How to Turn the Pandemic into an Opportunity for the Silver Economy

The lockdown and social distancing measures required by the COVID-19 crisis present an opportunity to accelerate the digitization of a major economic segment that has been financially excluded and lacks innovation.

The so-called “silver economy” refers to the economic activity, consumption, and finances of older population segments, those who are approaching old age, between 55 and 65 years of age, as well as the segments already retired (over 65 years). Many are still heavily involved in the world of business and entrepreneurship, small or large, and may require a micro-loan to open a store or start a self-employed project at home.

According to UN estimates, population growth in most countries in Latin America and the Caribbean (LAC) is running at an annual clip of between 0% and 1%, similar to that of wealthier regions. Similarly, the number of people aged 65 or over in the region will increase from 56.4 million in 2019 to more than 144 million in 2050, which indicates the scale of the problem — and the opportunity.

You may also like:

- Your Business is Next in Line for Internet-of-Things Disruption

- How Can Latin America Attract Foreign Investment in Times of COVID-19

- How exposed is Latin America to the trade effects of COVID-19?

Techno-phobia in older adults seems to be going away. In recent years, the use of technology has risen by a factor of two or three depending on the age range. According to a Pew Research Center survey of U.S. adults, 68% of Baby Boomers (55 to 73) and 40% of those belonging to the Silent Generation (74 to 91) own smartphones, a significant increase in the last decade. This number is 90% for Generation X, who in a few years will be the ones who are part of the silver economy.

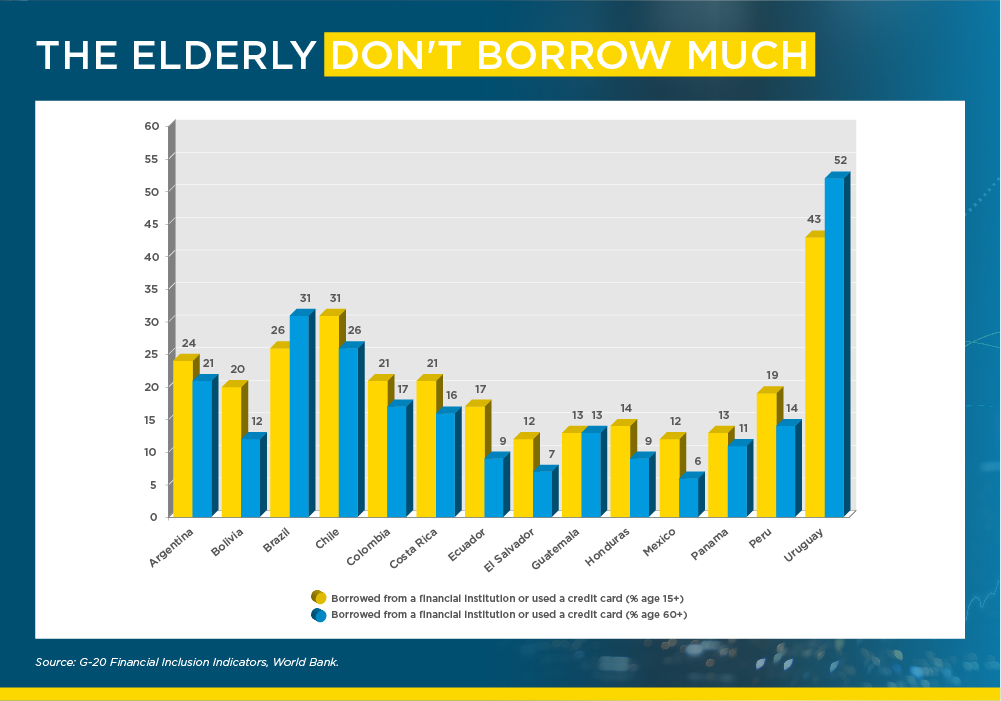

The digital financial inclusion of this population segment is a pending issue all over the world, but more so in LAC economies. According to the indicators shown below, the penetration of bank credit in the selected countries is 17% (15% excluding Uruguay) for the population over 60 years of age. With the exception of Brazil and Uruguay, all countries show less access to credit by the elderly population.

Long queues in bank branches, with people waiting to collect their pension, pay bills or withdraw small amounts of money, are still a frequent sight. In this context, it's key to promote the use of virtual channels, transactional products and digital payment / collection methods, such as debit, credit and prepaid cards.

The pandemic has accelerated the use of digital media for transfers and payments for services. In the first three months since the start of mandatory social distancing policies in LAC, early estimates show increases of more than 70% in the use of payments for services digitally and 60% in transfers.

The need to increase the supply of digital products takes on greater relevance during the COVID-19 crisis as it fits perfectly with government efforts to reduce the circulation of people and cash movements; in fact, it even becomes a business opportunity.

Caja de Compensación Los Héroes in Chile, a nonprofit corporation that is part of the country’s social security system, is spearheading a pioneering project that aims to seize this opportunity.

Caja Los Héroes provides services to beneficiaries of Chile’s Social Security Institute and pensioners with private retirement funds. It also pays subsidies and grants credit to its members, among other social services. It records the highest number of social benefit payments in the country. Its 178 branches process 2.4 million payments to beneficiaries every month, and serve 700,000 pensioners.

In June, Caja Los Héroes received $50 million worth of financing from IDB Invest to support efforts to financially include the elderly. The project involves a technical assistance package that includes the creation of a digital financial education program seeking to increase the use of digital financial products and services, such as non-face-to-face collections and payments, amid older adults.

The IDB Invest project complements the digital transformation plan that Caja Los Héroes launched before the pandemic. The current health situation has represented an incentive to accelerate this transformation, which consisted in the creation of new transactional and digital products, such as prepaid cards and virtual accounts. So far this year, Caja Los Héroes has issued 77,000 prepaid cards to pensioners.

Innovation + Inclusion + Digitization. These three concepts go hand in hand when it comes to achieving a disruptive change in the finances of older adults. The silver economy represents an opportunity for both traditional and technology-based intermediaries. Fintechs, banks, savings banks, governments, regulators: the effort and cooperation of all these actors is needed to foster innovation, promote inclusion, and accelerate the financial digitization of the elderly.■

LEARN HOW IDB INVEST CAN OFFER YOU SOLUTIONS HERE.

SUBSCRIBE AND RECEIVE RELATED CONTENT |

| [mc4wp_form] |

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe