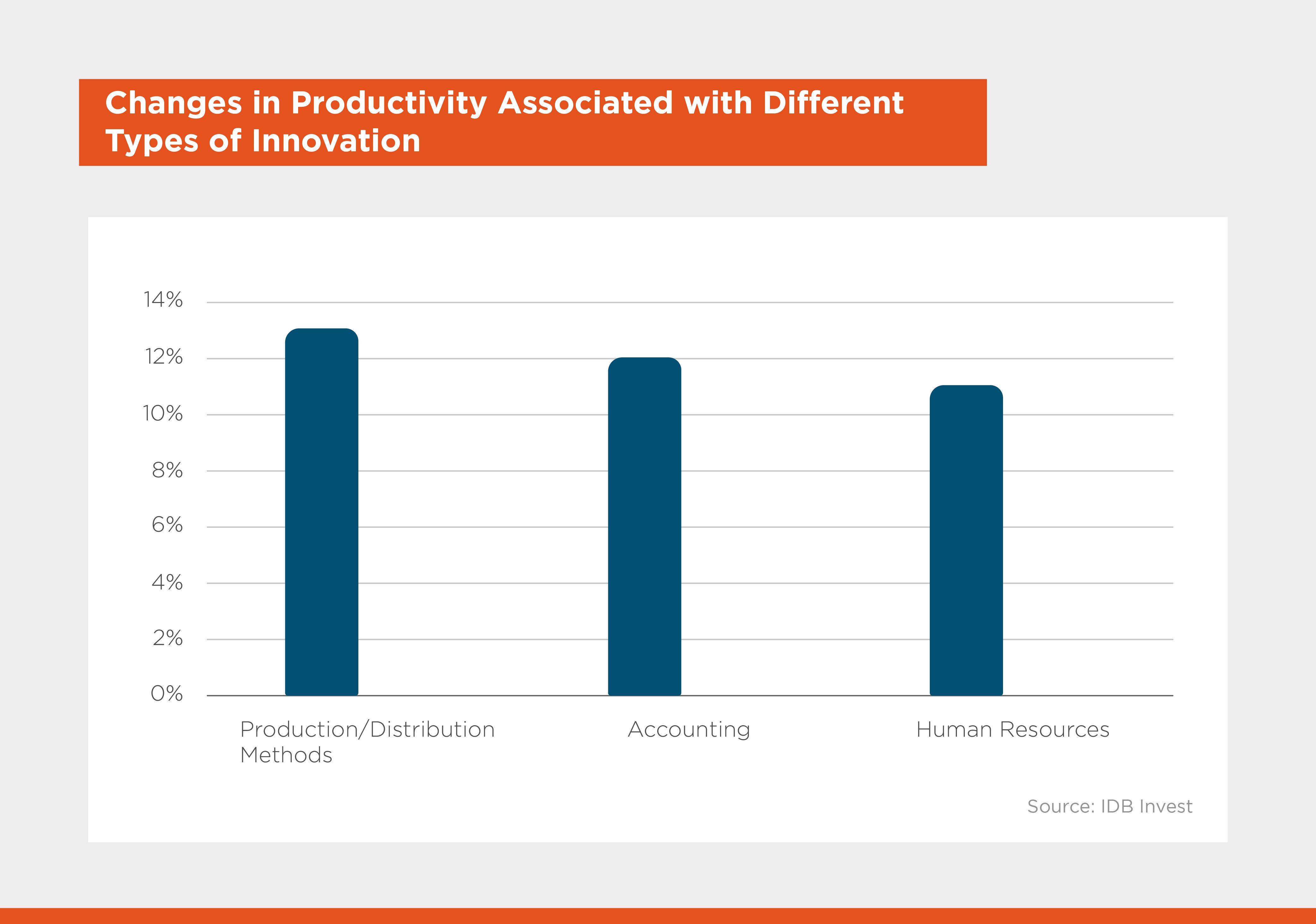

For instance, companies that focused on introducing innovations in their production or distribution methods saw the largest total productivity gains (13%), followed by innovations in accounting practices and human resources. Similarly, firms that invested in innovations related to distribution/logistics or production methods improved productivity in terms of sales per worker by 74% and 49%, respectively.

Source: Acevedo et al. 2023, Innovation and Firm Performance in the Caribbean.

Innovation drives productivity and economic growth. It can also make companies more resilient in the face of crises. Think about how many companies were forced to pivot to new ways of doing business to survive during the pandemic, which hit the Caribbean region particularly hard.

This underscores just how critical innovation can be for firms’ survival. Faced with major disruptions to global supply chains and the tourism industry, Caribbean companies that could innovate and adapt their business models—for example, by shifting focus to clients in local markets—were better off.

Despite the potential productivity gains and other benefits of innovation, many Caribbean companies still feel innovation is an uphill battle. To better understand why, we dug into the main barriers to innovation among Caribbean firms, comparing responses collected before (2019) and during the pandemic.

The lack of workers with the skills needed to implement innovative practices is the top obstacle to innovation, becoming even more acute in 2020. After the pandemic, about 90% of firms considered it a major constraint. At number two, 87% of firms in these small and island countries perceived their small market size as a significant constraint to innovation during the pandemic, up from 69% in 2019.

In 2020, 80% of businesses cited limited access to financing for innovation as a significant challenge, up from 60% in 2019. Most companies use their own resources to finance innovation, such as adopting new technologies or processes, with wide disparities by size: only 24% of small firms report self-funding innovation versus 71% of medium and 82% of large firms. Few, mostly large firms, take out loans specifically to fund innovation (20%).

These findings reinforce the idea that financial services for innovation in the Caribbean are underdeveloped. There was also a big jump in perceptions of the cost of innovation pre- and post-pandemic, from 26% of firms to 78% of firms citing this as a major constraint.

Innovation is clearly an ongoing challenge for many companies in the Caribbean. By working to break down these barriers through building workforce skills, increasing support for small business innovators, and expanding access to financing for innovation and other actions, we can help more companies pivot towards being more productive, have better profits, offer higher wages, and be more resilient in the face of crises.

For more details, see the study by Acevedo et al. 2023, Innovation and Firm Performance in the Caribbean, which is part of IDB Invest’s Development through the Private Sector Series. The results of this study are also summarized in this DEBrief.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe