Download the full report here

Blue bonds are emerging as an innovative way to fund ocean and water-related solutions, create sustainable business opportunities, and signal responsible ocean stewardship to the market. Ten years ago, a set of anchor issuances laid the foundation for the green bond market and, since then, the market has seen tremendous growth with more than $1 trillion in total issuances. Today, blue bonds are where green bonds were ten years ago, and the market is poised to see similarly fast growth. But what are they exactly?

IDB Invest has partnered with the UN Global Compact to understand blue market opportunities in Latin America and the Caribbean (LAC). We present five key takeaways from our reference paper:

1.Blue Bonds fund commitments towards oceans, water related initiatives and sustainability.

When a company issues a blue bond, it specifically commits to investing the proceeds on business solutions for oceanic health, freshwater and/or to improve access to water and sanitation.

Blue bonds can be issued as a subset of green, social and sustainable bonds, and should be grounded in globally recognized principles. Until there is a widely accepted set of blue bond principles, issuers are encouraged to use ICMA’s social and green bond principles, adapted to a blue use of proceeds. Moreover, the UN Global Compact Sustainable Ocean Principles can serve as a guide for responsible business practices.

Potential blue bond issuers should demonstrate an overall commitment at the corporate strategy level, and beyond the specific use of proceeds, to advance the Sustainable Development Goals (SDGs). This "Blue" eligibility criteria will open opportunities to a wider range of issues.

Once a company has defined the selection criteria for the projects financed by blue bonds, they can acquire an independent Second Party Opinion to reassure investors that the blue bond will meet their requirements.

2. The blue economy can create a triple win for people, nature and economic development

Maintaining a healthy and productive ocean is a critical precondition for the achievement of all 17 SDGs. Covering 70% of the planet, the ocean helps mitigate climate change by storing large amounts of carbon dioxide.

Expanding the sustainable ocean economy will also provide food for a growing population and foster low-carbon transport. In addition, it offers the potential to provide almost unlimited renewable energy. Business solutions for a healthy ocean are essential to meeting the goals of the Paris Agreement, which aims to limit global temperature rise to well below 2 degrees as compared with pre-industrial times.

Previous issuances of blue bonds have focused on investments within marine conservation and restoration, as well as water-related infrastructure. However, by expanding eligibility criteria and frameworks, blue bonds can fund more business opportunities that positively impact the ocean and water-related projects, and support sustainable development.

There is a wide range of sustainable business opportunities within the blue economy. Blue bonds can raise capital for projects and companies seeking to have a direct impact on ocean and water-related issues while advancing in social inclusion, economic growth, environmental protection, and the broader 2030 Agenda.

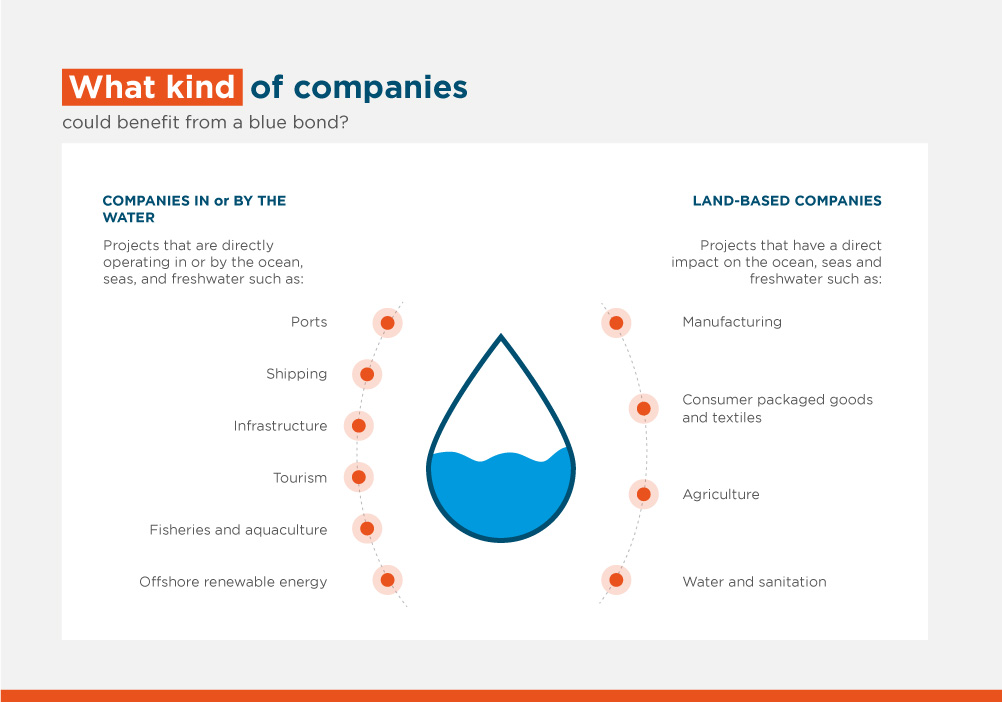

3. Blue Bonds are not just for fisheries and shipping companies

Blue use of proceeds can be allocated to sustainability projects that are directly operating in or by the ocean, seas and freshwater such as ports, shipping, infrastructure, tourism, fisheries, aquaculture, offshore renewable energy; and projects that have a direct impact on the ocean, seas and freshwater such as manufacturing, consumer-packaged goods designed for waste reduction, sustainable textiles, integrating SMEs with sustainable practices to increase value chain resilience, reducing agrochemical runoff, water and sanitation.

Projects within the blue economy can reduce negative impacts (e.g., poor waste management) as well as accelerate a positive contribution (e.g., sustainable fisheries), with numerous sectors having a role to play, with a particular focus on women, small producers, minority groups, and migrants into these projects.

4. There are great opportunities in Latin America and the Caribbean for a thriving blue economy

LAC has a coastline that extends over 70,000 kms. With 25% of Latin America’s population and 100% of the Caribbean’s population living on the coast, the blue economy is essential for sustainable business in LAC.

Moreover, because there are 23 small and island states which are almost entirely reliant on long-term oceanic health, the Caribbean region presents a particularly clear business opportunity for blue bonds. A report estimated that gross revenues in the Caribbean region from ocean use amounted to at least $407 billion, mostly through shipping, mineral resources, tourism, and fisheries.

Securing oceanic health for generations to come, and investing in nature-based solutions for climate change adaptation such as coral reef and mangrove management will be particularly crucial. Blue bonds are an opportunity to build back better with great potential to bring increased financing, effectiveness and make an impact on the region’s blue economy.

5. Blue bonds are where green bonds were ten years ago

Development finance institutions were important in building credibility around the green bond concept. IDB Invest is now committed to developing the blue bonds market in the same way, and can support companies interested in issuing in blue bonds while attracting institutional investors.

Blue bonds, like green bonds, may generate additional costs for external reviews, reporting and internal preparation issuers are becoming increasingly aware of the benefits associated with thematic bond issuance, such as high demand and improved financing terms, including larger transaction size and longer maturities.

Blue bond issuances may come from issuers at various stages in their sustainability journey, provided they set robust, transparent, and verifiable targets with clear eligibility criteria for how they will use the proceeds. Industries and companies that are in transition may also access the market to accelerate progress toward a net-zero future.

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe