Outcome-Based Financing Rewards Investors Upon Achieving Impact

Multilateral development banks working with the private sector have a dual mandate: maximizing positive social and environmental impacts while maintaining financial sustainability.

To support this mandate, development banks seek to provide financing at terms and conditions not available in local markets, targeting these resources to projects they consider have significant developmental impact potential.

However, financing potentially impactful projects at more favorable terms does not automatically ensure the desired outcomes will be realized.

Measuring Impact

In recent years, IDB Invest’s Blended Finance Team has increasingly moved towards providing “Outcome-Based Financing”, meaning that additional favorable financial terms (i.e. lower interest rates) are granted only when the impact is achieved and documented.

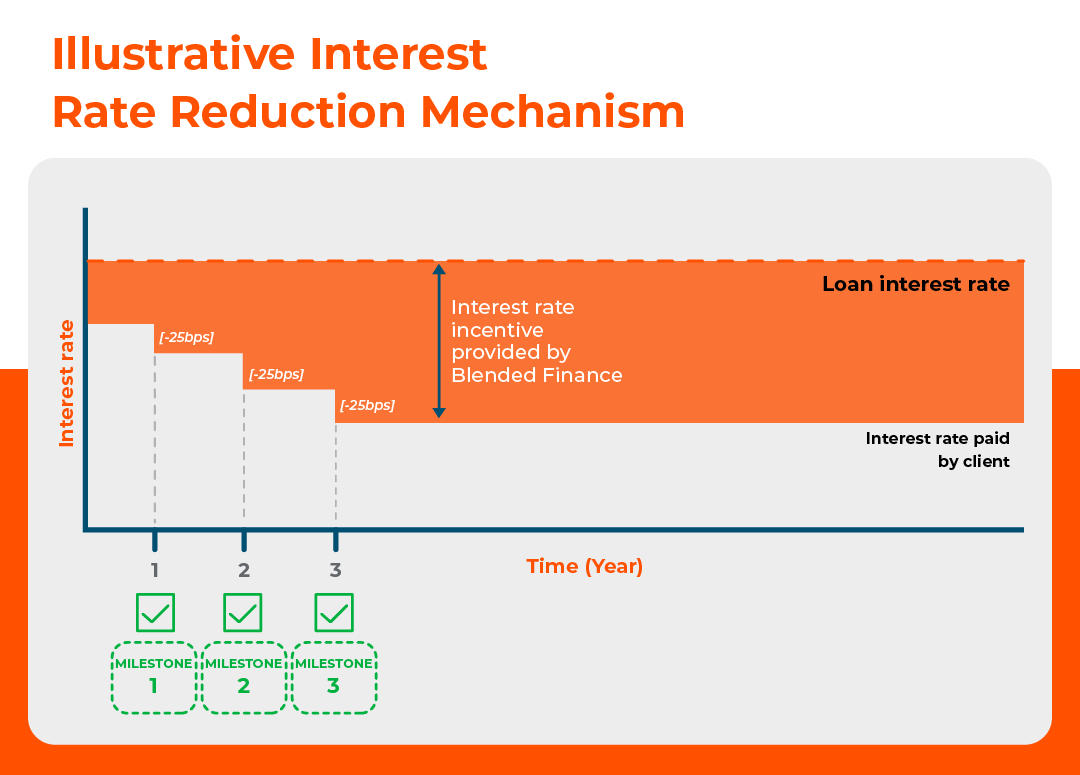

As shown in the example in Figure 1 below, the interest rate can be gradually reduced as a company achieves certain pre-established milestones.

Outcome-based financing is also known as Results-Based Financing (RBF) or Impact-Linked Finance (ILF).

Figure 1: Illustrative example of an outcome-based financing mechanism – a gradual reduction in the interest rate as milestones are achieved

Conventionally, while development finance institutions identify ex-ante the expected development impacts of a project, financing contracts focus on clearly defining the eligible use of proceeds. In some cases, this requires establishing sophisticated tracking systems to ensure the proceeds fulfill their intended purpose.

From the recipient´s perspective, a sole focus on tracking the use of proceeds can distract attention from achieving the desired impact. This is where outcome-based financing comes in, providing financial benefits only upon achieving pre-defined outcomes.

Financial Benefits

From a conceptual standpoint, outcome-based financing can have several advantages compared to conventional development financing.

It can gear the client's focus on achieving impact, improve the overall impact accountability of development finance, and promote a data-driven decision-making culture.

However, outcome-based financing has also its own challenges:

- the difficulty of setting ambitious yet achievable targets,

- obtaining sufficient data to define baseline values to be able to set targets, particularly when the incentive is trying to promote a change that is a very new area for a company.

- carefully designing the mechanism for verifying the achievement of the desired outcomes, and

- deciding on the appropriate level of financial incentive for achieving the outcomes.

IDB Invest's Results

Since 2016, IDB Invest’s Blended Finance team has implemented 47 different outcome-based financings in Latin America and the Caribbean, having invested $273.71 million in blended finance resources and mobilized an additional $16.74 billion (see interactive dashboard with projects below).

Figure 2: Interactive dashboard of IDB Invest projects with outcome-based financing

The four main types of outcome-based financing solutions that have been implemented are:

- Performance-Based Incentive (PBI): A cash payment to the client upon the achievement of impact milestones.

- Interest Rate Reductions: Rates diminish successively to a later stage upon the achievement of pre-defined milestones.

- Impact Carried Interest: When social and environmental milestones are achieved at the end of the fund lifetime, the equity fund managers, or General Partners, receive a greater share of the fund's earnings.

- Share Transfers: When the company achieves environmental and social milestones in addition to financial performance goals staff and management receive equity shares.

Of the 47 outcome-based financings by IDB Invest, 22 had interest rate reduction mechanisms, and 17 had performance-based incentives. Three had share transfers to employees, two had an impact-carried interest, and the remaining three projects had other outcome-based financing mechanisms.

Beyond Targets

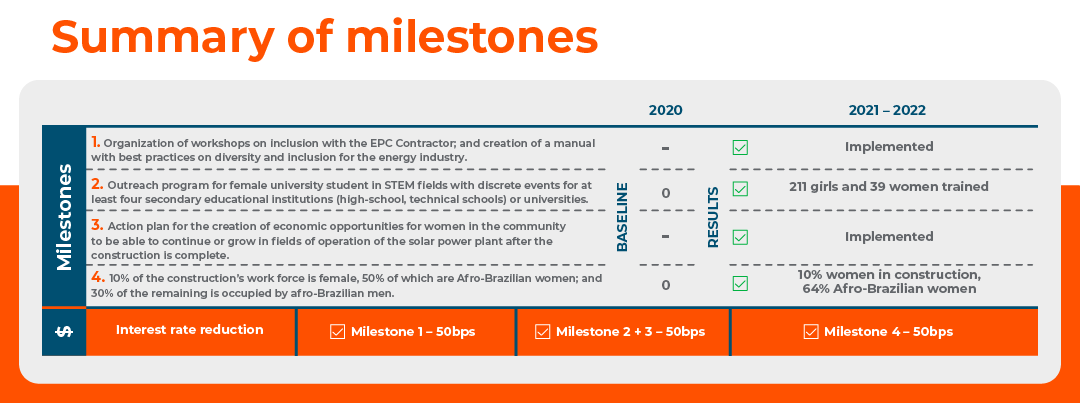

For example, the New Juazeiro Bifacial Solar Power Project in Brazil - with a total cost of $67.2 million - received a blended finance loan from IDB Invest for $15 million at a commercial interest rate.

Additionally, the project could receive up to a combined 150 basis points (bps), or a 1,5% interest rate reduction on the loan for reaching four gender occupational and operational milestones in the first two years (see table below).

As all milestones were met, the project received the entire 150 bps interest rate reduction. It was also awarded the Latin America Solar Deal of the Year Award.

Like New Juazeiro, IDB Invest has used PBIs in several other gender-focused blended finance projects. An IDB Invest report on seven case studies shows that PBIs contributed to achieving targets beyond those originally set.

They also provided critical internal justification for allocating resources, resulting in positive spillovers, such as changes in internal mindsets and creating demonstration and network effects.

Realistic Ambition

Outcome-based financing can be an effective tool for incentivizing development impact, especially when coupled with advisory services, through which support is provided to companies to build the conditions and internal capabilities to achieve outcomes successfully.

In IDB Invest’s experience, outcome-based financing works at its best when setting ambitious but realistic targets negotiated with the client through several iterations. We also learned that it is beneficial to focus on a limited set of outcome indicators easily understandable and measurable now and in the future.

We recommend keeping it simple and focusing on indicators that make a difference.

IDB Invest will continue to work on generating further evidence on the impacts of these innovative financial schemes.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe