Banking Agents, On the Frontlines of Financial Inclusion

Paul Volcker, the former chairman of the U.S. Federal Reserve, once berated the finance industry for leading the world into another crisis and said that “the ATM has been the only useful innovation in banking for the past 20 years”. We beg to disagree.

There is a Brazilian invention that is changing the lives of people across the planet, and laying the foundation for the digital revolution to come: banking agents.

A banking agent is a retailer, mobile network airtime seller, or public sector network like the post office, or national lottery, which is contracted by a financial institution to process client transactions.

Any kind of retailer can be an agent, from bakeries and pharmacies to convenience stores. Typically using the same point-of-sale machine that processes credit card payments, agents allow customers to make deposits, pay bills, withdraw cash, buy insurance, receive government benefits, check an outstanding balance or even request a loan, without ever coming into contact with an actual bank employee.

You may also like:

- Your Business is Next in Line for Internet-of-Things Disruption

- How Can Latin America Attract Foreign Investment in Times of COVID-19

- How exposed is Latin America to the trade effects of COVID-19?

The Central Bank of Brazil tested this model in the late 1990s when it authorized the public sector bank, Caixa Econômica Federal, to process bank transactions through a network of lottery store franchises. The goal was to ease congestion at bank branches and make use of bank accounts accessible for people across the huge country, where at the time around 20% of municipalities did not have a bank branch.

The experiment worked. In 2000, the Central Bank expanded this model to other kinds of retailers and to all banks in the country. The number of banking agents exploded in the ensuing decade, reaching nearly 180,000 by July 2020. Some agents even operate on boats in remote communities in the Amazon.

Today, this model is ubiquitous. People are used to being offered “cash back” in supermarkets in Washington, DC, or to paying bills at the local bakery or neighborhood banking agent (“Banco del Barrio” or “Mi Vecino”) in Guayaquil, Ecuador. This has revolutionized financial inclusion by providing a cost-effective way for banks to expand their reach to low-income populations in urban peripheries and remote corners of the world.

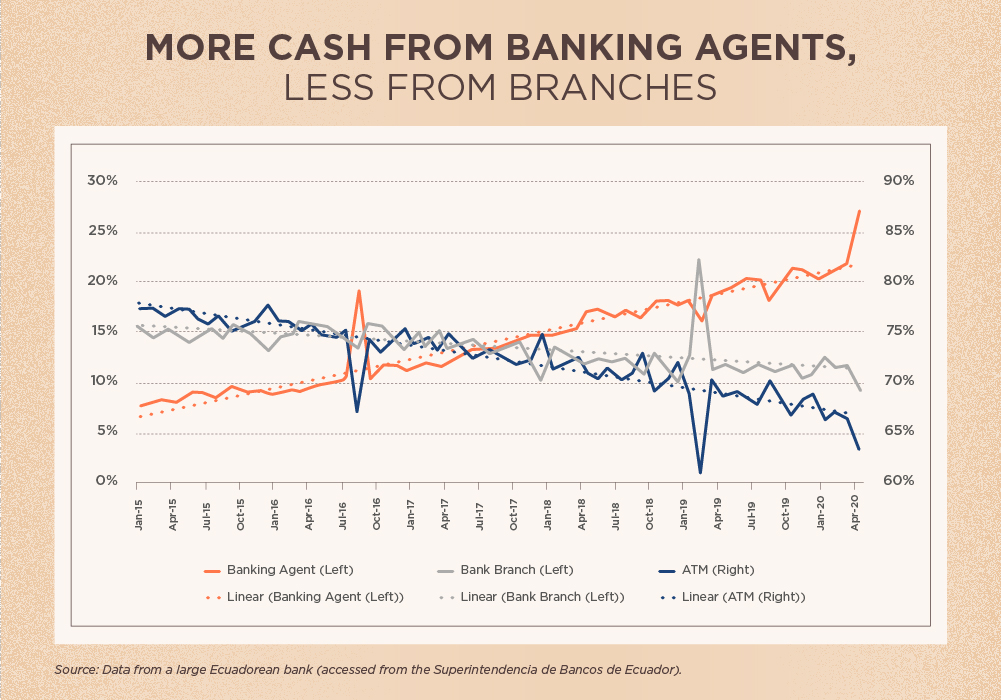

In the coronavirus context, this digital infrastructure is literally saving lives. Local banking agents have become a safer channel for clients to get cash during the pandemic, as shown by financial transaction data in recent months. For example, in Ecuador, even though the overall number and amount of cash withdrawals fell between March and June 2020 (last data available), the proportion of withdrawals made through banking agents rose strongly, while the increase through ATMs was minimal.

Interestingly, this occurred despite limitations posed by mandatory lockdowns that forced some banking agents to close and by the fact that offering cash withdrawal services depends on the amount of cash agents have on hand.

Data from Ecuador's banking regulator shows that the share of cash withdrawals made through agents increased by approximately 3 percentage points between April 2019 and 2020. This jumped to 8 percentage points for the agent networks of some banks, as seen in this chart.

The evidence we have generated at IDB Invest shows that small shops operating as banking agents in Ecuador benefit in terms of increased customer traffic, higher sales, and greater use of financial products. We have also seen that these benefits are proportional to the value of the services these agents provide to often underserved communities.

Banking agents continue to play a fundamental role in the new wave of the digital revolution sweeping across the financial sector. As financial institutions increasingly go digital, many people are still wary of purely electronic transactions. Even though we use our credit cards, the Internet, and our phones to move money around, it is still comforting to know that we can access cold, hard cash at any time.

This sense of insecurity is heightened for people working in the informal economy, where cash is still king and many have never visited a bank branch. The local banking agents who offer cash in/cash out services for electronic accounts provide the basic infrastructure upon which the new digital economy is being built: the certainty that any electronic payment can be turned quickly and cheaply into cash.■

LEARN HOW IDB INVEST CAN OFFER YOU SOLUTIONS HERE.

SUBSCRIBE AND RECEIVE RELATED CONTENT |

| [mc4wp_form] |

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe