Boosting Financial Inclusion for the Most Vulnerable Through Social Bonds

Microenterprises are the driving force of the economy and the productive base of Latin America and the Caribbean (LAC). Despite being the main source of economic development and employment in the region, they face many barriers in accessing finance.

This is a major challenge for the sector, which faces the greatest hurdles as part of the region’s sustainable and just transition. In the case of Ecuador, 90.9% of companies are microenterprises, which generate 25% of private sector jobs, yet they receive only 8% of the total loans provided in the country.

Against this backdrop, microfinance institutions are still the main vehicle for reaching and increasing banking penetration among disadvantaged populations. Even though their products and services are tailored to the needs of microentrepreneurs, they struggle to expand their client base given the extensive and costly field work involved, and to implement credit assessment models that would allow them to offer loans to unbanked populations.

In addition to government programs and the financing provided by development institutions, thematic bonds are a powerful financial instrument to attract investors and achieve inclusion goals. Specifically, social bonds are increasingly attracting investors seeking to reduce inequalities in the region and contribute to a just transition.

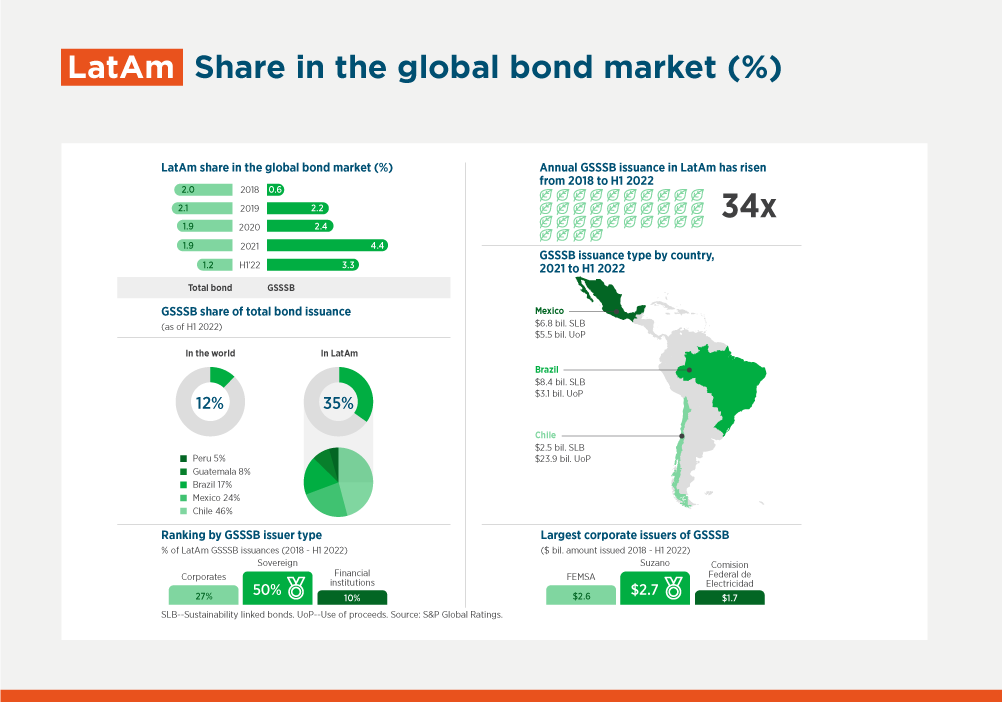

As of June 2022, thematic bond issuances in LAC accounted for 35% of total issuances in the region. While these issuances have grown exponentially in recent years, S&P foresees a year-over-year drop of 40% between 2021 and 2022 due to the recessionary environment.

That’s why multilateral institutions have an important role to play in continuing to promote this type of instrument while mobilizing investors to address financing gaps and helping build the capacities of issuers and the capital market. In the case of IDB Invest, our role is to be the catalyst for thematic investments by developing knowledge, opening doors to the capital market, generating trust, and connecting supply and demand.

At the same time, the evolution of the thematic bond market makes it increasingly important to transparently and homogeneously report the positive socioeconomic impacts on target populations. In fact, ICMA, the leading provider of guidelines, requirements, and best practices in the thematic bond market, is increasing its requirements in this regard. Having indicators in place to measure impact on vulnerable groups in terms of income and wealth growth, creation and/or maintenance of employment disaggregated by vulnerable group, access to social infrastructure, strengthening of financial inclusion, empowerment, among others, are increasingly a "must" in the conceptual framework design for social bonds.

These mounting requirements call for more mature financial institutions with stronger internal capacities to develop solid sustainable financing strategies with ambitious objectives, portfolio growth strategies, and appropriate impact measurement indicators.

Banco Solidario, a leader in microfinance in Ecuador, has been promoting the social and inclusion agenda to reduce the gap in microenterprise financing since 2013. The bank has designed a value proposition for excluded and unbanked populations based on site visits to 100% of loan applicants. In addition to the financial assessment, it also carries out a non-financial evaluation, analyzing the client's business management capacity and family situation, allowing the bank to monitor the financial health of its clients.

Banco Solidario's commitment to financial inclusion is reflected in the profiles of loans it provides: it offers the lowest average loan amounts in the Ecuadorian financial system, the average income of its clients is US$880 per month, 37% of clients cannot afford the basic basket of goods, 56% are women, and around a third of its annual loans are for unbanked microenterprises.

Banco Solidario's recent issuance of a $30 million Gender and Inclusion Bond, in partnership with IDB Invest, will be used to provide loans to women's microenterprises and unbanked microentrepreneurs. In the context of the issuance, Banco Solidario has also identified two new segments, namely migrants and senior citizens, as a business opportunity with a focus on sustainable inclusion. With the participation of IDB Invest, the bond addresses 6 of the 17 Sustainable Development Goals. The Second-Party Opinion was issued by S&P.

The bond issuance involved designing a conceptual framework to guide its implementation, focusing primarily on three key aspects: the professional experience of the committee assessing fund allocation for each category; the annual verification report on the objectives achieved by the issuance versus the expected results according to the bank's strategy for specific indicators; and the design of metrics to verify increases in income among the financed microenterprises as well as the building of their credit histories, which in turn helps boost their access to finance.

The bond focuses on reaching populations facing deeper financing and development gaps, such as women-led microenterprises (31.2% of women-led microenterprises have credit lines, compared to 50% for men); senior citizens (highly underserved due to transaction costs); migrants (4% of migrants are formally employed, 39% are seeking employment, and 29% are engaged in informal activities); and the unbanked (59% of microenterprises lack credit lines).

Closing these gaps requires the active participation of the private sector, with initiatives such as those being developed by Banco Solidario and other stakeholders in the financial system. Making the leap to a social bond will also allow the bank to diversify its funding products and accelerate the growth of its microcredit portfolio with an eye towards inclusion.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe