The Net-Zero Opportunity in Latin America and the Caribbean

An abundance of renewable energy resources gives Latin America and the Caribbean (LAC) a unique advantage that can help the region move rapidly towards the net-zero emission target.

When we say “net-zero”, we refer to a term as defined in the 2015 Paris Climate Agreement as a state in which the emissions of greenhouse gases to the atmosphere are balanced by removals out of the atmosphere over a specified period.

This seeks to prevent the Earth from exceeding the 1.5°C global warming threshold. To achieve this goal, anthropogenic emissions need to be reduced by 45% by 2030 and reach net zero by 2050.

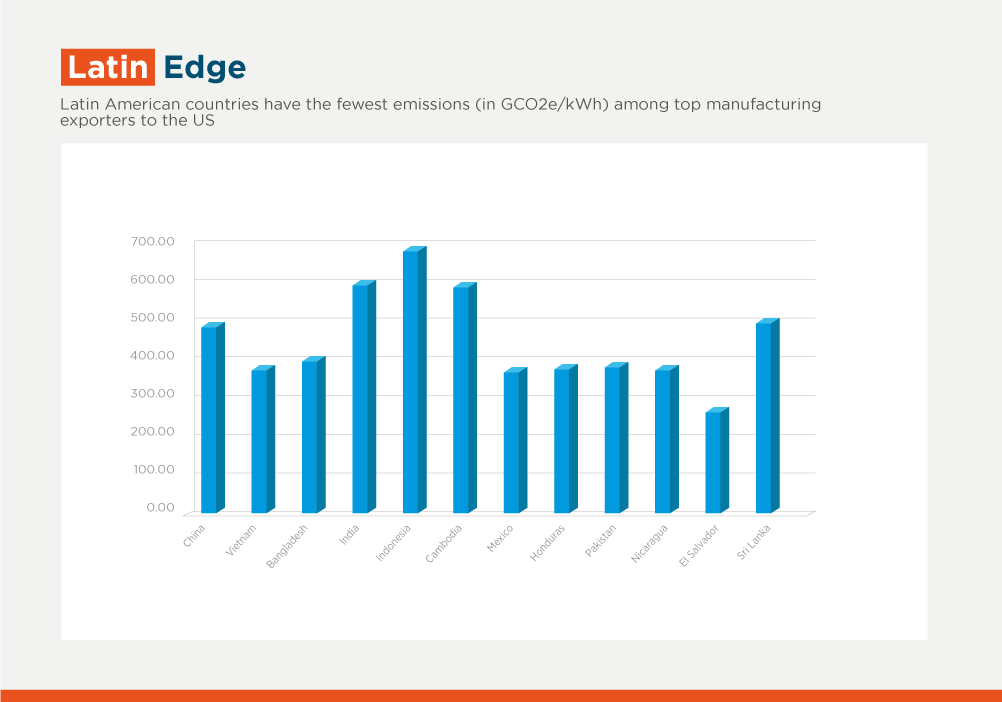

In this scenario, world markets, led by the European Union, are shifting towards less carbon-intensive imports by implementing tariff mechanisms that would benefit products with a low carbon footprint. These schemes could increase the competitiveness of LAC-manufactured products in the global arena, as the region is well below of many of its rivals in terms of greenhouse gas emissions per unit of electricity generated.

For example, when analyzing the power grid emission factors of the 15 largest goods exporters to the United States, we can see that Latin American countries show lower values than the rest, and even below average.

It is also important to note that renewable-based generation has been experiencing a sustained price reduction over the last few years. For example, the price of photovoltaic energy has decreased by 50% in the last 5 years and, according to the International Renewable Energy Agency (IRENA), a reduction of up to 59% compared to 2015 is expected by 2025.

In addition, the adoption of renewable energy solutions by corporate clients has increased over the years, covering around 30% of the electricity demand on average today.

In a net-zero context, the remaining emissions must be offset during the transition period by acquiring carbon dioxide credits or implementing offset projects. This presents a great opportunity to generate credits from nature-based solutions in the region. These solutions can help the private sector to adequately adapt to the impacts of climate change. In addition, these mechanisms can drive the restoration of key ecosystems, such as the Amazon Basin.

IDB Invest has been helping key regional manufacturers and financial institutions to assess and develop their strategies, taking into account decarbonization scenarios based on national targets, as well as the sectorial guidelines developed by the Science Based Targets (SBTi) initiative and the UNEP FI guidelines for the NetZero Banking Alliance.

To date, only 11 of the more than 600 banks in LAC are part of the NetZero Banking Alliance. From our experience working with the corporate and financial sectors on these issues, we have been able to draw the following lessons:

1) Emission accounting and calculating decarbonization targets are way beyond our clients’ knowledge and expertise. Therefore, it is necessary to build capacity with specialized personnel, and provide support through automated tools.

2) Although there are validated guidelines and principles, there is a lack of technical knowledge to apply them to the clients' line of business and to systematize practices.

3) This global trend emerged and was tested primarily in developed countries. Applying it to LAC countries, however, poses major challenges as the productive sectors and the level of technological sophistication in the region are different. This is reflected in the portfolio of institutions that have acquired transitional fossil fuel assets. As they are at an early loan repayment stage (normally over a 10-year period), it’s unlikely that they will be able to settle them anytime soon. These unique conditions in LAC determine to a large extent the transition speed to a low-emission portfolio, as institutions invest in specific countries and not others.

4) Another basic, yet significant, challenge is that developing countries need economic growth. Growth requires an increase in financing, i.e. the portfolio size, resulting in inevitably higher portfolio emissions vis-a-vis the baseline. In this case, it is important to use GHG intensity-based targets per monetary unit in the portfolio — a clearer indicator of the emission reduction effort. This recommendation is particularly important for financial instruments linked to sustainability or decarbonization.

It is up to the banking and corporate sector to adapt, ensuring access to financial and technological instruments that support decarbonization, as well as advisory services, knowledge communities and automated tools to “translate” the climate science, facilitate it and accelerate its implementation.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe