Four Ways to Put the Circular Economy to Work for Your Company

An important appeal of the circular economy is that at its core it is fully aligned with efforts to drive a sustainable, low-carbon, just and inclusive economic recovery.

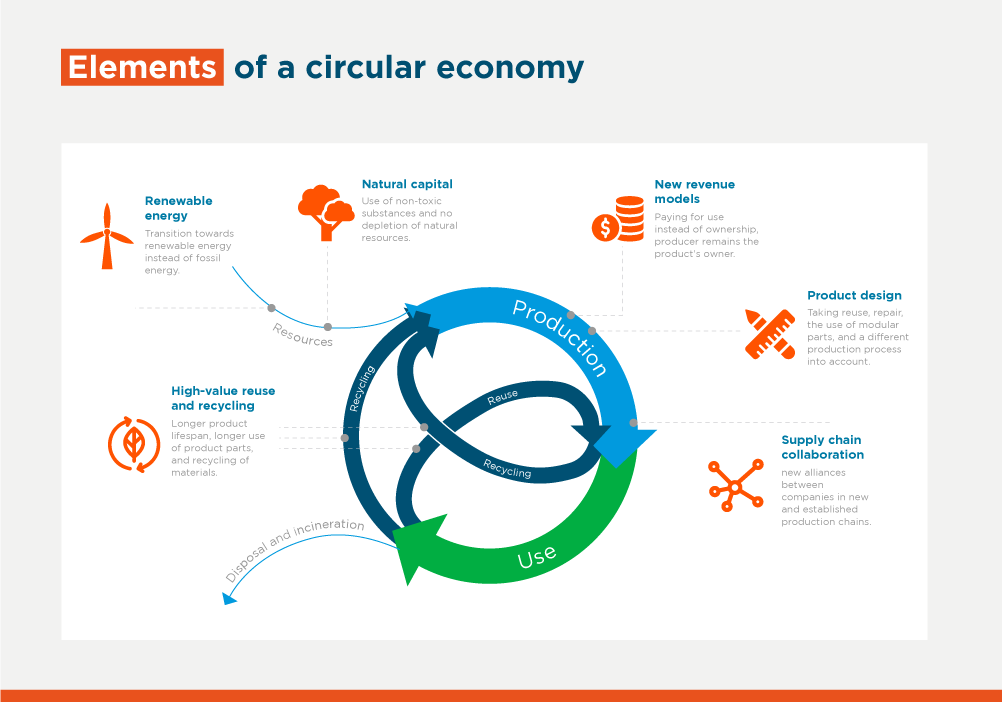

The circular economy, as it implies a switch to a restorative economic approach that keeps products, components, and materials at their highest utility and value, has a strong business case. Just like nature does not waste a thing, but restores, reuses and redeploys, the circular economy seeks to extend products’ lifecycles through thoughtful design and processes along the value chain, in a departure from the traditional “take-make-dispose” linear model.

This represents a great opportunity for companies and stakeholders and is an approach that is, of course, tailor-made to tackle climate change and to shepherd the limited natural resources we depend on. In past years, we have seen a tremendous uptake of this agenda in the region, both in terms of policies and public initiatives as well as private sector action.

In addition, regulatory, and consumer trends continue to be key drivers of this agenda. From a policy perspective, a recent publication by UNIDO shows that more than 80 public initiatives have been launched in the region – some of which include national circular economy roadmaps and strategies in countries like Colombia, Chile, Ecuador, Peru and Uruguay; or Extended Producer Responsibility regulations.

We are also seeing a growing body of research showing the links between material handling and use; greenhouse gas emissions released during extraction processing and manufacturing, and how the circular economy can contribute significantly to tackling climate change. Circle Economy's latest report estimates that circular economy strategies can reduce by 39% global greenhouse gas emissions. An Ellen McArthur Foundation report shows how applying circular economy strategies in five key areas (cement, steel, aluminium, plastic and food) can eliminate 9.3 billion tons of emissions by 2050 – which they compare to cutting all emissions from all transport to zero.

A fair and inclusive transition is also high on the global agenda and of particular importance in our region, which is hard hit by deep inequalities. An inclusive lens as we transition to a circular economy is imperative. In this transition, job markets will be impacted – creating new opportunities, sunsetting others, and demanding new skills. The fair transition is also about ensuring that small or less influential players are not left behind; this is relevant for MSMEs that are essential in closing the loop in value chains, in driving innovations and in enabling circularity. Support and incentives for SMEs, from regulators, corporations and financial institutions is needed to ensure they can also transition and thrive.

Against this background here are 4 considerations as you put the circular economy to work for your company:

1. To be or not to be - getting started is often the hardest step and can be overwhelming for some. Embracing this agenda is not a question of whether you are circular or not; but rather a transition to becoming circular. Companies ought to keep this in mind with ambition and a sense of urgency. Getting started is often a mix of understanding where the greatest circular opportunities and impacts are across operations and value chain; prioritizing; testing, implementing and measuring circular strategies. Our experience has proved that a thorough review of the external environment and a candid assessment of gaps in internal capabilities are essential steps when putting circular solutions to practice.

2. Connect the dots – articulating your circular economy thinking into your business strategy and as a pathway towards your decarbonization and sustainability goals will prove valuable in aligning your roadmap across departments and stakeholders.

3. Share the value – companies are often quick to embrace a win-win shared value approach; but some are more forgetful when it comes to sharing that value along the chain, which is critical for long term success. You can’t become circular by working only on one patch; plus, most of the impact and opportunities rely on the value chain and those value chains depend heavily on Micro, Small and Medium-sized Enterprises, or MSMEs. To name a few: usership over ownership models open new needs for maintenance and repairing services; tech MSMEs can enable circular economy through traceability, data analytics, Internet of Things applications; B2C reverse logistics create new business opportunities for transporters; distributors and local stores among others; and lastly demand for recovery of used materials can grow and enhance the value of recycling work - generally relegated to micro-enterprises (many of those informal).

4. Ride the wave of sustainable finance - Forward thinking corporate finance teams are playing a pivotal role integrating key agendas into sustainable finance strategies that contribute to delivering sustainable business models and performance. We see an opportunity for corporate clients to consider performance-based financial instruments, such as sustainability-linked bonds and loans in line with their overall business and sustainability strategy. When it comes to unlocking financing along the value chain, sustainable supply chain financing can also be an attractive opportunity addressing MSME working capital needs and providing incentives to improve circular solutions along the chain.

At IDB Invest, we have seen this increased interest and commitment first-hand. In past years, we have been supporting clients, through our financing and advisory services, in their transition to a circular economy. Examples include Arzyz Metals in Mexico which has invested in a new plant which increases its aluminum recycling capacity; CRN in Nicaragua to increase the penetration of recycling; and Grupo Kuo whom we worked with to understand and implement circular solutions along its value chain on one of its chemical business lines.

In Colombia, we are working with national and commercial banks in the development of a common taxonomy for financing the circular economy in the country, understand market needs and identify adequate financing instruments that allow promoting lines of financing for the circular economy at the local level. And we are fostering and developing a robust pipeline of projects in Mexico, Dominican Republic, Chile, Ecuador among several countries, with circular economy components.

In the end, it’s not a matter of if, but when companies will jump into the circular economy bandwagon. It is not only the right thing to do, but also the profitable thing to do.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe