Overcoming Three Challenges to Unlock the Potential of Green Hydrogen

Latin America and the Caribbean is at a tipping point in terms of green hydrogen development. There are currently 65 projects in the region, 92% of which are early-stage projects, while many others are at a proposal stage. The region faces a series of legal, regulatory, financial and market obstacles that have only slowed the progress of clean energy initiatives.

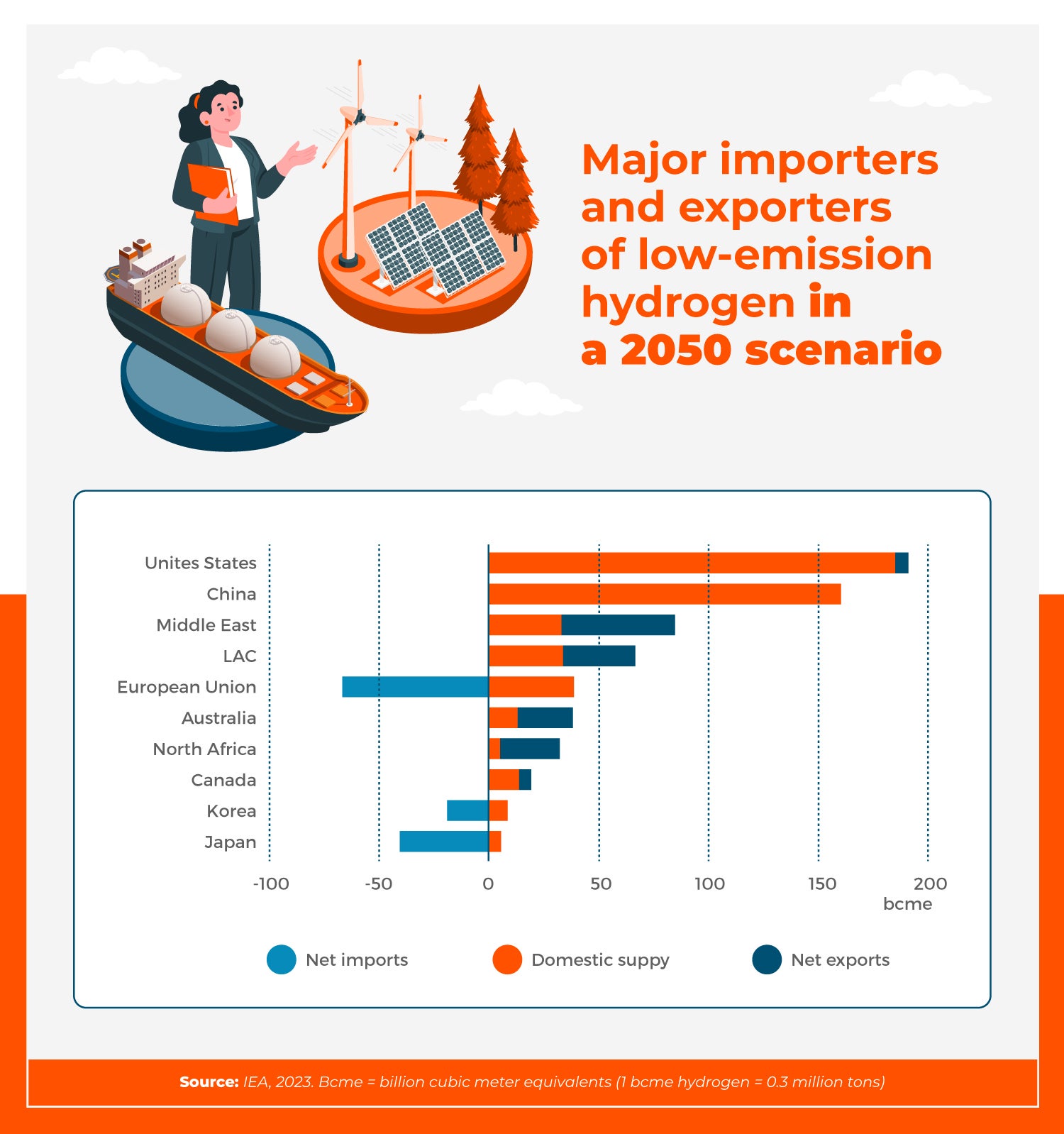

With a global market expected to hit the $10 billion mark by 2028, several countries are well positioned to become export leaders. Latin America and the Caribbean will be the fourth region with the highest green hydrogen export potential by 2050, with the European Union, Japan and Korea as the biggest net importers.

The time has come to unlock the region’s green hydrogen potential, that will place it among the world leaders in the sector. Projects need to move beyond the development stage and into the building and operation phases.

This requires addressing three challenges:

1. Regulatory Frameworks and Fiscal Incentives

Adopting and developing green hydrogen requires both government support and a regulatory framework, as well as the active engagement of the private sector, academia and other stakeholders. In addition, a national development strategy and roadmap need to be designed. In fact, in 2023, Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, Panama and Uruguay had hydrogen strategies in place, whereas Bolivia, Paraguay, Peru, and Trinidad and Tobago were mapping them out (IEA, 2023), mostly with IDB support. Collaboration to define standards and certification programs is another critical component of the equation.

Sustainability Week 2024: The most consequential sustainability event for the private sector in Latin America and the Caribbean. Register here!

Innovative financing structures with clear legal frameworks, investment or budget incentives, and seed capital investments to reduce risks should also be considered. Globally, six funds of this kind have been launched since 2021, including a $7 billion funding opportunity in the United States in 2022. In 2023, IDB and other development entities supported Chile—one of the countries with the greatest potential in the region—in launching a USD 1 billion Green Hydrogen Development Fund to provide technical assistance and concessional financing for new projects.

2. Mass Production of Electrolyzers

To advance green hydrogen production and decarbonization goals, electrolyzers need to be mass-produced, as the current supply does not meet global demand. In 2022, the global electrolysis capacity in place was four orders of magnitude below the 4,400 GW needed by 2050. However, the current cost of electrolyzers is very high ($1.355/kW in 2022), and despite their increased efficiency in recent years, (~80% for some companies), it should be vastly improved.

Let’s take as an example the hydrogen used by Trinidad and Tobago to produce ammonia in 2020 (750 kton of grey hydrogen). To produce a green hydrogen equivalent, 5-10 GW of electrolysis would have been needed (depending on the renewable source capacity, e.g. hydro vs. solar). This would amount to at least USD 6.775 billion. There’s also a cost reduction need for power generation—the largest cost involved in hydrogen production.

Implementing electrolyzers can leverage local value chains and boost job creation, as is the case with Nuevo León, a Mexican state that is spearheading the electromobility revolution in Latin America and seeks to become the largest innovation hub.

3. Domestic Demand, Related Logistics and Efficient Export Channels

There’s a mismatch between hydrogen import and export projects. Of the proposed 12-million-ton (Mt) annual hydrogen exports, only 2 Mt have potential or real buyers, whereas another 3 Mt do not have a specific region to export to. For commercial scale (several MW) projects, a diversified domestic or export off-taker base should be kept to allow for demand redundancy. In other words, different use scenarios should be planned, like heavy cargo transportation and related infrastructure, and energy-intensive industrial sectors. Additionally, not only transportation logistics need to be established, but also export requirements (including permits and insurance) and trade agreements must be in place.

All this should be supported with local technical and professional capacity in all related areas. As the largest multilateral development institution for the region, the IDB Group is emerging as a key player in leveraging green hydrogen in Latin America and the Caribbean.

Latest posts

- The Sustainable Bond that Transformed Central America's Financial Markets

- Not Just Tourists: Now Also Cars Recharge Under the Sun of Punta Cana

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe