Reigniting Women-led Businesses in the Caribbean with Better Access to Finance

It is no secret that despite their importance, micro, small, and medium enterprises (MSMEs) – accounting for 99.5% of firms in Latin America and the Caribbean, or LAC – face big hurdles in accessing the financing they need to innovate, invest, and grow. This problem is even more pronounced for MSMEs owned or led by women.

In the Caribbean region, women-owned/led firms tend to be on the smaller end of the MSME spectrum, with fewer employees on average. Moreover, recent evidence from the Caribbean suggests that women-owned/led firms were more negatively impacted by the COVID-19 pandemic relative to other firms.

Against this backdrop, what do Caribbean women entrepreneurs themselves have to say about what’s holding them back from accessing finance? A new report by the IDB’s Caribbean Department, IDB Invest, and Compete Caribbean analyzes self-perceived barriers to financial access using firm-level data for over 1,000 firms in 6 Caribbean countries, drawing on the Compete Caribbean enterprise surveys. Analyzing the data, we have identified the most persistent barriers faced by women-owned/led businesses versus their male-led peers. Additionally, we draw on examples of how the IDB Group is working to improve financial access for women-led MSMEs.

What are some of the main takeaways?

- Women-owned/led business are more likely to rely on short-term financing. Our data indicates that over the last 20 years, women-owned/led firms accessed approximately 20% of the volume of all short-term credit granted in each country (loans with a maturity less than three years). These include lines of credit, overdraft facilities, and credit cards. Importantly, they only accessed 1.3% of medium-to-long term loans over the same period. These short-term instruments also tend to have higher borrowing costs.

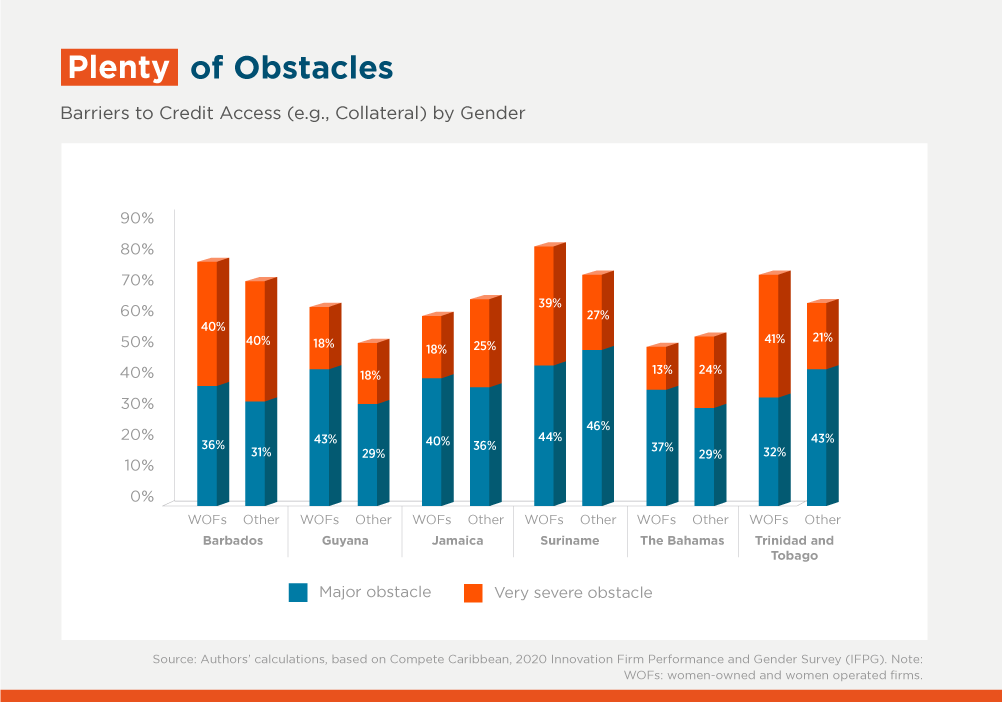

- Two-thirds of women-owned/led firms report access to finance as a major or severe obstacle to business. In most Caribbean countries, a higher proportion of women-owned/led firms cite barriers to accessing credit, particularly collateral requirements as a major or severe obstacle relative to other firms. This difference is most noticeable in Guyana and Suriname, where women-owned/led firms are 14 and 10 percentage points more likely, respectively, to have this view.

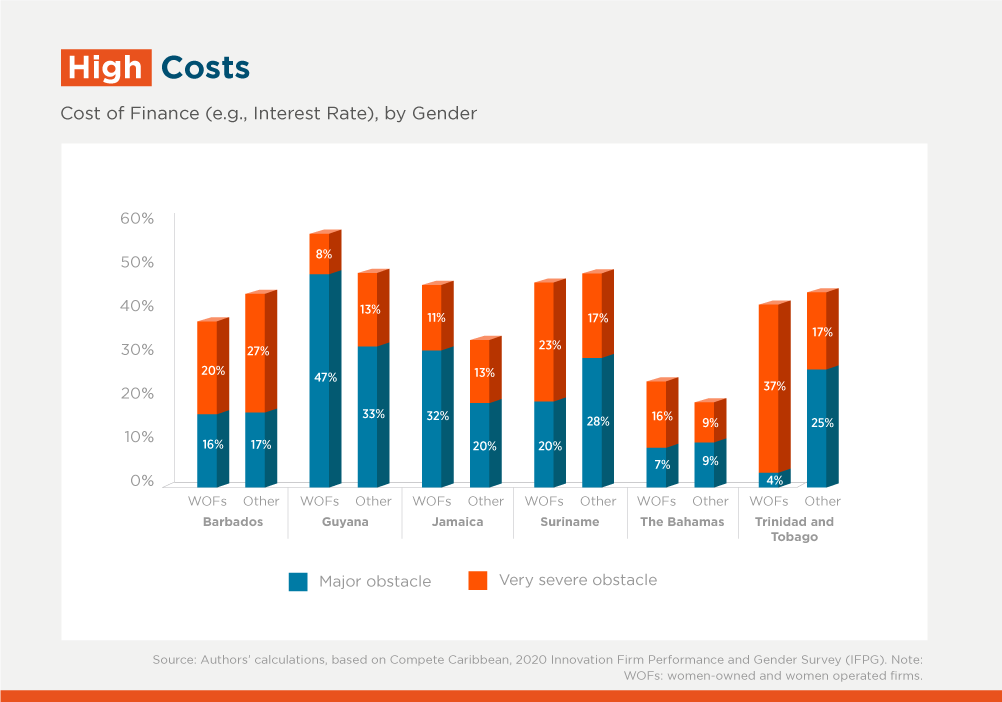

- The cost of finance also plays a role in overall financial development. 39% of women-owned/led firms view high interest rates as a major or severe obstacle to doing business. In Guyana, Jamaica, and The Bahamas a higher proportion of women cite cost of finance as a major or severe obstacle relative to other firms. Interestingly, in Barbados and Suriname where more women-owned/led firms cite access to finance as a major obstacle relative to other firms, the cost of finance isn’t the main reason. For example, 76% of women-owned/led firms in Barbados cite access to finance as a barrier, but only 36% say that the cost of finance is a hurdle. This suggests that other factors are at play, such as the terms of loans (tenor) and how they are structured, the ability to secure enough collateral, or a lack of capacity to successfully apply for and obtain business loans. Notwithstanding, overall, 31% of women-owned/led firms in the region that decided not to apply for a loan reported unfavorable interest rates as the reason (the highest single reason cited).

- Financial institutions can do more to boost the growth of women-owned/led firms. Multilateral and development finance institutions are working hand-in-hand with the financial sector to develop solutions to increase access to finance for women-owned/led firms. For example, the Women Entrepreneurs Finance Initiative (We-Fi) is an international alliance that aims to unlock financing and access to markets for companies owned or led by women. With financing from We-Fi, IDB Invest provided performance-based incentives and advisory services to help Banco Promerica in the Dominican Republic grow its portfolio of women-led SMEs. Initiatives like this can provide a model for future interventions seeking to expand access to credit for women.

By gaining access to finance, women-owned/led firms can overcome constraints that would otherwise prevent them from growing. We should continue to learn from interventions that have helped private financial institutions increase their financing of women-led SMEs, as they can serve as a blueprint for promoting more and better access to finance for women across the region.

For more details, see the July 2022 edition of the Caribbean Economics Quarterly, Finance for Firms: Options for Improving Access and Inclusion.

(Khamal Clayton and Monique Graham of the IDB’s Caribbean Country Department are also contributors of this report.)

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe