How Trade Finance Boosts Access to Credit for Smaller Businesses and Food Security

In Latin America and the Caribbean, international trade plays a pivotal role in economic development and growth, helping to boost firm competitiveness and innovation. Likewise, trade among countries within the region helps strengthen cooperation and integration at home. The region also seems poised for another commodity boom given the growing need to feed both the world and the green revolution, further underscoring the importance of trade, and its lifeblood, trade finance.

While most of the world’s commerce depends on trade finance, the global trade finance gap surged to an estimated $2.5 trillion in 2022, a 47% increase over 2020, widened by the pandemic and ongoing economic and geopolitical uncertainty.

Clearly, there is massive unmet demand for credit among firms seeking to expand their export markets or import critical goods to improve their productivity. This mismatch hits developing markets, and the smallest players within them− small and medium-sized enterprises (SMEs)− the hardest, as the perceived risk of trade transactions is higher in these contexts.

That’s why facilitating the flow of trade finance in Latin America and the Caribbean is so critical, especially during economic downturns. For example, our Trade Finance Facilitation Program (TFFP) plays a countercyclical role, ramping up when commercial trade finance ramps down, as we saw at the height of the pandemic. The TFFP provides short-term loans to local banks in the region to finance importing and exporting companies, as well as credit guarantees to global banks to mitigate their perceived risk of trade transactions with banks in the region. From 2018-2022, it financed $7.8 billion in trade transactions and mobilized $716 million from partners in B-loans.

Notably, increasing trade finance is having a positive impact on two pressing challenges facing the region: limited access to finance for SMEs and mounting food insecurity.

First, SMEs. In general, the TFFP mostly works with banks that already have SME clients within their trade finance portfolios. In 2022, the program financed 22 banks that reported having at least 15% of their trade finance portfolio dedicated to SMEs.

Today, the program takes an even more targeted approach by working with banks to match SMEs in need of trade credit directly with TFFP funds. From January 2022 to August 2023, $136 million in financing was earmarked for SMEs through this matchmaking. These transactions help smaller companies, most of which already face significant barriers to finance due to lack of collateral or limited credit histories, access the short-term funding they need to expand to international markets or improve their efficiency by importing cheaper or higher quality inputs.

Next, we have the growing global problem of food insecurity. Latin America and the Caribbean is the world’s largest net food exporter. Its exports of poultry, animal feed, sugar, coffee, fruits and vegetables help to lower and stabilize international food prices. Yet food insecurity in the region persists. The impacts of climate change on agricultural production, inadequate transportation infrastructure for moving products to market, and deep-seated poverty and inequality are among the contributing factors.

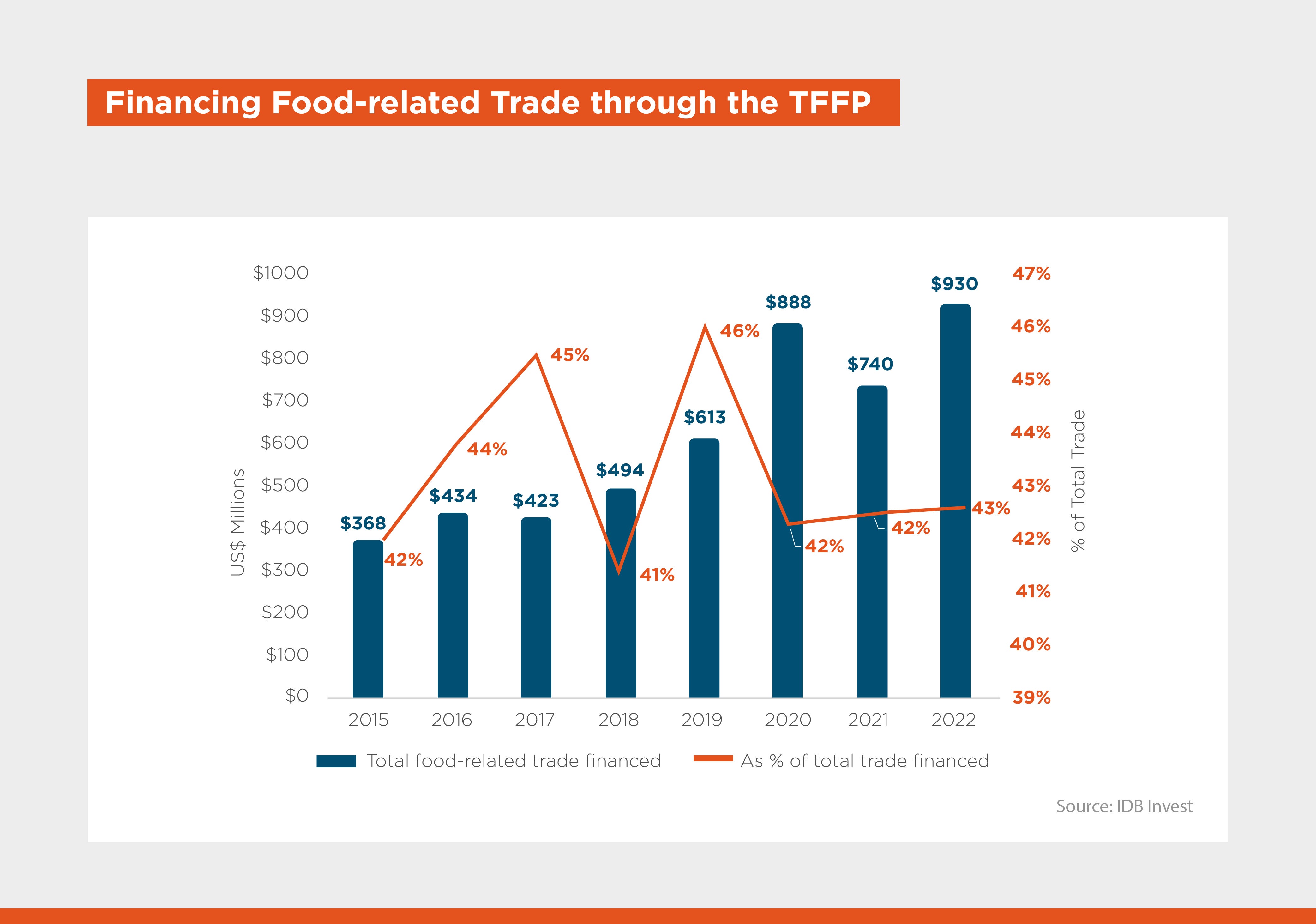

Against this backdrop, trade finance has a catalytic role to play. The amount of food-related trade financed by the program—including for agricultural products, processed food, and inputs for agricultural production such as machinery—has steadily increased, reaching $930 million in 2022, representing 43% of the total trade it financed last year. More than half of this is among countries in the region and much of it originates in Brazil. For example, Ecuador, Chile, and Bolivia are the main destinations of Brazilian fruit and grains, and most of its frozen meat goes to Paraguay, Uruguay, and The Bahamas.

The program also contributes to the global food supply by financing food exports to other regions. As demand for the region’s food production will likely continue to grow alongside the world’s growing population, expanding the reach of trade finance will surely help to feed it.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe