Improving Telecommunications Drives GDP and Productivity

A 10% increase in mobile connectivity would boost GDP by 1.6%. In contrast, the same percentage increase in broadband connection can, on average, increase GDP by 3.19% and productivity by 2.69%, according to the study "How New Technologies Are Transforming Telecommunications in Latin America and the Caribbean" by IDB Invest and NTT Data.

These entities have conducted a research series to provide findings, insights, and recommendations on how new technologies are transforming different industries and how smartphone usage is crucial in bridging the digital gap in the region.

Regarding new technologies, the research determined that by the end of 2022, 40% of the region's GDP was attributed to digital businesses, and by 2025, the telecommunications sector would represent 7.4% of the GDP, equivalent to USD 365 billion.

The COVID-19 pandemic significantly boosted connectivity demand in Latin America and the Caribbean, recording a 34% increase between 2019 and 2020. This upward trend led to 76% of the region's population using the internet by 2021, emphasizing the crucial role of the telecommunications industry in the digital era.

This growth represents both an opportunity and a challenge for the sector, which must ensure greater capacity, quality, and service coverage while trying to maintain profitable margins after significant investments in infrastructure.

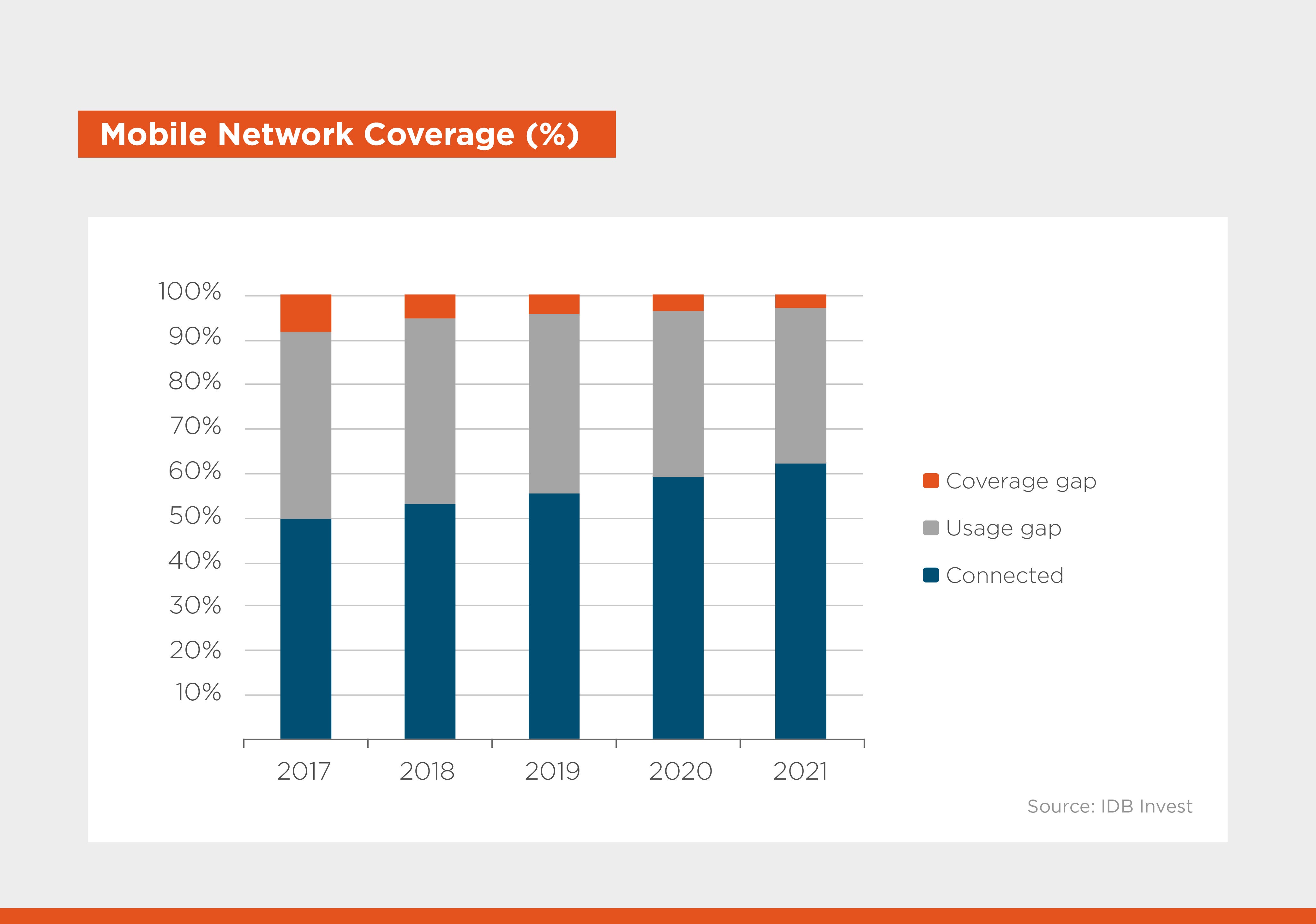

Telecommunications networks in Latin America and the Caribbean reached 97% of the population in terms of mobile network coverage in 2021. However, approximately 230 million people (35% of the population) do not connect to the internet via a mobile device.

Three main factors causing this gap between access and use are high costs, connection quality, and digital illiteracy.

According to the BID Invest and NTT Data study, internet access is directly related to productivity, job creation (650,000 direct and 970,000 indirect jobs in 2021), and economic activity growth. Therefore, reducing the connectivity gap is crucial to fostering the development of Latin America and the Caribbean.

Telecommunications infrastructure plays an essential role in expanding connectivity because the region's development becomes much more complex without it. Fortunately, current technology has allowed significant advances in the sector. Since the introduction of 5G, there has been an increase in capital investment, expected to reach a total of USD 60 billion between 2021 and 2025, so tech companies have much at stake in staying up-to-date with these trends.

A clear example is fiber optic infrastructure, which is gradually replacing traditional copper lines, allowing greater data transmission capacity, fewer connection interruptions, and interference elimination.

Similarly, data centers are on the rise, providing shared access to applications and data with various modalities due to the accelerated migration to cloud technologies.

Additionally, trends such as next-generation satellite internet and submarine cables could pose a risk to the sector, facilitating the entry of new players, especially hyperscalers, offering high-speed services with broader coverage.

In this regard, seeking partnerships may be an alternative in the medium term, as it initially does not require significant capital investment (CAPEX).

Despite the unprecedented growth of tech giants, the primary users of communication infrastructure, telecommunications companies face the challenge of margin increases, calling for a reinvention of the sector's leading players who want to monetize connectivity and be an active part of this digital revolution.

There are relevant initiatives exemplifying this situation, from supporting the creation of digital ecosystems and positioning within the value chain of other sectors to expanding their product offerings in applications, generating a new source of income, and improving customer engagement.

Telecommunications play a fundamental role in developing emerging technologies in Latin America and the Caribbean, opening doors to socio-economic progress in the region. To tackle challenges and capitalize on opportunities, companies in the sector must adapt and diversify in this constantly evolving digital era.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe