Microfinance to Reduce Gaps for the Migrant Population in Chile

Photo: Fondo Esperanza

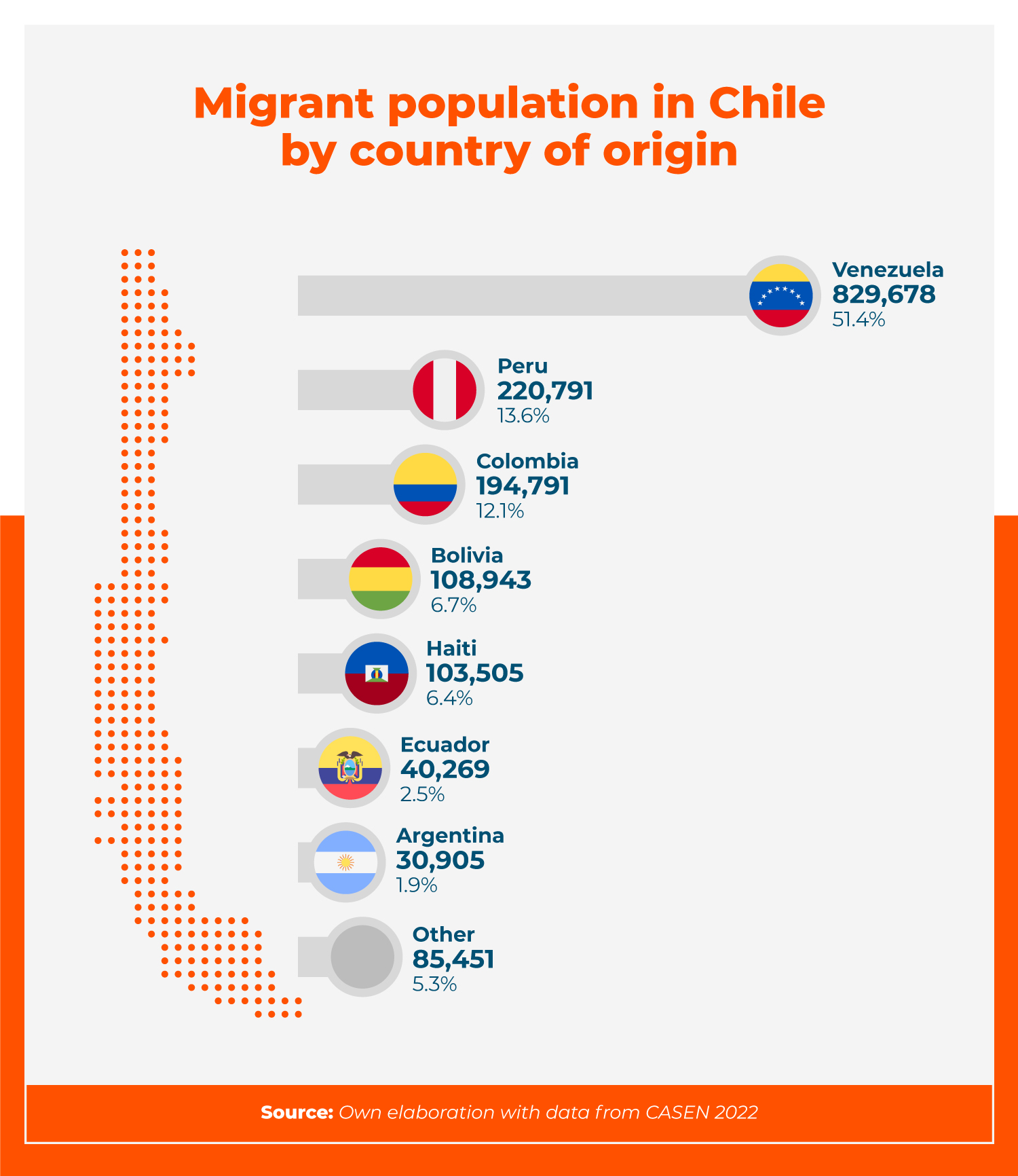

Latin America and the Caribbean are facing the largest immigration crisis in their history. According to the United Nations Department of Economic and Social Affairs (UNDESA), the number of immigrants has doubled in the last 30 years, from 7 million in 1990 to almost 15 million in 2020.

Paradoxically, this challenge could become a tool for inclusive development if the public and private sectors and civil society collaborate to connect innovation with the economic and social growth opportunities that migration can generate.

The financial system can facilitate the social and economic integration of migrants in destination countries by providing access to and use of essential financial services (savings, payment methods, remittances, etc.) to gradually build a banking behavior history and access other services (loans, insurance, etc.), facilitating their responsible social inclusion.

In Peru, Colombia, and Ecuador, regulated financial institutions have sought to close gaps in serving migrant populations. The main barriers include lack of information in credit bureaus, migratory status, informality, and greater economic and social vulnerability.

Through banking mechanisms in these countries, knowledge obtained from savings behavior and cash flows enables the creation of tailored and affordable credit solutions.

Chile: Barriers, Challenges, and Solutions

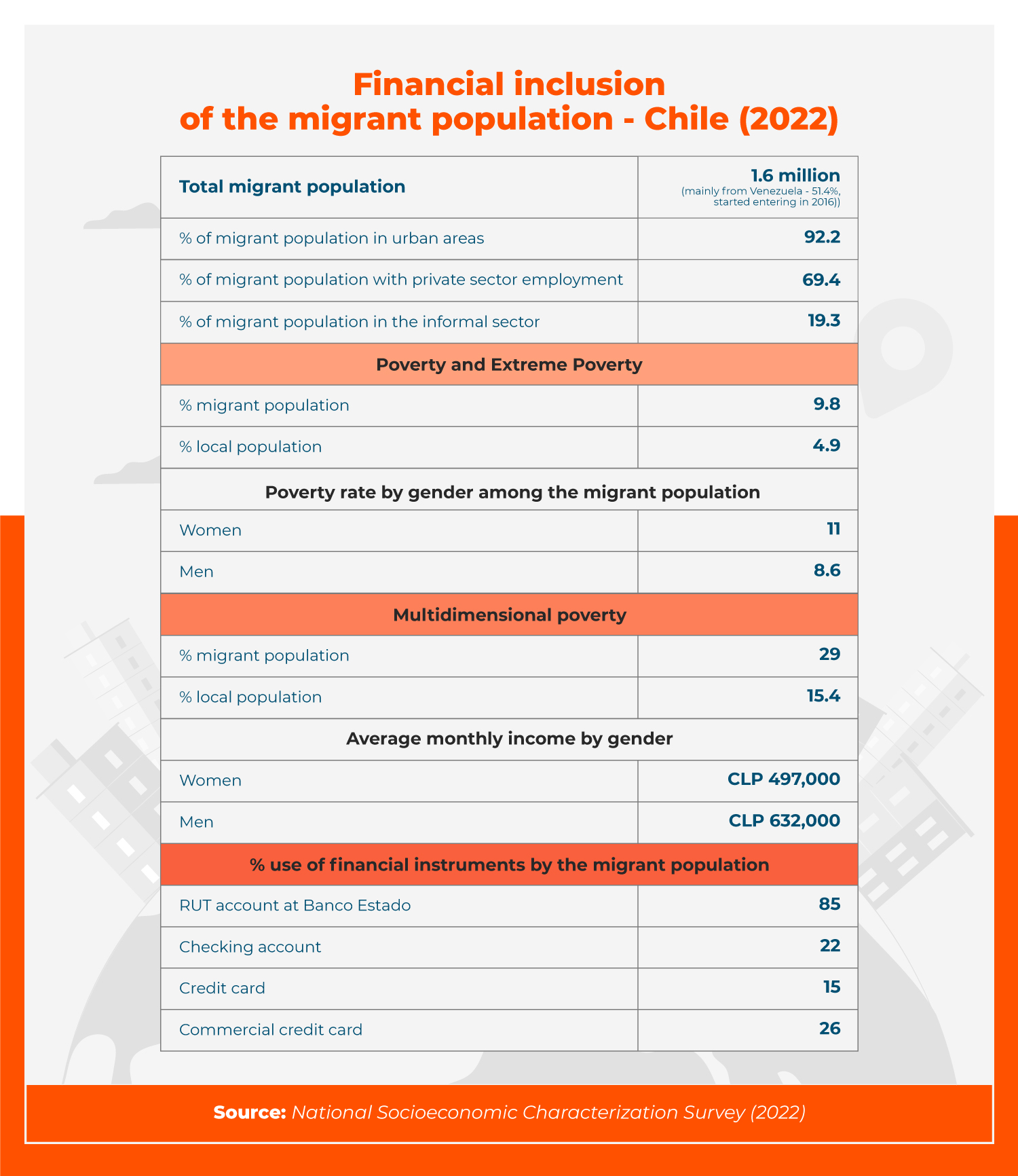

The migrant population in Chile is primarily served by non-banking financial institutions. Additionally, there is a changing regulatory framework regarding the legality of serving irregular migrants without access to banking services.

With higher risk perception, especially for recently arrived migrants, and the lack of credit history, access to banking services is limited to regular migratory status with a Banco Estado RUT account (a no-cost transactional savings account).

Recommended reading

- Boosting Financial Inclusion for the Most Vulnerable Through Social Bonds

- Using Digital Payments to Push Financial Inclusion

Limited support networks decrease migrants' social cohesion and affect their ability to understand and appropriately use financial solutions.

Fondo Esperanza, a pioneer in Chile with its microfinance services focused on entrepreneurship in vulnerable sectors, supports 130,000 ventures, 80% of which are women-led and nearly 5,000 belong to migrants.

From the belief that economic inclusion is essential for social integration, Fondo Esperanza provides access to financing and social products for those in regular and irregular migratory situations.

With the support of IDB Invest and the consulting firm Fundación Capital, Fondo Esperanza strengthens its value proposition by identifying the migrant profile (recent migrant, millennial, traditional migrant), designing a tailored offering, setting goals, and proposing non-financial services.

For example, one value proposition is a prepaid card linked to credit, reducing transaction costs for migrants and Fondo Esperanza. Additionally, it represents an accessible and affordable payment method currently in the viability assessment phase.

Non-financial services for the Venezuelan migrant population are challenging due to their higher educational levels, the diversity of approaches, and the use of gender and vulnerability lens. Essential information capsules on financing conditions in Chile, integration fairs, and empowerment are examples of non-financial services.

From a comprehensive and gender perspective, financial services contribute to breaking dependence and promoting the economic empowerment of migrants. They also facilitate social cohesion by fostering connections in the host community, enhancing resilience, and closing gaps.

As the next step, the proposal is to initiate dialogues between the public and private sectors to raise awareness about the importance and benefits of social and economic inclusion for migrants, strengthening the social and economic fabric. A critical factor in this process is identifying innovative financial inclusion mechanisms for migrants, encouraging more financial actors to join this trend.

IDB Invest is committed to raising awareness, developing knowledge and innovation, and providing financing for the development and growth of financial products for this new segment of inclusive and sustainable financial institutions that address the significant challenge of financial inclusion for the migrant population across the entire region.

Latest posts

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe