How to Leverage Green, Social and Sustainable Bonds in Our Region?

Thematic bonds are very similar to their standard, plain vanilla relatives—they are a traditional debt instrument of similar credit profile, but their use of proceeds contribute to the UN Sustainable Development Goals (SDGs) as demonstrated through additional reporting requirements.

Green bonds are used solely for environmental goals, while social bonds are dedicated to projects aimed at improving social welfare, and sustainability bonds combine both social and environmental objectives.

Even though globally the thematic bond market is expanding rapidly it still lacks depth, as issuances represent less than 1 percent of the global corporate bond market. Furthermore, in Latin America and the Caribbean thematic bond issuance is lagging global thematic volumes, despite being the most vulnerable region in the world regarding climate change. The opportunity for the thematic bond market to grow further is tangible as there are more green and social projects to finance and investors to participate.

Attracting investors’ participation

From an investor’s perspective, integrity and transparency of the asset class are crucial to the expansion of Thematic bonds. Any breach of environmental and social integrity could have devastating consequences for the nascent thematic bond market.

There is no explicit universally accepted standard definition of “green,” “social” or “sustainable” bonds–although some standards are becoming more utilized. For instance, for the green bond market there’s the Green Bonds Principles by the International Capital Market Association (ICMA), or also the Climate Bonds Standard, the two most widely used frameworks. For green and social bonds, the ICMA principles have helped standardize the market, providing a framework which covers the use of proceeds, process for project evaluation and selection, management of the proceeds and reporting.

In addition to that, issuers’ compliance to the green bond principles or social bond guidelines is voluntary and there is no built-in enforcement mechanism. As a result, investors have limited options should an issuance not achieve its proposed thematic investment objective. A bondholder in breach of its own investment criteria may be obliged to sell the investment at loss and suffer reputational damage. This risk undermines the effectiveness of the ICMA principles.

It is not enough to stamp a bond to make it “green” or “social.” One key role from multilateral development banks is to back the promises of social impact with strong accountability; it may seem like asking much from the clients’ perspective but investors may rest assured in the long-term commitment of a thematic bond delivering what it was meant. Demonstrating the actual environmental and social impact of thematic investments is necessary to maintain investors’ confidence in the asset class and is the cornerstone to attract the participation of mainstream investors.

The role of multilateral development banks

Multilateral development banks are working toward shaping the thematic bond market, encouraging private sector’s participation while attracting institutional investors to this asset class. A key goal is to develop a robust instrument from an investor perspective, enhancing the product’s integrity and mitigating potential reputational damage.

The Inter-American Development Bank recently launched a Green Bond Transparency Platform (GBTP) to enhance efficiencies and more robust reporting standards in the market. Efforts to bring greater transparency to the Latin American and Caribbean’s green and social bond market are not limited to reporting standards.

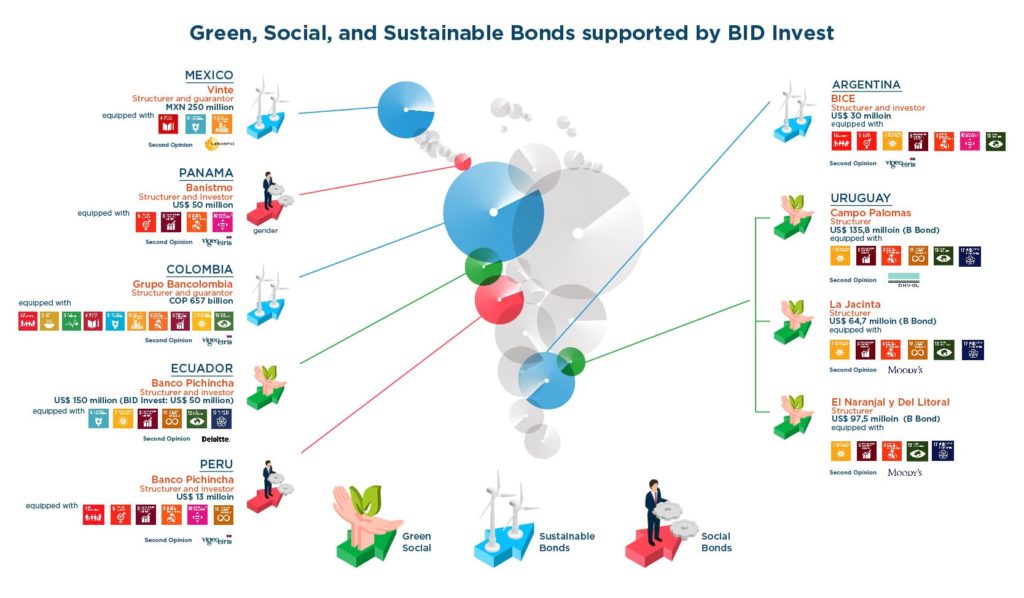

For its part, as a main actor in private sector thematic issuances, IDB Invest works with issuers to include our key requirements as a multilateral development bank into the bond documentation, which include use of proceeds toward green, social or sustainable projects and those that relate to integrity, social, environmental and corporate governance policies. IDB Invest may require price adjustment, acceleration clauses or exit rights from the financing if there is any failure to comply with its requirements.

IDB Invest recently invested in the $50m Green Bond from Banco Pichincha, listed in the Quito Stock Market, the first in Ecuador, as part of building a more robust bond product in order to scale up further the potential of the thematic bond market in the region.

In taking care of this new thematic bond market for Latin America and the Caribbean, IDB Invest works towards incentivizing issuers’ compliance with thematic investment. This in turn may require price adjustments, acceleration clauses or exit rights from the financing if there is any failure to comply with its requirements.

As more and more sustainability-minded investors are interested in knowing where their investments are going, IDB Invest is partnering with clients to ensure they can attract the right investors to the region and contribute to the UN Sustainable Development Goals.■

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe