How a New Sustainable Mindset Will Help Future Construction

Years ago, when I was leading a green business division in a private bank, I had the opportunity to share dialogues with several professionals who at that time created the Green Construction Council in Guatemala. This was a step in the right direction in the construction industry, although there has long been a need for greater incentives to continue down that path.

These incentives are already arriving, with an emphasis on how we can invest differently, that is, including right and center a focus on mitigating climate change and increasing the resilience of infrastructure in the countries of Latin America and the Caribbean ( ALC). This occurs both at the level of social and financial infrastructure, as well as in physical infrastructure, such as buildings and bridges.

To understand this new emphasis, we need to understand and internalize a new mindset that is based on: a) understanding that we need to invest in a way in which our investments do not help climate change continue to advance, and b) recognize that climate change that has already happened today is not reversible and, therefore, we need to invest in assets that are prepared to withstand the climate change that we already cause.

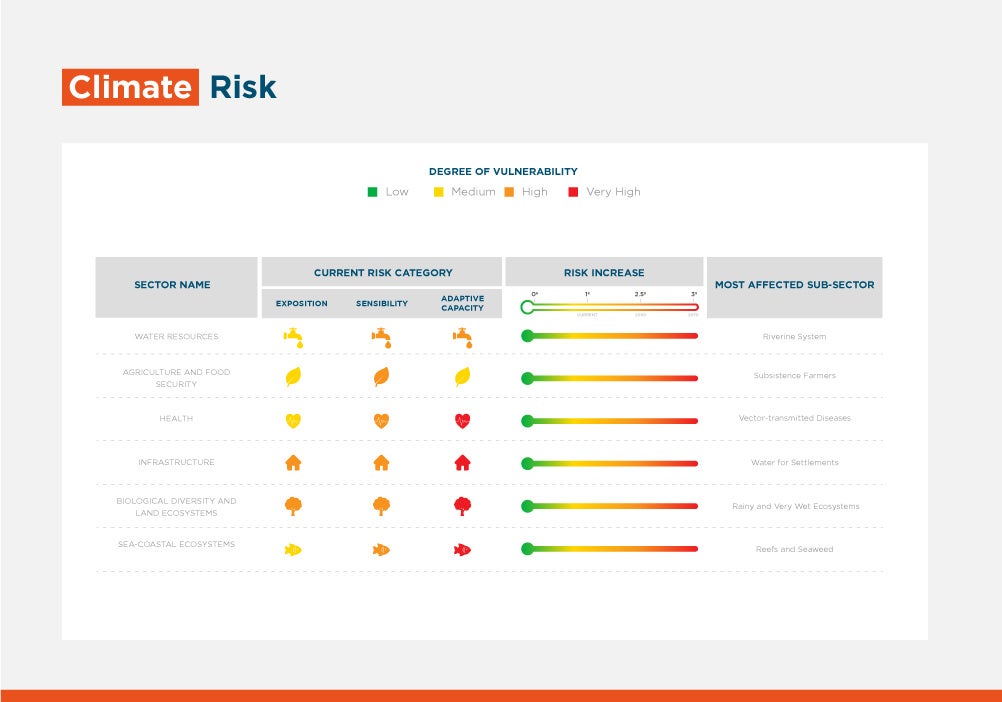

This vision and commitment are absolutely necessary, especially in construction assets that in Caribbean and Central American countries are exposed to very high risks due to extreme climatic events. Many changes to traditional business are necessary, as already pointed out by the Guatemalan System of Climate Change Sciences in 2019.

In this regard, it is important to invest in infrastructure that reduces greenhouse gas emissions. By adding the emissions caused during the construction of buildings to the operational emissions of such buildings, the construction sector accounted for 38% of the total global energy-related CO2 emissions. On the other hand, consumption in transportation generated 50% of total annual emissions in Guatemala, using data from 2016.

Scaling sustainability and future climate action in the construction sector has much more to do with incentives, risks, financial markets and marketing than with an exclusive focus on certifications. Certifications should not be the only formula to promote sustainable construction.

The application of the sustainability approach in construction allows the creation of heritage assets, or long-term investment portfolios in infrastructure where exposure to systemic risks such as climate change is lower; this represents a central and highly relevant financial incentive, because these assets will have less exposure to that risk, of a systemic and permanent nature. Such a step results in lower risk long-term portfolios, of special interest to capital markets, investment funds and institutional investors invest in assets of this type.

At IDB Invest, we are working with the private sector in the region to promote a powerful and sustainable post-pandemic economic recovery that allows scalability and replication of best practices in the region. Therefore, together with Banco Agromercantil (BAM) in Guatemala we have designed an alliance that will allow, through the combination of our financial and advisory services, to generate innovations in the financial market by creating financial products that provide appropriate market incentives, both for sustainable construction projects, as well as to finance low-emission mobility.

This alliance, formalized in the framework of the Global Conference on Climate Change 2021 (COP), in Glasgow, Scotland, will channel $70 million in financing from IDB Invest through BAM to the private sector in Guatemala.

Through this alliance, investments will be financed to reduce greenhouse gas emissions in constructions, saving at least 20% in energy, 20% in water and 20% in construction materials, both in construction and in operating costs. Additionally, hybrid and electric vehicles may be financed, as is financing towards other alternative methods with zero emissions for urban mobility, which will make it possible to capitalize on public efforts to create alternative means of transport such as bicycle lanes.

IDB Invest and BAM share values oriented towards innovation and breaking paradigms within the traditional financial system, which allow sustainable businesses to flourish. For this reason, we have created a win-win alliance based on joining efforts, resources and shared visions for a common goal, contributing in turn to the U.N. Sustainable Development Goals (SDGs).

There is still a gap between this first initiative and how to transcend it at the national level so that more institutions join this effort. With initiatives and alliances such as that of BAM, a new trend towards change is being promoted and accelerated, which we hope will allow the financing of sustainable construction and low-emission mobility to scale up in Guatemala and in the rest of the Central American region.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe