Financial Inclusion in the Pandemic: the Way Forward for Banks & Fintechs

Consider banking agents, as they use business models that encourage financial inclusion and have managed to kick-start the digital transformation. These agents can be private retailers or public sector establishments, from cell phone stores to post offices, contracted by a financial institution to process customer transactions, such as paying bills, withdrawing cash and even applying for small loans.

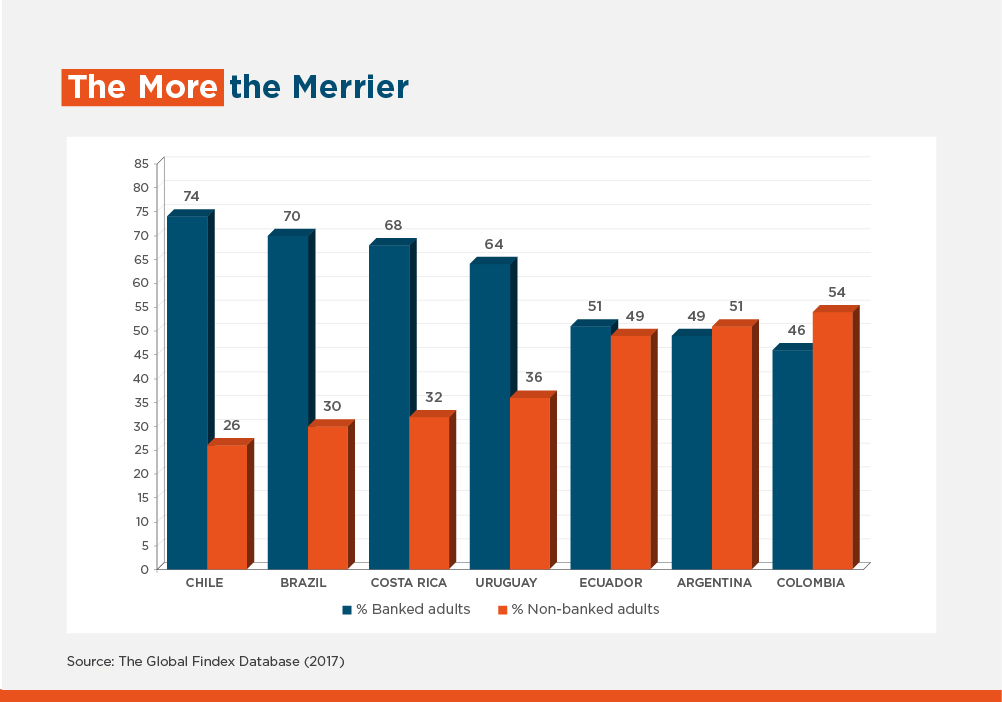

Let's now examine Ecuador, where only 50% of the population uses banking services. Banco Guayaquil recently issued a social bond, with the collaboration of IDB Invest, to raise the financial resources it requires to help the country's micro, small and medium-sized enterprises (MSMEs), as this sector has been badly affected by the COVID-19 crisis. Banco del Barrio, a Banco Guayaquil program that represents the largest banking agent network in Ecuador, will be largely responsible for distributing these funds.

Commercial banks use similar initiatives to serve families with low resources, making them indispensable to the economy. Banco Guayaquil and Banco Pichincha used their banking agent networks as channels for government assistance to 240,000 low-income families in the country between April and May 2020.

Consequently, Fintechs have a golden opportunity to provide financial services that reach all such vulnerable and neglected families using their technological platforms. This will complement their efforts to include these families in the formal financial system.

Similarly to Ecuador, other governments have had to innovate to deploy their support programs. This was the case in Brazil, where regulations were relaxed and a public bank allowed digital savings accounts to be opened by people outside the banking system, so they could receive the assistance they needed. The result was 25 million new accounts, and around 40% of the funds have been used by beneficiaries to make digital payments to public services, companies and even online purchases.

This demonstrates how this segment can successfully tackle financial digitalization. The next step is to identify their payment and consumption habits and creating financial services and products that meet these requirements, in order to keep them within the financial system.

Aside from regulatory easing, Fintechs and digital banking services have been vital to making these government programs viable. Without these services, many people would have been left stranded at the peak of the crisis.

Complementing traditional services to improve financial inclusion

An immediate effect of the pandemic was concern about the future of traditional banking. Imagine the queues, branches crammed with people waiting for their turn, served by a small group of employees in a poorly ventilated place. The rise of Fintech companies has accelerated in recent years, and the tendency has been to perceive them as competition to the "analogous" financial sector, as their disruptive character increases access to financial services and makes their costs more competitive.

However, both Fintech and banks must be seen as complementary disruptive suppliers when serving customers and providing greater benefits with innovative products.

Digitalization certainly brings greater efficiency, saves operating costs and generates profitability. These are sufficient reasons for banks to prioritize digitalization in their financial inclusion strategy. Staying in their comfort zone might jeopardize the continuity of their business. Accordingly, digital channels introduce immediate changes, they can adopt new approaches to credit evaluation and predictive models for other products, since traditional models do not reach the majority of people who most need banking services. Financial products need to be expanded in a more profitable manner, and Fintechs are strategic partners in this mission.

The crisis has prompted many banking regulators around the world to remove, or at least relax, one of the biggest entry barriers for competitors to traditional banking, which is paperwork. Financial services are now partially digitized, so procedures can be completed using scanned documents and digital signatures.

Arguably, these circumstances have made Fintechs' dreams come true by erasing many obstacles to their growth. The enthusiasm about their future is logical, and we share it. We will see a boom in financial services that address specific problems and beneficial market niches that were not served by traditional banking.

For example: Alphacredit, one of the largest Fintechs in Mexico, which expanded into Colombia. This Fintech succeeded in increasing access to financing for retirees and pensioners, particularly those in lower socio-economic segments, to meet their health-care expenditure requirements, a neglected niche.

Another success story is Creditas in Brazil, which provided loans at competitive rates by using technology and data analysis to increase both operational and distributional efficiency. The processing time for these loans in both cases can take from 24 to 48 hours.

Such transactions remain a challenge for traditional banks. Therefore, the role of digital startups that complement traditional banks will be critical over the next few years, as they will accelerate transformation and increase financial inclusion.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe