How to Promote Energy Efficiency in the Private Sector

Investing in energy efficiency has the potential to boost growth by enhancing private sector productivity in a sustainable way – a must now that the post-pandemic recovery will likely be accompanied by increasing energy demand.

Energy efficiency has been called the “fifth fuel” after coal, hydrocarbons, nuclear, and renewables. Reversing this order, the International Energy Agency considers it the “first fuel”, elevating energy efficiency as the “cleanest, and in most cases, cheapest way to meet our energy needs.” This makes sense seeing that energy consumption is the main contributor to climate change, accounting for around 60% of total greenhouse gas (GHG) emissions.

Latin America and the Caribbean (LAC) is already characterized by high energy consumption and low productivity. This means that firms aren’t maximizing their output for every unit of energy consumed. In this respect, adopting energy efficiency-enhancing technologies not only helps reduce emissions, but can also decrease firm operational costs and, in turn, increase profitability.

Given this win-win situation, how can we boost energy efficiency adoption in the region’s private sector? To start, our new IDB Invest study analyzes energy efficiency trends for the region using firm-level data for over 6,000 firms in 19 countries, pulling from World Bank and Compete Caribbean enterprise surveys. We review research on how firms make decisions about investing in energy efficiency and the various market and behavioral forces at play. We also summarize the existing evidence on what has and hasn’t worked in promoting uptake of energy efficiency practices among firms, with an eye towards guiding future approaches.

What are the main takeaways from the study?

- Greater energy efficiency and productivity go hand-in-hand. Energy efficiency is measured by the amount of energy required to produce a unit of output. We found that a 1% increase in productivity is associated with a 0.4% increase in energy efficiency. In other words, the most productive firms tend to invest more in energy efficiency, and using energy more efficiently helps boost efficiencies in other areas, creating a virtuous cycle.

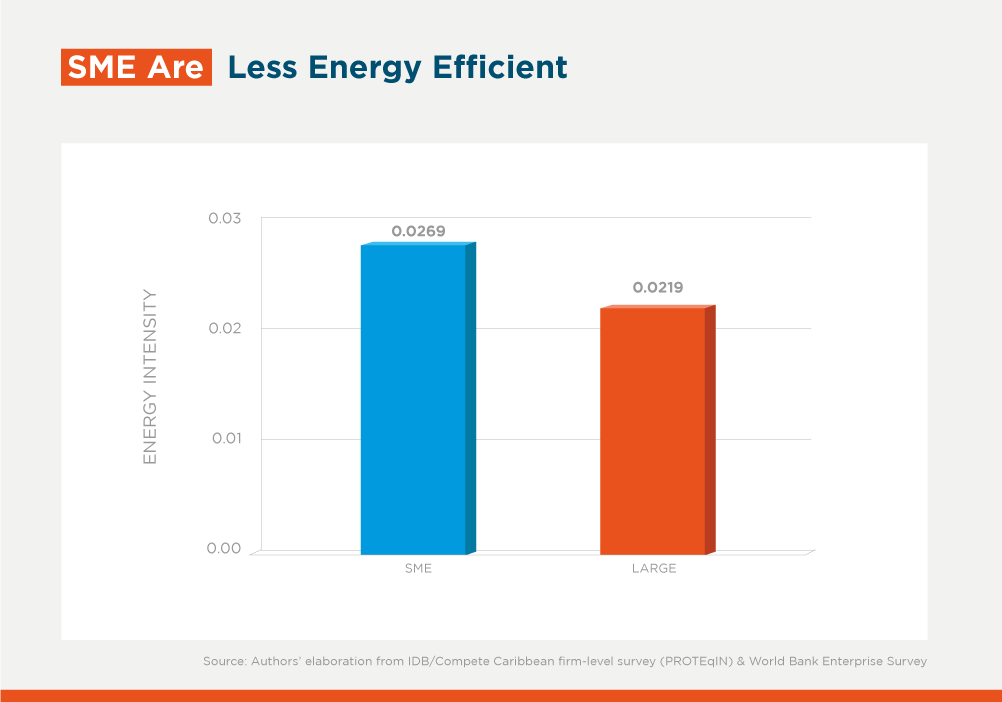

- Energy efficiency varies by sector and firm characteristics. On average, the services sector is more energy efficient than manufacturing. The three least efficient sectors are Textiles & Garments, Plastics & Rubbers, and Hotels & Restaurants. Focusing interventions in high energy use sectors such as these could help LAC meet its energy intensity reduction goals. Unsurprisingly, small and medium enterprises (SMEs) are 19% less energy efficient than their larger counterparts. However large firms are still responsible for the lion’s share of energy consumption and output. This signals the need to work with firms of all sizes in the region to reduce energy use. Additionally, firms with a track record in innovation are 20% more energy efficient than non-innovative ones. The gender of firm owners does not play a significant role in energy efficiency levels.

- Information campaigns and energy audits have proved to be effective in promoting energy efficiency uptake. Typically, efforts to promote energy efficiency have focused on pricing, by taxing energy use over a certain threshold during “peak” times. However, non-price interventions, such as information campaigns and energy audits, have also proved to be effective. For example, information campaigns aiming to change people’s energy use behavior can focus messaging on potential cost savings or peer comparisons of energy consumption. Another information-based strategy is an energy audit, which provides a deep dive into a firm’s historical, current, and future energy needs and makes recommendations about where to target investments. Audits that communicate recommendations to firms in a “user-friendly” way are particularly effective.

- Financial institutions can play a key role in promoting energy efficiency among firms by providing both green credit and information about the benefits of green technologies. The credit constraints facing firms in LAC is a top reason for low levels of investment in energy efficiency. At the same time, demand for “green credit” to finance such investments is still nascent in the region. Interestingly, our results suggest that the energy efficiency gap between credit constrained and non-credit constrained large firms is greater than the same gap among SMEs. Therefore, increasing credit access for large firms with energy efficiency goals could bring the largest gains. Likewise, banks can promote “green” lending lines among firms by coupling messaging about the business benefits of energy efficiency alongside information about the financial product. They can also provide training to clients on green technologies and offer continued support to maintain sustainable practices. IDB Invest works with banks in the region to devise these sorts of green financing strategies.

Energy efficiency is a cornerstone of sustainable development for the region. Prioritizing the so-called “first fuel” is one way for the private sector to rethink how it operates and help contribute to environmental sustainability, while also creating benefits for firms.

For more details, see the study and DEBrief by Aparicio et al., (2022),“How Can the Private Sector Promote Energy Efficiency? A Review of Lessons Learned and Evidence from Latin America and the Caribbean”, which is part of IDB Invest’s Development through the Private Sector Series.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe