Innovative Incentives for Early Coal Plant Phase Out: The case of Engie in Chile

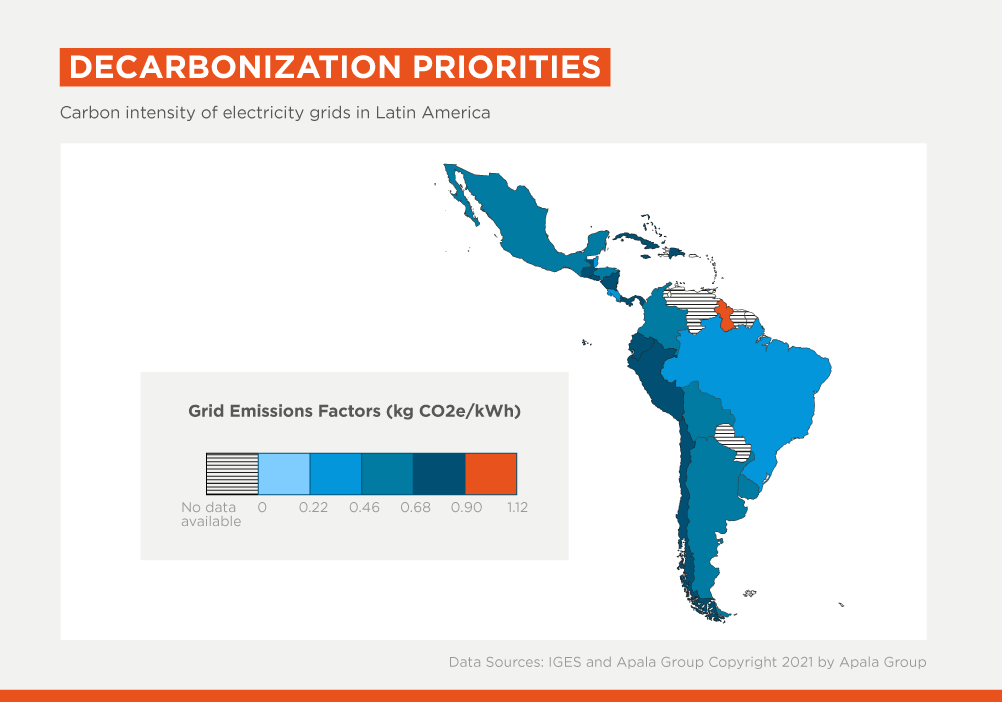

As Latin America and the Caribbean (LAC) reduces its carbon footprint, the experience of the Chilean subsidiary of France’s Engie with the use of carbon markets stands out as a valuable example for others.

Four years ago now, the Chilean government and Engie signed an agreement in which the company committed to phasing out its coal plants in the city of Tocopilla, in the country’s arid north, no later than May 31, 2024.

This didn’t come out of nowhere; rather, it was a response to the publication of the government plan "Energy Route 2018-2022" a year before, establishing the decarbonization of the energy matrix through a binding schedule for the dismantling of coal-fired power plants as one of ten government commitments.

Also in 2018, the government convened the "Decarbonization Working Group", a public-private dialogue with the owners of coal-fired power plants (AES Gener, Colbún, Enel, and Engie to develop a schedule of voluntary commitments to gradually dismantle all such coal plants by 2040.

It’s in this context that IDB Invest proposed to Engie Energía Chile a pioneering model of incentives for the accelerated retirement of two coal plants, Units 14 (136 MW) and 15 (132 MW). Using blended finance funds from the Climate Investment Funds (CIF), a monetization model for the reduction of greenhouse gas emissions (GHG) through their replacement by clean technology projects was designed.

The methodology used for calculating avoided emissions (available for download here and in Spanish here) was designed by the IDB Invest Infrastructure and Energy team and the Advisory Services team based on previously existing methodologies of the Clean Development Mechanism (CDM), and it includes elements to safeguard additionality and the long-term permanence of the accounted emissions.

In summary, only those emissions generated during the acceleration period of the retirement regarding the original commitment (in this case, before May 31, 2024) are accounted for as long as there is a clean technology replacement asset covering the generation that the coal asset would have produced.

This is how that works in practice: IDB Invest and Engie Energía Chile announced in 2021 a financial deal for the construction of the Calama Wind Farm with an installed capacity of approximately 151 MW, located near the city of Calama in the Antofagasta Region. The financing package includes a $15 million blended finance tranche from the CIFs, linked to the accelerated retirement of Units 14 and 15 by January 1, 2022, and the effective operation of the Calama Wind Farm.

Importantly, the concessional loan interest rate will be adjusted upon maturity based on the effective amount of displaced emissions and a predefined floor price for those emissions. In November 2021, the Calama Wind Farm began commercial operation. This way, Engie Energía Chile already had the replacement asset before the estimated date for the retirement of Units 14 and 15.

When, on June 30 2022, Engie Energía Chile disconnected Unit 14 in Tocopilla, the projected emissions from this coal-fired power plant, displaced by the Calama Wind Farm, began to be accounted for monetization under the CIF loan.

Later, on September 30, 2022, Engie Energía Chile disconnected Unit 15 and, likewise, the count of emissions displaced by the Calama Wind Farm increased with the emissions that this second unit would no longer generate, until the committed date in 2024.

The monetization mechanism actually works as a mechanism to purchase the future carbon inventory of a country, sector, or specific company. With this monetization, we contribute to accelerating the energy transition and, thus, to the future commitments of companies (in this case, Engie Energía Chile), the energy sector, and countries (in this case, Chile with its Energy Route). For this reason, this pilot incorporates a transition scheme to Carbon Markets aligned with the Paris Agreement.

If, during the 12 years of the concessional loan's lifespan, a carbon market is established in Chile in accordance with the development of Article 6 of the Paris Agreement (and once the methodology proposed by IDB Invest is incorporated into its regulation), then Engie could directly sell the carbon credits generated by the early closure in that market, while maintaining the optionality of the floor price set with the CIF funds.

At IDB Invest, we believe that Carbon Markets represent a useful tool for accelerating the energy transition in LAC when additionality, permanence, and equity can be ensured. That is, when we can effectively accelerate the retirement of fossil fuel-based generation units and their replacement with renewable energy; when that disconnection is permanent; and when that transition takes into account future opportunities for the affected sectors and communities.

This is how carbon credits can be generated and meet the highest quality and integrity standards to fulfill the decarbonization commitments of the Paris Agreement. Using blended finance, advisory services and its sectoral expertise in Energy, IDB Invest can act as a catalyst for these markets, helping to define their governance as well as establish referential price ranges to provide liquidity, transparency, and long-term visibility.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe