Lessons from a Success Story: Private Port Operators in Latin America and the Caribbean

At a time of economic gloom, the role of private sector in the management of commercial ports in Latin America and the Caribbean (LAC) is a success story that provides lessons to ensure the supply of food and essential goods in the region.

Maritime transport is essential to the world’s economy as over 80% of the world’s trade is carried by sea, and LAC accounts for 7% of total container cargo worldwide, which roughly represents the region's share of global GDP.

However, most developing countries have been challenged with poor port infrastructure and management, leading to low productivity and expensive operations. The solution, since the 1980s, has been the rise of Public-Private Partnerships (PPP) that leave port authorities as owners, but put the private sector in charge of operations.

You may also like:

- El Hub, a new podcast for exporting SMEs

- How Can Latin America Attract Foreign Investment in Times of COVID-19

- How exposed is Latin America to the trade effects of COVID-19?

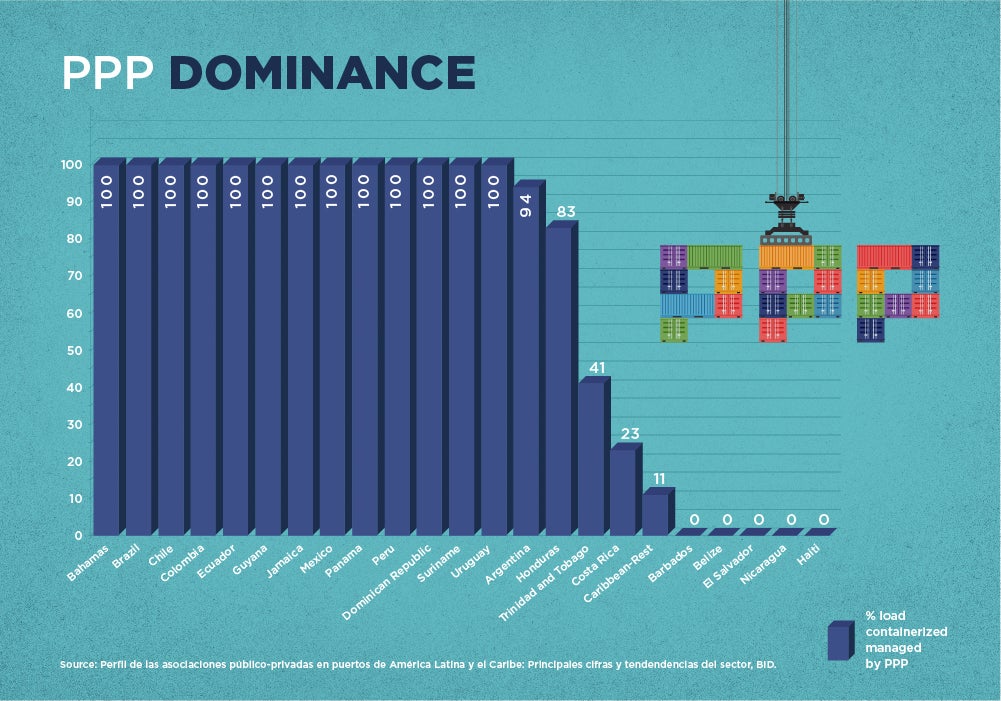

Across the world, PPP have proved themselves useful to address cargo containerization trends, shortcomings in efficiency and outdated infrastructures. LAC has been no exception: PPP are now the norm for multi-purpose or container cargo port terminals. 92% of TEUs in the region are moved from/to PPP ports, which account for 83% of container terminals in the region.

According to IDB’s estimates, in the last decade there has been an average of three new PPP port projects developed per year, typically landlord agreements on existing infrastructure implemented through competitive tendering processes. Until 2019, most PPP were financially self-sustaining, providing a revenue stream for governments from fixed or revenue based payments, thus generating fiscal space to address other public needs.

Private port operation has improved LAC's competitiveness through remarkable increases in efficiency and productivity in cargo management. Particularly, since the turn of the century, ports in Latin America and the Caribbean have increased their operational efficiency by more than 20%. Data shows private sector participation and port competition is correlated with higher levels of operational and economic performance, and better maintained ports.

As COVID-19 has battered economies, the leading role of the private sector in incorporating technological advancements will be key for ensuring safety in the terminals, protecting food security, the supply of essential consumer goods and trade. The pandemic has only heightened the need of technology to allow remote operation and autonomous computer control, and the private sector is well positioned to further deploy these advancements. Examples range from paperless and remotely stationed operations to automated crane handling, autonomous or remote pilotage, automated shuttling of containers and blockchain-enabled digital shipping platforms.

A key, well-known takeaway is that public sector projects aiming for private sector involvement must be structured through an adequate regulatory and institutional framework. They must also align incentives to maximize social returns. Risks need to be thoroughly identified and efficiently allocated – particularly since COVID-19 makes risk identification and management key for infrastructure projects.

Lessons learned from previous PPP indicate that robust technical teams on the public side are critical for the correct identification, structuring, tendering and implementation of projects and for ensuring high standards of asset performance and service provision. In fact, there is a close relationship between regulatory quality, compliance, government effectiveness and infrastructure efficiency.

Multilateral institutions also have a relevant role: not only in providing and mobilizing financing resources to these projects, but also in supporting governments. Evidence shows that multilateral financing increases the number of lenders of a project as well as the average maturity of syndicated loans, making them more affordable. Some recent examples are Puerto Antioquia in Colombia, Puerto Posorja in Ecuador, and Kingston Container Terminal in Jamaica (check out our recent case study on this project here), all financed by IDB Invest.

The past sheds light on the future: in the midst of COVID-19 and beyond, the role of the private sector – supported by robust public counterparts – is and will be more relevant than ever, and multilaterals will continue to have a key role in providing assistance, financing and mobilizing resources to successfully materialize these investments while maximizing social returns.■

LEARN HOW IDB INVEST CAN OFFER YOU SOLUTIONS HERE.

SUBSCRIBE AND RECEIVE RELATED CONTENT |

| [mc4wp_form] |

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe