ESG & Climate Risks in the Financial Sector: Private & Public Sector Opportunities

The financial sector plays a unique role in allocating scarce resources in every corner of the economy; from that perspective, it could also be a catalyst for sustainability and inclusion. Many actors within the sector believe that a sustainable approach is key to their future, but they do not know the best way of being "sustainable".

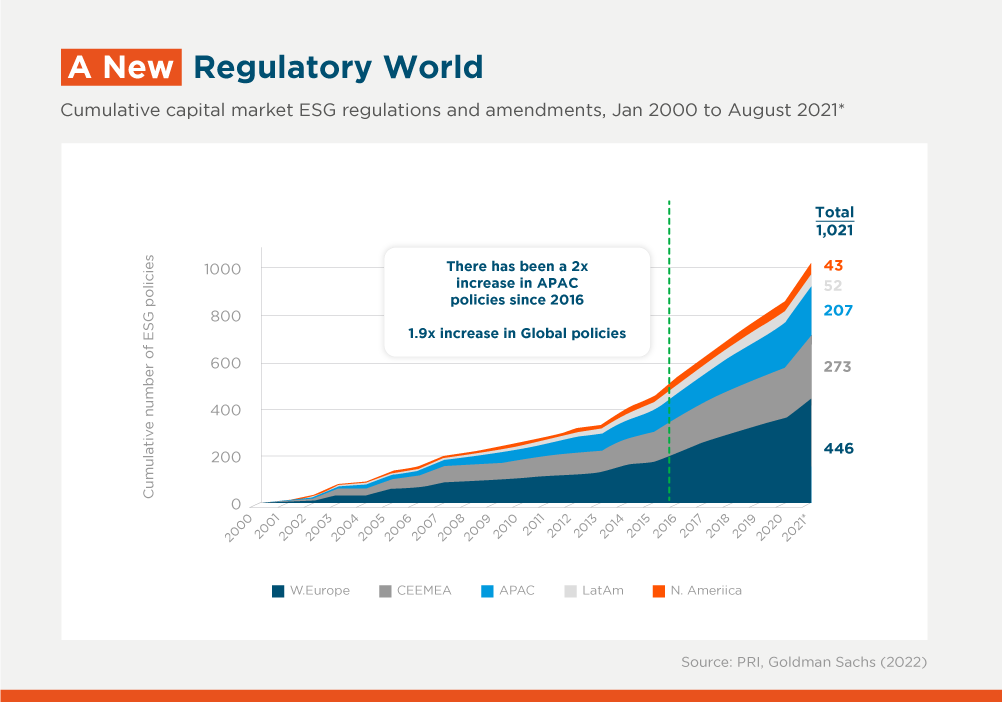

On the other hand, regulators are also moving toward standards proposals that will generate incentives for financial institutions to adequately disclose Environmental, Social, and Governance (ESG), and climate-related risks for enterprises and the financial sector.

It is fundamental for the financial industry to have a more proactive role in sustainability than it has had in the past. For too long, the idea of "do-no-harm" has dominated, but that idea is no longer valid given the scope of the problems we face in terms of ESG risks stemming from a myriad of factors (climate change, desertification, mass migrations, wars), and the opportunities arising, including the rapid growth of sustainability-driven investments.

To this extent, the financial sector must identify opportunities to contribute to society and create business models and strategies that consider ESG risks, returns, and impact in the broader sense. When we talk about impact, we refer to sustainability moving beyond "do-no-harm" into "can-do" mode. Concrete actions from the financial sector can mitigate ESG risks in the broadest sense. Let us go through some examples from the Social and Environmental aspects from ESG.

Take the case of gender impact, a frequently found social factor (the "S" from ESG). We all know that gender discrimination remains in Latin America and the Caribbean (LAC) and elsewhere. One great way to create a positive impact is through programs launched by banks to support women's businesses. The examples of financial institutions offering such products are more common. For instance, BHD Leon, a Dominican bank, offers its Mujer Mujer Program; BAC, a Central American bank, created its Mujer Acelera program.

Net-zero emissions are another example of how banks could generate impact. These actions are related to the "E" in ESG. As we move beyond the basic idea of trying to save resources and re-use materials, private banks are actively pushing the agenda towards net-zero. Furthermore, many of the region's banks have subscribed international agreements, showing that net-zero banking is now a thing. For instance, Colombia's Bancolombia, one of the largest banks in the country, is a pioneer in this topic, subscribing to the agreements, disclosing its environmental risks, and taking concrete action towards net-zero. Disclosure is a relevant topic that ties the financial industry and the regulators, creating a conundrum where private and public sectors meet.

Regulators and standard-setting bodies around the globe are moving fast. As recent as March, 2022, the International Financial Reporting Standards -IFRS- through its new International Sustainability Standards Board (established at COP26) launched a consultation for two proposals that create a comprehensive global baseline of sustainability disclosures. One of the standards focuses on general sustainability-related disclosure requirements, while the other on climate-related disclosure requirements. These standards align the work of the Climate Disclosure Standards Board, the International Accounting Standards Board, the Value Reporting Foundation (house of the SASB Standards), the Task Force on Climate-related Financial Disclosures (TCFD) and the World Economic Forum.

The proposed standards are a historic effort to create objective, material, trustable, quantifiable information on the financial services industry's environmental, Social, and Governance, and climate-related factors. To achieve such a challenge, ISSB calls for international collaboration (local regulators and financial authorities, and, of course, the financial sector) to develop a global baseline for a consistent disclosure system for ESG. The work of regulators is collaborative with the private sector, showing the need for impact. Now, disclosure is relevant for the financial industry because it is the only way to guarantee that investors and financial institutions allocate resources sustainably, responsibly, and efficiently.

The region's regulators are also working toward consolidating specific public policies for greener and more sustainable financial sectors. Colombia, for instance, recently created a green taxonomy to classify assets and economic activities that might contribute with the objectives and compromises that the country established. This measure was the last of a series of policies, including adopting ESG criteria and disclosure, and a framework for issuing sustainable financial instruments, that was finalized with the issuance of a sustainable sovereign bond.

In another concrete example, Chile established a sustainability roundtable to implement a Road Map for climate finance. The country also issued a regulation on ESG disclosure, pretty much aligned with SASB standards, and recently issued the world's first bond tied to sustainability. As the examples of Colombia and Chile, many other countries embrace the ESG opportunity with blue bonds in the Caribbean, regulations in Brazil, Honduras, or Paraguay. Many of these efforts accounted for the support of the Inter-American Development Bank.

Recently, we supported a group of students from University of Columbia in producing a Capstone Project denominated "Guidelines for Sustainable Finance: Disclosure and Regulation in the LAC Region". The document compares the regulatory gaps for disclosure in Brazil, Chile, and Colombia against the European Banking Authority standards.

For the foreseeable future, IDB and IDB Invest, in a partnership with Global Reporting Initiative, will report a document on guidelines for disclosure in the capital markets. Through data from investors, issuers, and regulators, the document analyses the perceptions from these actors and involves regulatory gap analysis and recommendations for both private and public sectors.

Although the regulatory burden might seem rather exhausting, public policies are creating the ground for enabling and scaling sustainability. At IDB Invest we support our clients with a comprehensive value proposition that helps them with financial products and advice accompanying them on their "sustainability journey” to create impact. We are helping them do the right thing: proper preparation for disclosure, and regulations, and taking advantage of the opportunities.

We know that most of the financial institutions in the region are already acting proactively to create disclosure and to seize the huge opportunity from sustainability. The transition for all of us will be easier with clear rules to end with the "do no harm" concept and move to more "can-do" in the region. In the end, both public and private sectors are paddling in the same stream to an identical goal.

This blogpost is published in connection with IDB Invest Sustainability Week 2022, to be held between June 28 and July 1 in the city of Miami. Learn here how to register to participate, either in person or virtually.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe