How to Create More Economic Opportunities for Women through the Private Sector

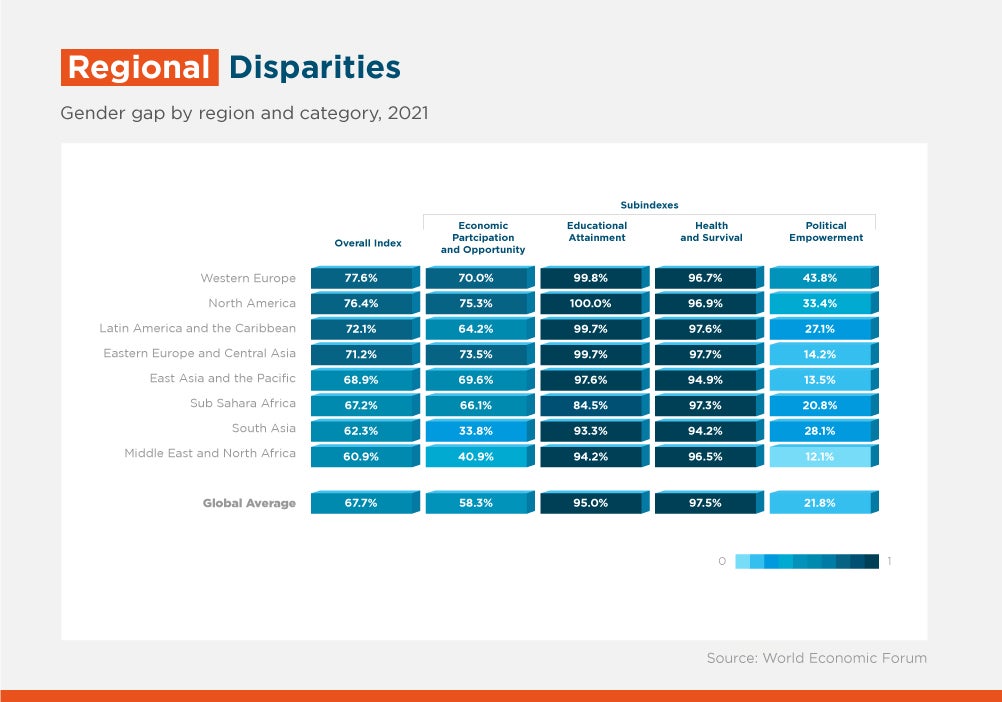

As we enter the third year of the pandemic, closing gender gaps in the economy remains one of the most urgent actions to ensure an inclusive growth. And Latin America and the Caribbean (ALC) is the hardest-hit region in the world in terms of job losses.

Accounting for almost 75% of jobs in the region, LAC's private sector plays a key role in reducing inequalities. It has the ability to level the playfield in giving equal access to economic opportunities for women, by creating jobs, and providing equal access to capital and new markets.

Gender equality is one of the five pillars of Vision 2025, the IDB Group’s blueprint to achieve a sustainable recovery and economic and social development in the region. Through a holistic approach, at IDB Invest we are supporting companies to achieve gender equity and create economic opportunities for women.

Our work is focused on creating employment and skills, promoting access to financing and facilitating access to markets for entrepreneurs in three ways:

1. Guiding companies to ensure that women have access to job opportunities

IDB Invest works with companies in the creation of diversity and inclusion strategies that pave the way for inclusive recruitment. It promotes more women in leadership positions, as well as fosters equal pay for equal work. In addition, through the use of blended finance, the Bank has motivated companies to integrate women in jobs where they are under-represented, such as science, technology, engineering and math (STEM).

Central Puerto, a power company in Argentina, created a gender action plan that has yielded tangible results: in 2021, more than 60% of job openings were filled by women. In New Juazeiro Brazil, where our client Atlas is sponsoring a renewable energy project, 10% of the workforce is female.

2. Promoting new financial instruments to increase access to finance to female entrepreneurs

As the pandemic forced 40% of women owned-led SME to exit the market, it is urgent to continue supporting women entrepreneurship.

Together with financial institutions, we are increasing access to finance to women owned-led businesses. We offer innovative financial instruments that allow our clients to see the added value of focusing on women. We guide them in identifying key untapped markets, seizing the business opportunity and creating a specific value proposition to respond to the need. Since 2016, we have invested more than half a billion dollars lending to women entrepreneurs through different financial intermediaries.

Beyond this so-called on-lending to women, IDB Invest has played a pivotal role in the creation of a new asset class in by launching the first gender bond in the region (Banistmo in Panama) and today, with 5 gender bonds, LAC is the region with the highest number of issuances.

3. Facilitating access to markets for women entrepreneurs

To achieve a sustainable economic recovery in the region, women owned-led business must access markets to sell their products or services.

Through its investments, IDB Invest seeks to open spaces for the participation of women's businesses in value chains. We are supporting our clients to create inclusive value chains by developing an inclusive procurement strategy to increase both the number of women-led enterprises (WSME) in their value chain as well as the volume purchased from them.

With our clients, we provide those WSME with specific support to grow their business and finance. For example, with advisory and blended finance, clients like Elcatex will increase their access to women entrepreneurs both in number of providers from 5% to 24% and in sale volumes from 24% to 40% in a 5-year period.

Beyond supporting our clients, as a development bank we focus on designing and implementing market-level solutions to advance gender equity. Over 1500 companies in LAC have used the WEP tool to assess gender equality. We bring leaders of the public and private sector together to advance on gender equity through the Gender Parity Accelerators. We bring cutting-edge trends in gender equality and tools that can be accessible to businesses to advance in gender equality. We intend to give the private sector in the region guidance and tools to advance in their journey.

We also believe in leading by example. Within IDB Invest, over 50% of our financed projects had a gender component in 2021. We are also one of just eight banks worldwide to be EDGE Move certified.

We recognize that there is still work to be done. We strive to become a more inclusive bank, not only in gender but in all dimensions of diversity, in our teams and in our investments. Equality needs everyone and we all have a role to play.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe