Traveling for Good: How Nature-Based Tourism & Regenerative Travel Can Drive Development

Travel has long been a means of escape, adventure, and relaxation, giving us rich and unique perspectives. It can also help us save the world.

As we face unprecedented environmental challenges, the way we explore and experience destinations must evolve. In recent years, as travelers have become more interested in reducing their negative impact on the environment, two significant travel trends have emerged: nature-based tourism and regenerative travel. Interestingly, as visitors form a deeper connection with their surroundings through these tourism modalities, they are further inspired to support conservation efforts and responsible practices.

Nature-based tourism allows travelers to experience the raw beauty of destinations. By understanding the fragility of ecosystems, a focus on sustainability, conservation, and responsible stewardship emerges. This results in visitors making more conscious travel choices, opting for environmentally-friendly accommodations, selecting hotels that strive for green certifications that seek to protect the environment, and engaging in activities that support conservation.

Nature-based tourism spans a broad spectrum of subcategories like wildlife-watching, adventure tourism, community-based tourism, and stargazing, to name a few. They all attract a wide amplitude of demand segments, and this interest only continues to grow. In fact, according to a UN analysis, by 2050, around 70% of the population is expected to live in cities, underlining the need to maintain a connection with nature and seek nature-based experiences.

The United Nations Environment Programme has found that for every US$1 spent on nature restoration, an astounding US$9 in economic benefits is obtained. For investors, this is a golden opportunity to generate exponential impact by aligning their portfolios with genuinely responsible tourism practices, to obtain profitability while contributing to positive environmental impact.

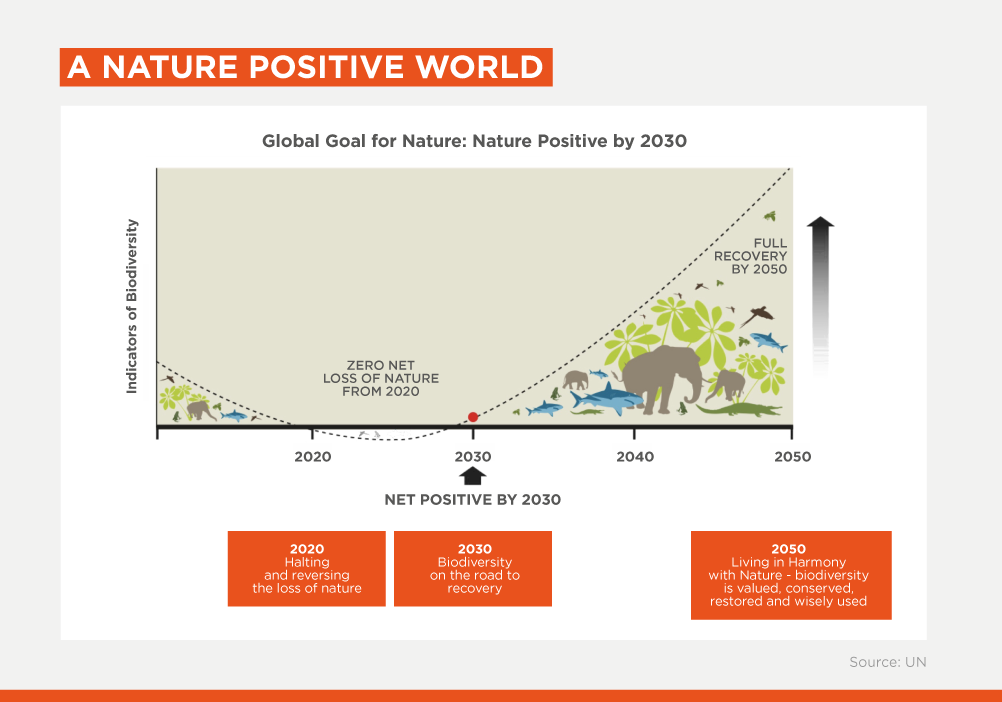

As the largest potential source of investment in climate change mitigation and adaptation measures, with the ability to effect positive change across entire value chains, the private sector has a crucial role in these endeavors, as recognized by the Global Biodiversity Framework. The appeal combines financial returns and a desire to help fight the climate crisis, creating a circular investment thesis.

Likewise, regenerative travel is driven by travelers placing a premium on authenticity and seeking genuine environmental, social, and governance (ESG) practices. These travelers, who tend to be environmentally-conscious, are more apt to recognize meaningful ESG initiatives and reject superficial greenwashing attempts. This approach sets the stage for understanding the importance of the regenerative living method, which actively involves travelers in revitalizing the environment and communities. It emphasizes the restoration of ecosystems through myriad activities like reforestation and habitat restoration, inviting travelers to actively participate in these conservation efforts.

For investors, this goes beyond taking simple steps toward better practices such as removing straws from restaurants, eliminating single-use plastics from bathrooms, or fostering the re-use of towels. This is about asking them to do a deep dive on the needs of a destination or community and become part of the solution, thereby creating development impact through a circular effect.

As such, engagement with community members and sponsors is key to building resilience. The regenerative living method becomes even more powerful when travelers understand their role in contributing to a circular economy by embracing efficient resource use, waste reduction and the support of products designed for recycling and reusability.

In Latin America, Costa Rica represents a beacon for nature-based tourism and regenerative travel with over 25% of its land protected, as well as 30% of its waters. Benefitting from a thriving sustainable tourism sector, the country offers fertile ground for impactful development projects. Its extensive network of national parks and commitment to conservation and community engagement have made it a global leader in ecotourism, with over 400 certified sustainable tourism companies, providing appealing prospects for impact-driven investors.

Opportunities abound there to support projects with high environmental sensitivity and collaborate closely with the local community to create direct and indirect quality jobs and generate long-term economic prosperity. This has created an ideal environment for domestic and international investors who seek an impact investing agenda to find attractive opportunities in the country.

Moreover, Costa Rica's commitment to nature-based tourism has safeguarded its biodiversity and boosted the economic activity of local communities. Nicoya’s Blue Zone, highlighted in the Netflix documentary “Live to 100: Secrets of the Blue Zones”, showcases the residents' longevity, a testament to sustainable tourism's positive impact on community well-being for decades now. Investors and financial institutions keen to support ventures that balance profit and societal benefits can find ample opportunities in Costa Rica's sustainable tourism landscape, where financial growth aligns with environmental and social well-being.

This development impact mandate aligns well with IDB Invest's principles and core mission, resulting in support not only through resources, but also through the introduction of innovative financial solutions and the provision of advisory services. The latter is key, as technical assistance is often required to provide guidance on implementing tailored solutions and grant resources to magnify certain initiatives to make them more impactful and demonstrative.

Furthermore, through the effective use of Blended Finance, financial incentives can be provided subject to the achievement of certain sustainability performance indicators. In fact, potent trends are emerging around the integration of the local value chain, especially by engaging small and medium-sized enterprises. This ultimately has a multiplier effect.

Nature-based tourism and regenerative travel are more than buzzwords. However, there needs to be an evolution from traditional philanthropic conservation models to develop new business propositions that actively monetize sustainability. Ultimately, developing these types of platforms will create the necessary project-level scale to obtain profitability on a sustained basis.

The journey is challenging and worth taking. It’s where the common interests of every stakeholder intersect: a genuine desire to pursue meaningful sustainability principles in the context of profitable tourism projects.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe