Pushing boundaries with blended finance in Latin America and the Caribbean

Let’s consider for a moment the transition when bus fleets move to low-carbon technologies. Which manufacturers will take the first step in adapting their supply if none of the large cities in the region includes this as a requirement in their tenders? And, in turn, what cities will cross this boundary if no financial scheme exists that could reduce the cost gap and include an assessment of externalities in its proposal? This is precisely the role now played by concessional funds, together with the development banks’ own financing and their pulling power, allowing the change to happen where it was not possible.

Concessional funds are financial resources offered under more favorable terms and or conditions than those available in the market, if any. These are the funds that can propel the deployment of energy storage batteries in the region, lighting replacement schemes for more efficient street lighting in our cities or the new business models for distributed solar power, opening up affordable and sustainable access to energy in remote areas of our region.

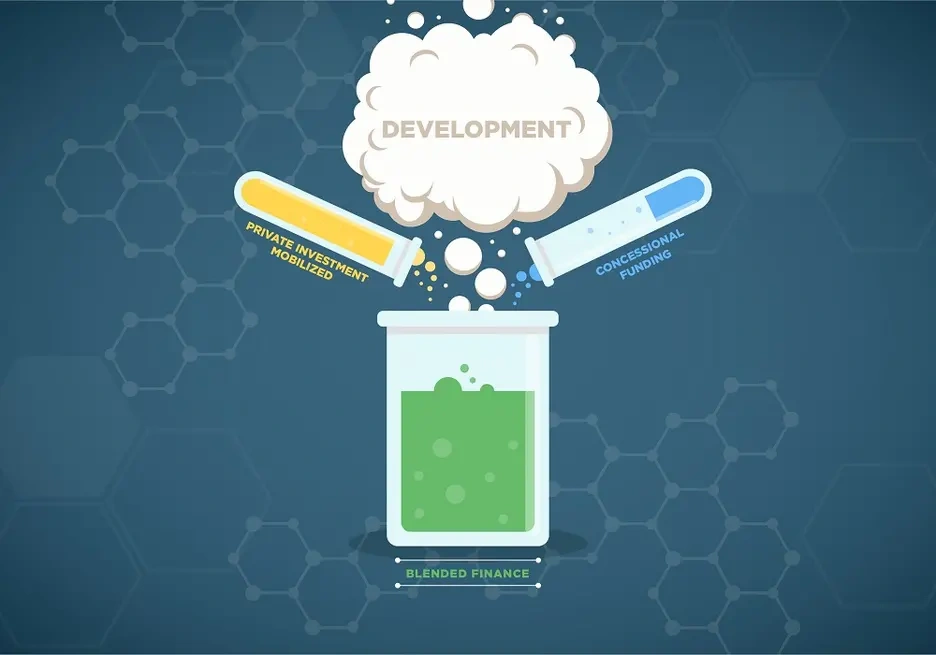

What we have now come to call blended finance is the targeted use of concessional funding in high impact projects where actual or perceived risks are too high for commercial finance alone. For instance, a project may be sound economically but struggle to access commercial capital because of lack of familiarity in a given technology, limited market track record, uncertain revenues stream or inadequate contractual arrangements.

IDB Invest uses blended finance to pilot, replicate and scale innovative business models and new technologies to deliver development and social impact in Latin America and the Caribbean.

In the city of Ensenada (Mexico) we are participating in the financing of the first private investment scheme linked to the energy savings generated when sodium vapor lamps are replaced by LED lamps provided by Óptima Energía. The participation of the Canadian Climate Fund for the Private Sector of the Americas (C2F) to close the financing, along with the presence of first-loss guarantees provided by the Clean Technology Fund (CTF), supported IDB Invest’s loan to Óptima Energía, creating a precedent in the regional market. Blended finance was also used so structure an incentive mechanism to promote gender equality in the sector.

In 2014, the French company, Neoen, was awarded the first large-scale photovoltaic solar plant in El Salvador, Providencia Solar (101 MW), thus introducing in El Salvador a technology and business model already proven in other regional markets like Mexico and Chile. At IDB Invest we are supporting this investment with our own capital plus US$30 million from the C2F. This tender was followed by a second one in 2017 that generated interest in the market and a marked decrease in the awarding prices, thus confirming the catalytic effect of the investment.

Finally, once a technology and a financing structure are already accepted in the market, we at IDB Invest can help to scale up private investment, as has been demonstrated with the B bonds issue for the La Jacinta Solar project (64 MW) in Uruguay, the first solar technology project in the region. This solution gives us greater capacity to mobilize B-lenders by attracting the type of institutional investor that usually rejects investments of this kind in the pre-construction phase, with a 25-year bond in partnership with the C2F.

With close to US$ 800 million of donor funds under management for blended finance, IDB Invest has a longstanding expertise in channeling partners’ concessional resources to the private sector in Latin America and the Caribbean. The institution relies on strong internal controls and dedicated teams that ensure a disciplined, efficient and impactful use of its partners’ concessional resources. We currently manage 17 programs representing five donors: the governments of Canada and the United Kingdom, the Climate Investment Funds (CIFs), the Nordic Development Fund (NDF) and the Global Environmental Facility (GEF).

As of March 31, 2018, at IDB Invest we have invested US$333 million from of donors’ in 37 blended finance investments, to which we have added US$595 million from our own capital mobilizing a total of US$3,117 million. Each concessional dollar invested has generated an investment of about US$2 from IDB Group and nearly US$10 in mobilized funds.

This cumulative experience and the portfolio of donor funds under management allow us to support the transformative processes for fostering private investment to deliver on the Sustainable Development Goals (SGDs) in Latin America and the Caribbean.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe