The COVID-19 Crisis: An Opportunity for the Financial Sector

Evidence of the profound impact of the COVID-19 crisis can already be seen across the region. Both large businesses and SMEs in Latin America and the Caribbean (LAC) have faced an abrupt interruption in their value chains and cash flows, limiting their capacity to fulfill their financial commitments. This has also affected the financial system, where banks will see a downgrade in the quality of their portfolios and funding, shrinking their profitability and possibly even their solvency.

Unlike in the 2007–2009 crisis, however, most banks in the region have stepped into this challenging scenario on a sounder financial footing than in the past. In response to the last financial crisis, many countries had enforced regulations to strengthen their balance sheets, while some have already adopted the recommendations of the Basel III regulatory framework.

Moreover, the region's regulators have been proactive in implementing measures that encourage banks to restructure their clients’ loan terms or refinance their clients, including temporary provisions for the accounting of overdue loans and the use of counter-cyclical reserves.

You may also like:

- ESG: Due Diligence in the Age of Social Distancing

- Three Ways to Support the Resilience of MSMEs to Overcome COVID-19

- Behind the Scenes: Access to Food in the Time of COVID-19

Lenders such as Banco Promerica Costa Rica are a good example of the initiatives taken at the commercial level: 70% of their business portfolio are SMEs, and the focus is now on identifying those that require support and loans to continue operations.

With specific industries such as tourism, trade and transport under special pressure, Promerica has taken specific relief measures. These include a payment freeze for clients in the tourism industry until 2021. All in all, the bank has provided financial support to 52% of its business portfolio since June.

Unburdened by the need to cut the money supply, banks have an opportunity to emerge from the crisis with a better strategic positioning than they had prior to the emergence of COVID-19. Some of the initiatives that they could adopt include:

- Implementing digital banking: With some exceptions, financial intermediaries in LAC have been slow to implement digitalization initiatives compared to other regions. The current need for digital services due to social distancing is quite obvious; however, banks need to implement more aggressive and permanent measures to transform their business model to digital. Given the limited economic activity, a low transaction volume is expected in the coming months, which could mean an opportunity to develop platforms and processes that offer clients a fully digital experience.

- Partnerships with Fintechs and other businesses: Expanding on the previous point, save for a handful of exceptions, financial systems in LAC have not been noticeably open to evolving towards open banking.Open banking is a scheme that allows consumers and companies to efficiently and safely share banking data with third parties (provided they have consented to it). This data exchange, which is essential to fostering business partnerships with financial or non-financial technology companies, offers great added value to banking clients. These new services and products may be provided on top of the existing offer or can stem from existing services to improve on them. The differentiated supply demanded by the current situation translates into great opportunities for banking innovation and financial inclusion in LAC. While support from regulators will be necessary to fully implement open banking, some countries in the region are already making the required changes (e.g. Mexico).

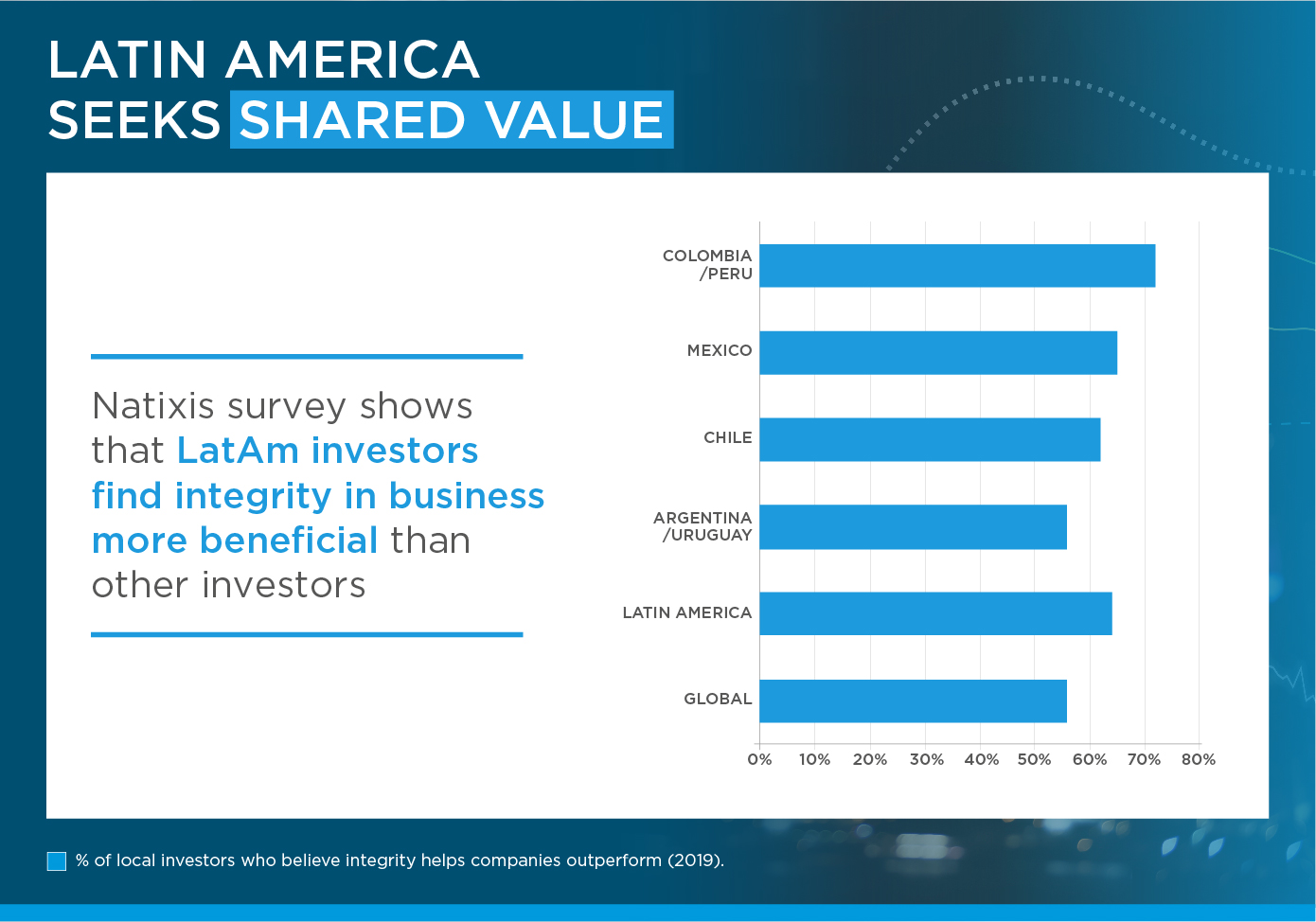

- Business focus on shared value: Long before the pandemic, companies tended to focus their business model on shared value, i.e. going beyond the economic value of the company and generating value for society. There is extensive literature and academic research indicating that companies that look after all their stakeholders generate greater value for their shareholders in the long term. In 2019, the Business Roundtable—an association that brings together the leaders of the largest U.S. companies—sparked an interesting reaction with its statement on redefining the purpose of companies; this statement confirmed the trend, as it posits that executives must not only safeguard their shareholders but also incorporate values such as the ethical and fair treatment of suppliers and support the communities where they operate. The COVID-19 crisis is an opportunity for banks in general to make amends for any past indifference, proving themselves to be true catalysts of the economy with a positive impact on their employees and community. This, however, should be more than just temporary aid. It is an opportunity for financial intermediaries to review their strategies and incorporate a structural social and environmental impact approach.

While we cannot yet speak in terms of hard numbers, the COVID-19 crisis is undoubtedly an opportunity for financial intermediaries to transform themselves and improve their long-term position. Unlike the 2007–2009 crisis, when the global banking system was one of the factors that caused the economic downturn, in this crisis banks are positioned to be part of the solution, and that is the role they must play.

Hand in hand with development institutions, financial intermediaries can ensure that the necessary engagement with their employees and communities becomes the first step to evolving towards a business model with greater long-term social and environmental impact.■

LEARN HOW IDB INVEST CAN OFFER YOU SOLUTIONS HERE.

SUBSCRIBE AND RECEIVE RELATED CONTENT |

| [mc4wp_form] |

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe