Climate Shareholders: Corporate Climate Action using Blended Finance in Equity Investments

Let’s say you run a small or medium size company in growth stage. You’re probably thinking you shouldn’t yet be worrying too much about your corporate responsibility regarding climate change, right? Wrong.

Climate change has become one of the key drivers for business sustainability. To achieve significant progress in climate change mitigation and adaptation, companies of all sizes can adopt corporate actions such as measuring their carbon footprint, decarbonizing their internal operations and their value chain, identifying and reporting on their climate risks or reacting and adapting to these risks.

This is the right thing to do and is not a pipe dream for a company that is strapped for cash and looking to increase revenue at a fast pace. There are risk-capital products that can support the growth and competitiveness of companies with relevant socioeconomic and environmental impact in Latin America and the Caribbean (LAC).

These products can also improve the development impact of each investment by mobilizing private capital while influencing the adoption of better governance practices and social and environmental standards into companies. The idea is that, once these companies achieve scale, they can consolidate their market position and become agents of innovation. The faster these companies achieve scale, the more impact they can achieve if properly influenced by value-adding patient capital investors.

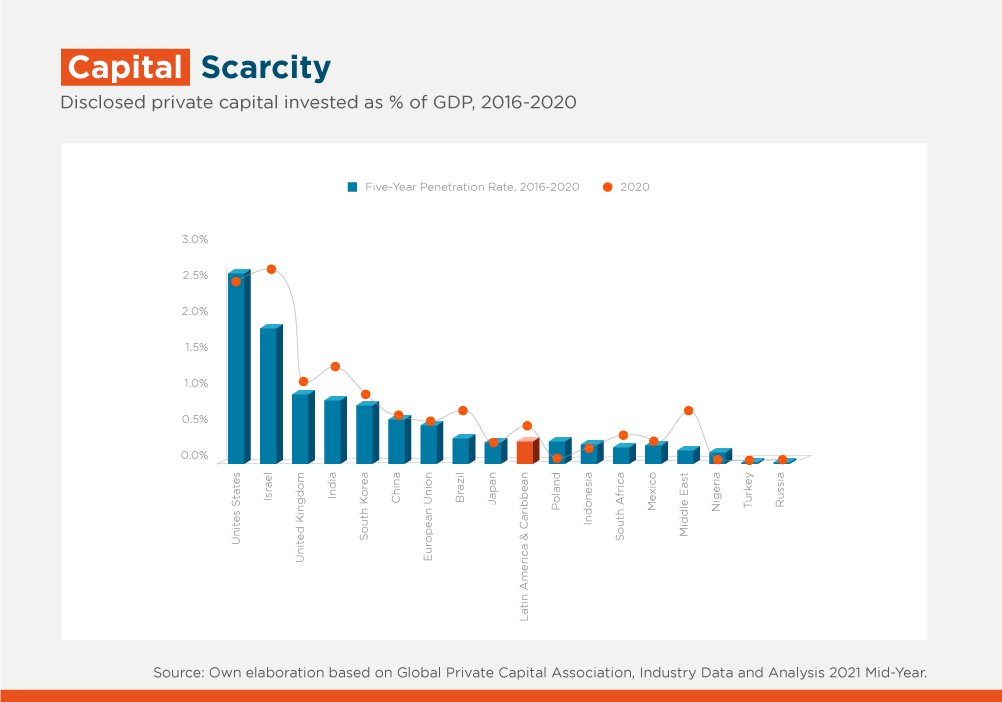

This matters because capital is scarce in developing regions like LAC: in spite of the recent growth of venture capital investment in tech, private capital activity in the region is still nascent compared to developed markets. The region has a five-year private capital investment penetration rate of only 0.24% over annual gross domestic product compared to 2.56% in the United States. In a context where bank lending is scarce, this translates into lower levels of productivity and employment.

In response, since 2018, IDB Invest has deployed over $100 million in equity investments to support the growth of ten companies in the technology, financial, energy, health, telecommunications, and retail sectors in LAC with a cross-sectoral approach to the digital economy.

Additionally, IDB Invest manages through its blended finance practice third-party concessional funds targeted at investments where real or perceived risks are too high for standalone commercial finance. These funds play a catalytic role to overcome barriers to access private capital in developing markets.

Going back to growth-stage companies, this is where the use of blended finance resources to invest in an equity round, together with other sources of commercial capital, may help address the main impediments to growth that companies with a high-impact potential face at that stage.

These impediments include: first, a lack of capital available to bridge the gap between early-stage investment and mature-stage financing; second, a lack of patient capital to support the company develop a solid business model, in a context where capital providers prioritize and incentivize quick growth; and third, the struggle of aligning the short-term growth needs of the business with its long-term impact.

Blended finance in direct equity investments can offer preferred returns to other commercial investors, signalling the opportunity and making it more attractive for them to invest, if there are real or perceived risks that they are not willing to take. Once a shareholder in a company, concessional funds can also be structured to offer incentives for the company to steer their operations towards corporate climate action, prioritizing the actions with the highest impact as the business grows. This approach makes companies stand out from the crowd too: LAC is still lagging in terms of corporate climate action if we look at the most relevant international standards.

In the last year, $11.5 million blended finance resources have been invested in 3 equity transactions involving IDB Invest, alongside $18 million from IDB Invest’s own capital and $104 million of external private investment.

As an example, in 2020, IDB Invest closed an equity investment in Cargo X, LAC’s largest trucking freight digital platform. Cargo X leverages technology and data to connect large shippers with small carriers in Brazil. IDB Invest invested US$9.9 million on its own account and $4.5 million with blended finance resources from the Climate Investment Funds (CIF).

The CIF investment included an incentive mechanism to give shares back to the company’s stock option plan upon the achievement of certain milestones, supporting the company’s commitment to the development of a robust methodology to measure the greenhouse gas emissions reductions derived from their business model through load consolidation and route efficiency.

With the development of this methodology, IDB Invest supported Cargo X to formalize their commitment to measure the largest risk on their business model, making it a strategic priority at a time of rapid growth as well as helping bridge an existing knowledge gap, providing a more rigorous framework for this growing industry.

IDB Invest’s investment structure in Cargo X showcases the value proposition that this approach brings to investee companies, leveraging IDB Invest’s signalling effect in the market by providing innovative incentives as a tool to increase corporate commitments towards climate action strategies and specific targets. Through these commitments, investee companies are not only better prepared to identify climate risks, but also to turn those risks into business opportunities in the long term.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe