Two Successful Models for Promoting Banking Digitalization: The Cases of Colombia and Peru

COVID-19 has left no doubt as to the urgent need to full digitalize banking services. The question now is how to implement the transition. The examples of Colombia and Peru show there are different ways of doing this, and all of them can work.

Digitizing banking is revolutionary for Latin America and the Caribbean (LAC). It does not mean simply optimizing existing, widely-available services (like in North America and Europe): rather, it includes a significant component of social inclusion by enabling the financial inclusion of a large segment of the population that does not yet have bank accounts but does have cellular phones.

In Colombia, the success of digital platforms like Nequi and DaviPlata offers a clear example of how private banks can optimize their services. Following a proven technology-based model, these platforms are effectively digital banks offering countless possible transactions. They collect so much information on their customers that they can form partnerships with other companies and offer personalized services: When you've collected all variety of information like how a person pays taxes and where they eat on the weekends, synergies quickly emerge.

You may also like:

- Sustainability, the vaccine for Latin America and the Caribbean economies

- Venture Debt Now Available! A New Financial Solution for High-Growth Firms In the Region

- Banking Agents, On the Frontlines of Financial Inclusion

Using the synergies, DaviPlata has formed a partnership with Rappi, a Colombian startup, as well as struck agreements with municipal authorities and several businesses and service providers to handle payments through the DaviPlata technology.

Launched several years ago, these platforms were already operating when the pandemic hit: Davivienda, the bank that owns DaviPlata, has provided financial inclusion to more than 2 million people using their cell phone numbers. It has been able to reach many people living in remote areas where the financial sector has no presence without them having to visit a branch or open a bank account. These banks had a certain advantage over the rest of the industry when COVID-19 struck, as social distancing that prevented the exchange of physical documents and money did not delay payments or obligations, and their platforms helped facilitate compliance with quarantines.

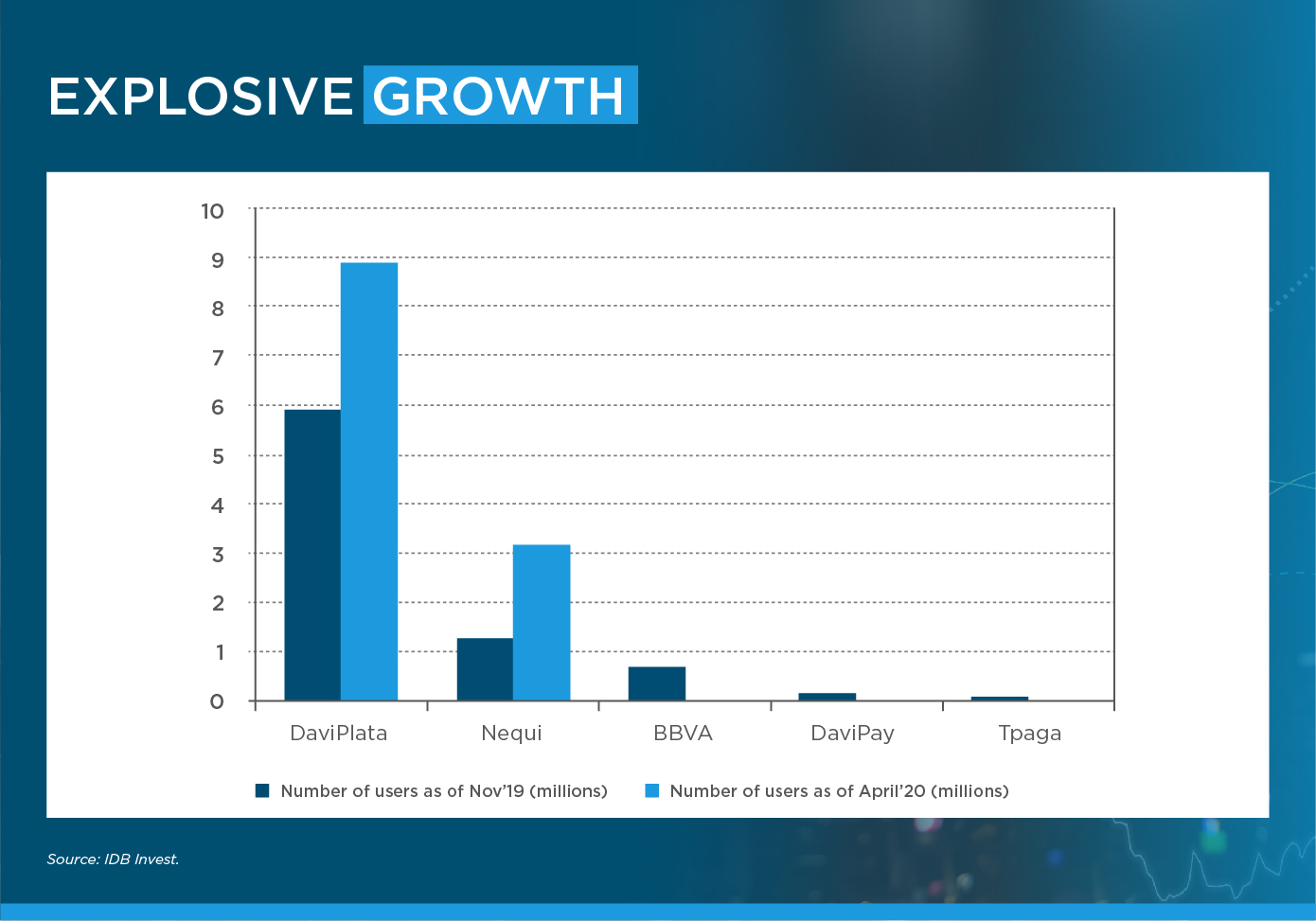

The platforms have enabled the distribution of pandemic aid and subsidies through cash transfers in which the recipient is identified only with their cell phone number. It's no surprise that, in this context, the number of users has skyrocketed: For example, figures through June show that the number of users registered with DaviPlata—Colombia’s market leader—increased 67% compared to December 2019, from 6 million users to 10 million.

In Peru, the market has developed more slowly than in Colombia, but with one big advantage: there, the banks have joined forces to create shared platforms—for example, PLIN—enabling better integration between the market’s various actors.

Another advantage of the Peruvian model is its scalability. All these steps forward in banking digitalization have helped increased inclusion of all sectors of society in the financial system, offering universal access to payment, credit, and other services. Ideally, this process should result in an "open banking" system in which the users, not the banking entities, are the owners of their data, including their credit histories, and can act as autonomous agents who can freely release the data to one entity or another to secure better terms.

A model that integrates a large portion of the sector from the beginning makes this transition easier, as financial entities are accustomed to sharing user data and to users being in contact with many entities through a single click.

The experience gained by the IDB Group as it studies these digital transition processes is available to everyone, and IDB Invest is preparing a series of seminars on how to encourage digital financial intermediation and transition to open banking. It should be borne in mind that these efforts will clearly benefit the financial sector as well as society as a whole.

In our own office, this year we used digital cellular phone-based platforms to help service providers—self-employed people like shoe shiners and hairdressers—by transferring pre-payments for their services while they were stuck at home. Thanks to digital platforms, they have been able to receive income at a very difficult moment for everyone.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe