A Sustainable Opportunity for Paraguay

The financial markets mechanisms are often simpler than they seem. Here’s an example: today when most of us are worried about the effects of climate change, issuers of sustainable debt can pay lower interest rates, precisely because there is a great demand for this type of debt.

In recent years, the message that we must act to stop and mitigate climate change has continued to build momentum. Accordingly, most pension and investment funds in more advanced economies of the world have begun to take into account sustainability criteria when making investment decisions.

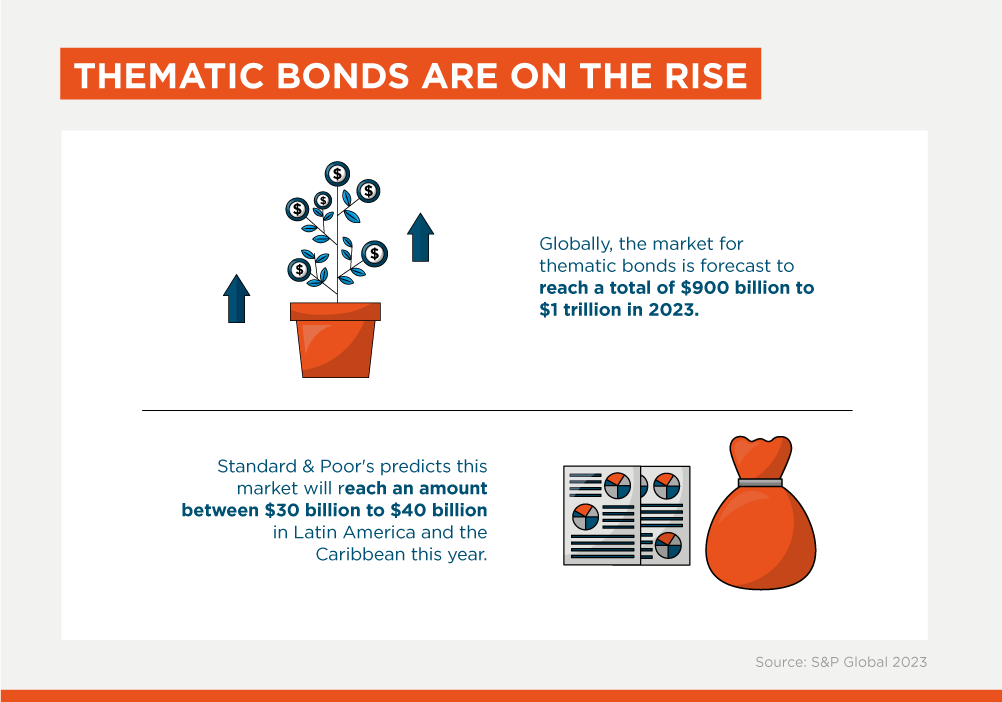

This is not a fad, but a trend that is dominating financial markets on other continents as well as in Latin America and the Caribbean (LAC), where products such as thematic bonds have continued to grow.

These bonds can be green, social or sustainable (the latter finance a combination of green and social projects), as well as those that are linked to sustainability. Their main characteristic is that the funds raised by the bonds are aimed at financing the Sustainable Development Goals (SDGs) of the 2030 Agenda, and are also aligned with international standards of transparency and the Paris Agenda.

Globally, the bond market is forecast to be worth between $900 billion and $1 trillion this year, according to Standard & Poor's. In LAC, this market is expected to reach between $30 million and $40 million in 2023.

The introduction of these bonds in our region has been largely led by IDB Invest, the private sector arm of the Inter-American Development Bank Group, which has played a catalytic role, supporting clients in the issuance of more than 35 thematic bonds to date, for a total value of more than $3 billion. Many of these have been pioneers in their markets, where we have often found promising projects and ambitious companies that need capital, but lack the experience to navigate a market that is new.

In recent years, at IDB Invest we have worked with two objectives in mind: to attract investments for development projects through innovative financing such as thematic bonds, and to strengthen the capital markets in all our member countries.

A medium-sized economy in the capital markets, Paraguay has a unique opportunity to issue its first thematic bond. As a large agricultural producer, particularly with products such as soybean and sugar cane, Paraguay could benefit from green, sustainable or sustainability-linked bonds. This was the case of the issuance of a green bond by a South American bank, where the proceeds were used in part to finance sustainable agriculture projects in the country.

Paraguay is one of the countries where IDB Invest wants to support the issuance of the first thematic bond in the local market. With the upcoming UN Climate Change Conference, COP28, just around the corner, the time has come to make this a reality.

--

*This opinion piece was originally published in Foco Magazine, part of the La Nacion newspaper in Paraguay.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe