Developing a Common Language to Drive Circular Financing at Scale

Building a sustainable, inclusive and thriving planet can only be achieved by changing consumption and production patterns. To change things, the circular economy (CE) approach plays a key role, and extending it to business value chains becomes essential.

The concept of circular economy has gained considerable momentum in recent years as a sustainable approach to resource management. However, it involves multiple efforts at various levels and has not been fully adopted by small- and medium-sized enterprises (SMEs).

The transition to a circular economy model poses several challenges, including stakeholder coordination efforts to unlock project financing, the absence of a common system to define and categorize circular projects, and an increased risk perception. Creating the conditions so that businesses and circular practices can be developed would result in greater productivity, new markets, better financial support and resilience to climate change.

Advancing the circular economy transition requires developing a common language or a system to identify, categorize and measure positive impacts, and report on circular project investments consistently and transparently.

The IDB Group has partnered with three leading Colombian banks (Bancóldex, Bancolombia and Banco de Bogotá) to develop a common language that would drive CE financing at scale through a practical tool that enables comparability and transparency among financing institutions.

This is how a CE categorization system with practical steps was designed in Colombia, drawing on international and local experiences. Some critical system components were inclusion filters to identify and categorize projects (social and environmental considerations), exclusion filters and criteria to determine each project circularity level—low, medium and high.

Given the progress made in terms of CE regulations and private-sector engagement, Colombia became a strategic ally in promoting this initiative, with great potential to be replicated in the region. While reflecting some characteristics of Colombian regulations, the system can be easily adapted to other countries in the region.

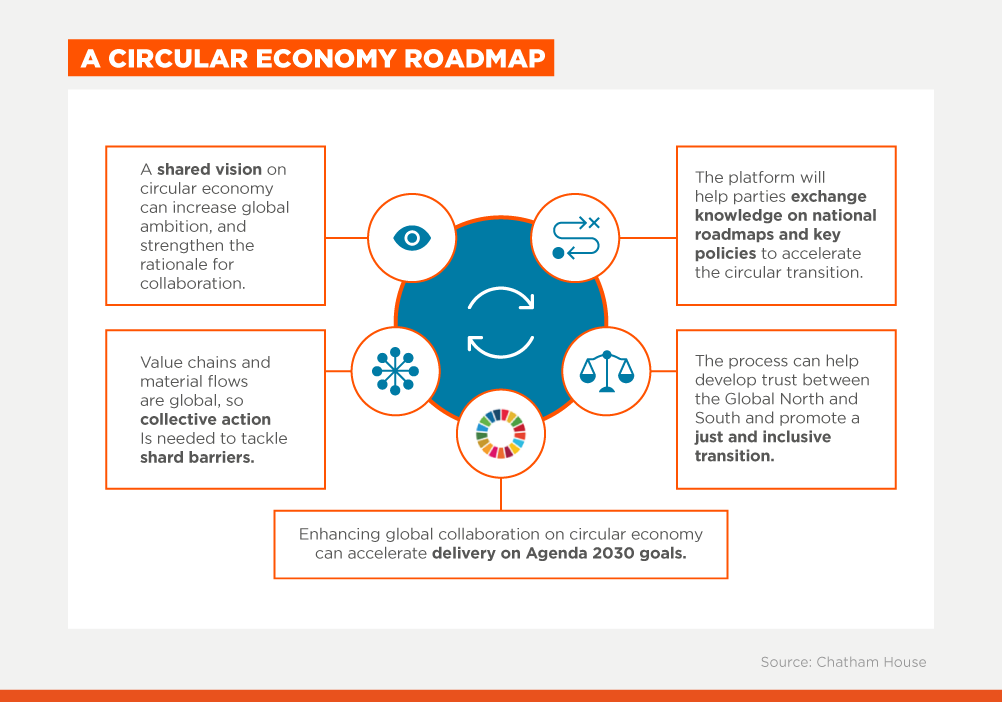

The circular economy creates a range of opportunities for the business and financial sector. Transitioning to a circular model requires increased in-house capacity-building, as well as coordinated and collaborative work among stakeholders. The coordinated work involves the public sector (generation of enabling conditions, boosting demand, etc.), the private sector (capacity development, synergies, union work, etc.), academics (pieces of knowledge, development of laboratories, etc.) and society (changes in consumption patterns).

These barriers can be lowered by understanding the differences between a linear and a circular model focused on the materials value chain, and the key role of SMEs and collaborative work; constantly innovating and assessing the risk associated with developing new products and market niches (models that include reuse, repair, remanufacturing and recycling, among others); and getting the financial sector to adopt a value chain and material flow approach, rather than a client- or sector-centric model, to expand development and financing opportunities and engage SMEs.

To engage SMEs in circular economy projects effectively, we need to understand that financial institutions and the business sector are biased to relate the CE with larger companies, neglecting its potential implementation in small- and medium-sized enterprises.

Recognizing that the circular economy is not limited to big players becomes essential. Additionally, despite some clear biases toward thinking that CE is about waste recovery, the circular economy actually gets to the bottom of innovative strategies, such as extending product life cycles, implementing product-as-a-service models and leveraging technology platforms to maximize resource efficiency and minimize waste generation.

With a common, CE investment-centric language, banks can identify, assess and finance projects to advance a more sustainable and circular future. It helps improve risk assessment, build trust among investors, and promote public, private and financial sector collaboration.

The circular economy can go a long way towards building a sustainable economy, with a clear environmental, social and economic impact. The financial sector performs a coordination role, providing the resources to support the transition of businesses and SMEs beyond waste recovery practices can, in fact, be described as “low-hanging fruit.”

Along these lines, creating a common language, namely a categorization system, needs to be an ongoing process that can keep up with evolving technologies and CE trends. Other measures to foster private-sector partnerships, innovation and greater financing should also be implemented.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe