How to Measure Job Creation in Development Projects

Job creation is one of the main indicators of a healthy economy. However, in Latin America and the Caribbean, where over half the labor force is informal, creating quality jobs is a significant challenge. Development finance institutions such as IDB Invest are instrumental in addressing this issue by financing projects that drive sustainable growth through the private sector.

Development banks help to unlock employment opportunities that might not otherwise emerge, particularly in underserved sectors and regions. Reliable measurement of employment outcomes is therefore key to effectively capturing this impact. In this context, IDB Invest is piloting a new approach to estimate the direct and indirect jobs supported and created by its portfolio.

Creating and Measuring Private Sector Jobs

Development banks typically want to measure how much their projects contribute to employment, but this is more complex than it may sound. Despite efforts to develop a standardized methodology for measuring job creation, there is currently no universal approach.

Instead, development banks often report related concepts, such as jobs supported or employment sustained by their investments, which are easier to quantify but lack conceptual clarity and scope.

A Pilot Framework to Estimate the Contribution of IDB Invest’s Portfolio to Employment

IDB Invest’s pilot to measure the contribution of its projects to employment draws on client data, country-specific aggregate statistics, and standard economic models. The framework proposes a methodology to estimate both jobs supported and jobs created —direct and indirect.

The methodology estimates contributions to employment at the portfolio level, rather than measuring the impact of each project. Estimating the latter would require rigorous impact evaluations with counterfactual analyses at the project level — essentially, comparing a project’s job effects with the scenario in which it had not existed.

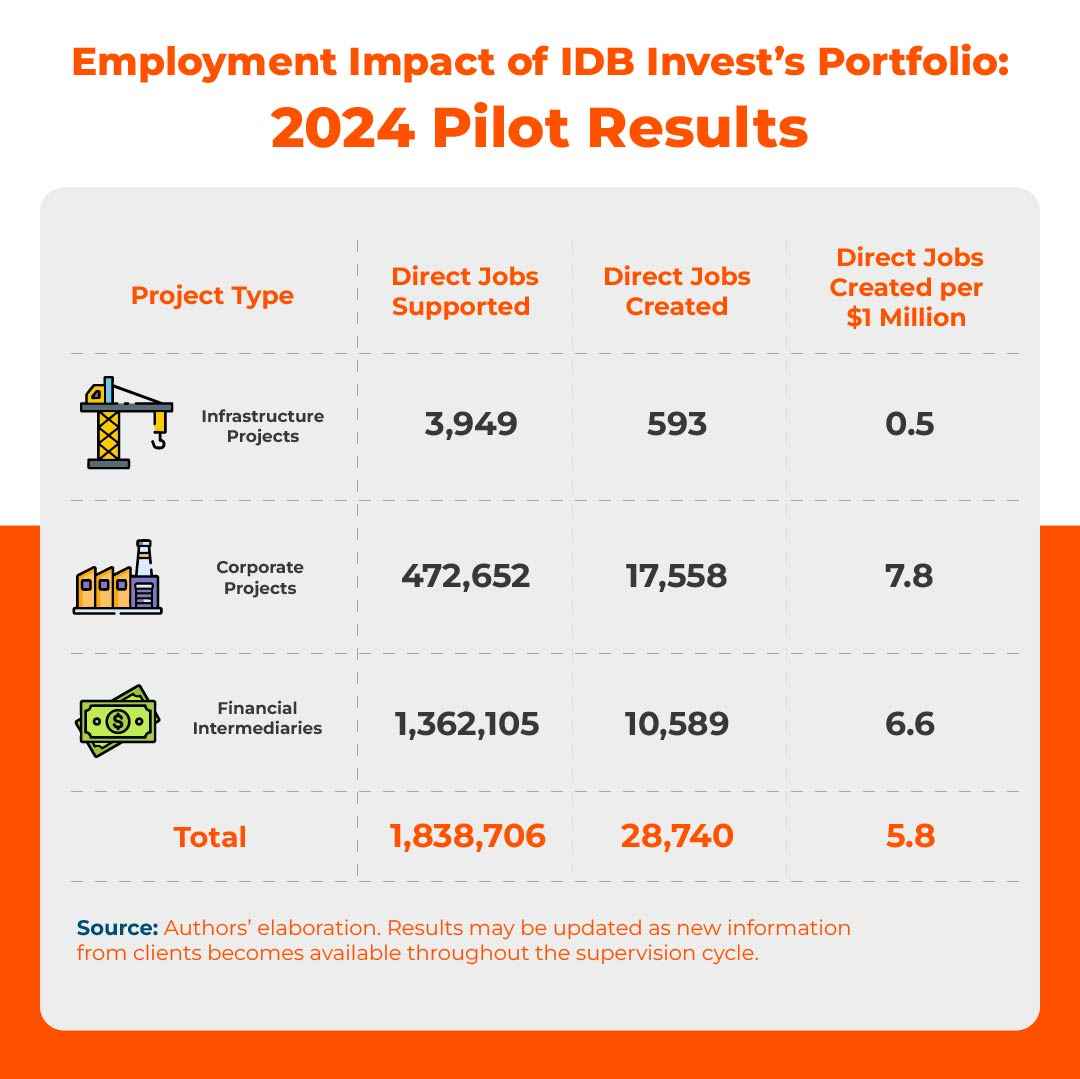

IDB Invest applied the proposed framework to its portfolio of active projects in 2024. It estimated the number of direct jobs supported (defined as the number of employees working within the project, the client company, or the final beneficiaries) and direct jobs created (defined as the number of new employees hired as a direct result of the project).

Pilot Results

The results show that Corporate projects create the most direct jobs, typically through large-scale expansions and scale-ups of established companies. These projects often involve operating new plants, opening new production lines, expanding service offerings, or entering new markets, each driving multiple rounds of recruitment for managerial, technical, and operational jobs.

Similarly, projects through Financial Intermediaries, which enable access to financing for many micro, small, and medium-sized enterprises (MSMEs), also generate a significant uptick in direct employment.

Meanwhile, Infrastructure projects, such as highways, bridges, or wind farms, tend to create relatively few permanent jobs. While they mobilize large workforces during the construction phase and generate indirect employment, long-term staffing needs generally stabilize around small maintenance teams. Additionally, the results show that IDB Invest projects created an average of 5.8 jobs per year for each $1 million invested. This aligns closely with existing research.¹

From Job Quantity to Quality

This framework is a first step towards quantifying how a portfolio of development projects contributes to employment. There is still more work to be done to capture the full spectrum of job effects, such as indirect jobs supported and spillovers across industries. Measuring the quality of jobs in terms of wages, skill requirements, stability, and other factors is also essential.

This pilot aims to propose a standardized approach that can be applied to other development finance institutions facing similar measurement challenges. We encourage the application and refinement of this framework and look forward to ongoing collaboration towards a shared methodology.

For more information see:

Measuring the Contribution of Development Projects to Employment: IDB Invest’s Pilot Framework

DEBrief summarizing the main findings.

- - - -

¹ Figal Garone et al. (2025) estimate that an additional US$1 million in credit to MSMEs in LAC generates 6.5 permanent jobs per year. They also find that this effect is stronger among the fastest-growing firms and for investments in fixed assets. Brown and Earle (2013) report that each US$1 million in loans in the United States created 5.4 jobs, while Brown and Earle (2015) estimate between three and four jobs per million dollars. The Centre for Economics and Business Research (2016) finds a similar multiplier in the United Kingdom. Finally, the IFC (2021) estimates SME loans in developing economies yield 8.15 jobs per US$1 million. See also Arraiz et al. (2014), Chodorow-Reich (2014), Bentolila et al. (2017) and Amamou et al. (2020).

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe