Eliminating Gender Bias from Lending in Mexico

A common belief is that women are more risk-averse than men. Paradoxically, many financial institutions see women as higher-risk clients, leading to less favorable credit offers compared to their male counterparts—smaller amounts, shorter tenors, and higher rates and collateral requirements. This means that women-led businesses face greater barriers to accessing the credit they need to manage and grow their business.

This is a loss for both women and the economy, as women-led businesses also tend to hire more women than male-led companies. Additionally, banks miss out on millions of dollars in profits, as we have confirmed with various financial institutions in the region. Part of the problem lies in the entrenched gender biases that affect lending decisions and the terms offered.

How can we unroot these deep gender biases in the financial sector? Fintechs may have an answer.

Fintechs have revolutionized the world of finance, enabling greater access to financial products and services. They have a big impact on inclusion, as they have huge potential to ensure equal, unbiased access to credit. Many fintechs rely on automated, sophisticated algorithms and mathematical models to make their lending decisions.

While algorithm fairness is not a given, a well-designed one with minimal human involvement in the decision-making process can eliminate the biases—related to gender, ethnicity or origin—that negatively affect the financing options offered.

This is the case of the Mexican fintech Konfío. As part of our work with the company, we audited their algorithm and concluded that there’s an identical credit offer for both men and women. In addition, we compared repayment behavior of the two groups and confirmed that it is identical. However, an equal credit offer for both men and women is the exception rather than the rule among financial institutions in Mexico and the rest of the region.

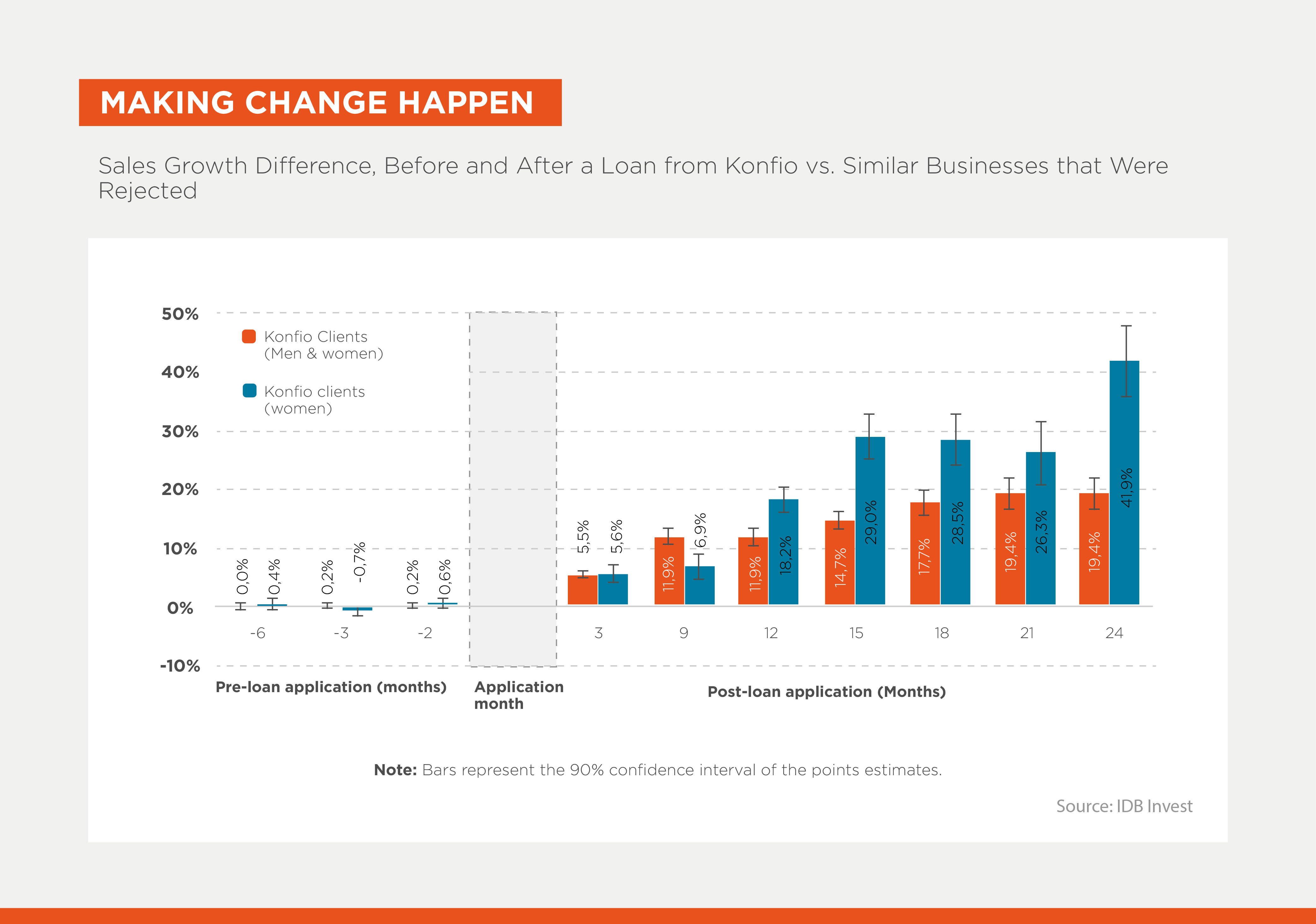

We’ve also worked with Konfío to estimate the impact of their lending on companies’ sales growth. We found that two years after receiving a loan from Konfío, companies’ sales growth was 19% higher than that of similar businesses whose application had been rejected. Among Konfío’s female clients, sales grew by more than 42% compared to similar women-owned businesses whose application had been rejected.

The question then is: Why is the growth rate more than twice as high when we only consider women-owned businesses?

Since it is often harder for women-owned businesses to access credit and, when they do, it is typically on less favorable terms, it is likely that the women-owned businesses rejected by Konfío experienced lower growth rates than the rejected male-owned companies, which likely had easier access credit elsewhere. In short, the large difference in sales growth among women is likely less due to Konfio’s female clients performing better, and more due to the other women performing much worse due to prevailing credit market constraints in Mexico.

This situation offers a unique opportunity for fintechs in Mexico and the region. If these financial service providers define a gender strategy from the outset and mitigate potential biases in their lending process, they will grow by attracting an underserved segment that is ready to make the most of these loans.

These gender-inclusive fintechs will have a unique advantage over their competitors, as women tend to be loyal customers. The provider that serves the women’s segment first is more likely to keep them in their portfolio.

If all financial institutions in Mexico and the region were able to remove gender bias from their loan offers, women-owned businesses could achieve their full growth potential, while driving the region’s economic growth without damaging financial institutions’ performance. It would be a win-win. There is nothing risky about that.

For more information about the study discussed in this blog, check out the DEBrief by Irani Arráiz (2023) “Boosting Business Growth while Leveling the Credit Playing Field for Women MSMEs in Mexico”.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe