Posts by Financial Institutions

Blockchain: Democratizing finance

Fourteen million small agricultural producers in Latin America and the Caribbean are exposed to climate change with repercussions on land quality and yield. These producers have very limited ability to access financial services such as agricultural insurance. Less than 20% of local banks serve agribusiness, due to the high costs and the difficulty of assessing credit risk or damages in the case of insurance. The revolution in financial inclusion has the shape of blocks This situation is changing through the introduction of Blockchain in financial services. Blockchain is a technology to carry out financial transactions securely, transparently, and reliably between two separate users, whether banks or individuals, without using an intermediary, so that costs can be reduced. Blockchain technology uses a distributed database that saves blocks of information and links them to facilitate information retrieval and verify that the blocks have not been altered. In the case of agricultural insurance, Blockchain makes possible the use of smart contracts between the farmer and a financial institution, using reliable information based on weather data. One of the advantages is the automatic execution of the contract that relies on predefined conditions without requiring human interpretation. For example, a compensation is paid when a defined quantity of rain is exceeded, causing production losses. Another advantage is that with this model, insurance can be accessible in terms of costs ($2 to $3 per month) and in terms of geographic coverage, which is not feasible with the traditional insurance model. [clickToTweet tweet="Some banks stated that Blockchain-based commercial services will operate before the end of 2017" quote="Some banks stated that Blockchain-based commercial services will operate before the end of 2017." theme="style1"] There are already start-ups developing products that increase financial inclusion using Blockchain technology, such as the Etherisc company with crop insurance. Other applications cover remittances’ transfers, identity and background check systems, clearing and settlement in payment systems, credit history, property registration, and land tenure. The rules of the game are changing for financial institutions With the availability of Blockchain, banks can increase their client base, geographic coverage, and the financial products they offer while reducing operating costs. In an IBM survey, 17% of the banks interviewed stated that Blockchain-based commercial services will begin to operate at commercial scale before the end of 2017. Ignoring this wave of innovation not only means losing an opportunity to contribute to financial inclusion in our region, it also means running the risk of not being competitive and being left out of the market with little notice. Subscribe to receive more content like this! [mc4wp_form]

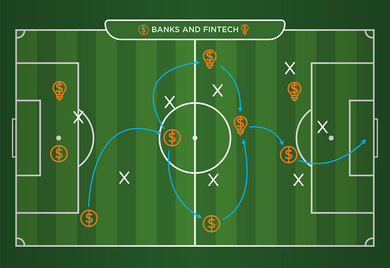

What can Messi, Neymar and Suarez tell us about banks and fintech companies?

On May 26, 2013, a tweet from FC Barcelona confirmed that the 21-year-old Brazilian striker Neymar Jr. had accepted a multi-million dollar contract to join five-time Ballon d’Or winner Lionel Messi in the Catalonian soccer team. Fourteen months later, the same club hired the Uruguayan star Luis Suarez. A couple of weeks later, Barcelona’s legendary player Johan Cruyff suggested that the new hiring could ruin the team: “The three of them are too individual; I can't see how Barça intends to continue playing…” Fintech firms, the emerging financial service sector of the 21st century, are flourishing across Latin America and the Caribbean with no exception. The Inter-American Development Bank and Finnovista have identified more than 700 Fintech firms in 15 out of 18 countries in the region. Bullish observers believe the emergence of Fintech companies represent the end of traditional banks; the skepticals claim Fintech firms are not meant to last. Though it is difficult to anticipate how tech innovation will shape financial intermediation in the future, market participants have more to win in a collaborative “ecosystem”, rather than playing a zero-sum game. Business opportunities are huge for all participants and every player has something to bring to the table. The field for FIs and Fintech firms in the region Credit still represents, on average, less than 45% of the gross domestic product (GDP) in Latin American and Caribbean countries, well below the average 150% in developed countries. For example, in Argentina, one of the richest countries in the region, credit represents less than 15% of GDP. On top of this, half of the adults in the region do not have a banking account and, in some countries, such as Nicaragua or Peru, this ratio hits three out of four citizens. Cash continues to be the most used mean of payment in the region with 90% of utilities paid in cash, according to some studies. [clickToTweet tweet="Credit represents less than 45% of the GDP in #Latam and #Caribbean countries" quote="Credit represents less than 45% of the GDP in Latin American and Caribbean countries" theme="style1"] However, the region benefits from a huge advantage: technology adoption is incredibly fast. Mobile penetration reaches 70% of the population, comparing relatively well with the 84% enjoyed by Europe, the world’s most developed continent mobile-wise, according to GSMA. On top of this, Latin America is expected to be the second fastest growing mobile market in the next five years, setting the perfect platform for fintech companies’ growth. Fintech firms’ biggest assets are their accessibility through digital and mobile channels, their agility and velocity to adjust to a changing environment, and their capacity to maximize the customer experience. According to Capgemini, almost 70% of costumers would refer their fintech service provider to a friend, but roughly 45% to their bank. On the contrary, though the gap is closing, traditional banks take the lead when talking about trust. 60% of consumers completely trust their banks, no matter the quality of the service, indicates the study. In the same line of thinking, although fintech companies are gradually diversifying their funding sources, banks have a wider reach in terms of access to capital and cheap and stable retail deposits. And banks also benefit from the regulators’ blessing. A new game strategy for Latin America and the Caribbean At the Inter-American Development Bank Group (IDB Group), we believe collaboration should be the rule and not the exception. That’s why, in the context of the 2017 Mobile World Congress, we launched FINCONECTA, a 10-month program dedicated to create the first interconnected ecosystem of solutions between financial institutions and leading fintech firms to foster the exponential growth of the financial industry. The results will be announced in the FOROMIC 2017, to be held at the end of October in Buenos Aires. [clickToTweet tweet="1 out of 3 #banks operating in #Latam are already partnering with #fintech companies" quote="One out of three banks operating in Latin America are already partnering with fintech companies" theme="style1"] “Messi knows that the players around him make him a better player, and he makes his mates better too,” affirmed former Barça’s head coach Luis Enrique in an interview. In the last three seasons, Messi, Neymar, and Suarez have scored more than 300 goals by playing together. According to a study conducted by PWC, one out of three banks operating in Latin America are already partnering with fintech companies, and more than 80% expect to be doing business together in the next three to five years. The ball is rolling. It’s time to let banks and fintech firms play together and consumers will be as happy as Barcelona’s fans. You can also see more on the impact of the fintech revolution in Latin America and the Caribbean on this full report. Subscribe to receive more content like this! [mc4wp_form]

Finance adapts to climate change

Climate change is already a real threat that affects macroeconomic variables and company results in Latin America and the Caribbean. For example, Peru may not be able to reach its inflation target this year due to the rise in agricultural prices caused by atypical rains. In Colombia, insurers face pressure on their risk rating due to recent landslides and floods. In the Dominican Republic, the trade deficit and the exchange rate are being affected by the impacts of climate change on agricultural exports. In effect, Latin America and the Caribbean lose an average of 1.21% of their gross domestic product (GDP) due to economic damages associated with climate change, according to the Climate Risk Index 2017. These events are geographically dispersed but are occurring with increasing frequency and generating unanticipated costs. The impact of climate change is all around us: from damaged roads and destroyed bridges that keep products from reaching their market to changes in agribusinesses such as coffee and cacao quality and harvest. It is even reflected in the risk to business continuity that a company may have when obtaining a bank loan. [clickToTweet tweet="#Latam & #Caribbean lose near 1.21% of GDP due to economic damages associated with #climatechange" quote="Latin America and the Caribbean lose an average of 1.21% of their GDP due to economic damages associated with climate change"] For this reason, more than 280 investors are taking steps to ensure that climate-related risks are formally presented, so as to make more informed decisions. This new process, associated with new regulations and reduced technology costs, is generating a tendency to divest stranded assets. In addition, institutional investors now prefer cleaner sectors, such as solar power. This opens up a window of opportunity, where financial institutions in Latin America and the Caribbean are already taking the lead. What are the opportunities for the financial sector? Climate change is accelerating the transition to more flexible, greener, and more circular economies. In Latin America and the Caribbean, we see how the financial sector is developing and using financial products that can only be explained by the existence of climate change: Green bonds for financial institutions. Green and/or climate bonds are a new financing option and have begun to grow rapidly in the region with solar energy projects under way, such as Solar City in Mexico. Investment funds. Ecotierra’s Canopy Fund is an example of this, in that it seeks to diversify the risks associated with climate change in the production of coffee and cacao, attracting both impact investors and traditional financing for such supply chains. Climate finance. Climate finance has helped to launch public-private partnerships (PPP). For example, in Chile, public lighting is being replaced by LED technology, with the support of the Canadian Climate Fund for the private sector in the Americas (C2F). Changes in business models. Banks are beginning to internalize climate change in credit ratings, for example by analyzing the flow of each of their clients according to the segment to which they belong. In IDB Invest (formerly known as Inter-American Investment Corporation), the private sector arm of the IDB Group, we are developing approaches and tools to make it possible to reduce and transfer investment risks, facilitate the development of PPPs and promote financial innovation to adapt financial products to the new unstable reality presented by climate change. These are just a few examples of how to take advantage of climate finance. What is clear is that climate change is an opening emerging sector that require specific financing. Those financiers that adapt are gaining the benefits as first-movers. Subscribe to receive more content like this! [mc4wp_form]

Venture Debt Now Available! A New Financial Solution for High-Growth Firms In the Region

Venture debt can be an attractive, efficient and flexible financing option to drive innovative and tech-companies growth, in addition to and complementing venture capital investment. Find out what it's about and the first regional fund focused on this instrument for expanding ventures.

Banking Agents, On the Frontlines of Financial Inclusion

Banking agents, or small shops contracted by banks to process client transactions, are laying the foundation for the digital transformation of the financial sector. They have also become a safer channel for clients to get cash during the pandemic.

Fintech Solutions as a Vehicle to Expand Financial Inclusion in Latin America and the Caribbean

Fintech solutions and digital banking services offer a unique opportunity to serve previously underbanked individuals and SMEs. Though most commercial banks are adopting these solutions, there is an opportunity to deepen the collaboration with Fintech firms in order to close financial inclusion gaps in the region, while promoting responsible finance practices.