Latin America & the Caribbean Has a Truck Problem, But the Solution is on its Way

Latin America and the Caribbean (LAC) has a truck problem.

Cargo trucks in the region typically leave full but return empty. In part, this is the result of an archaic way of originating loads, consisting of “word of mouth” sales and telephone calls, or of having truck drivers canvass Post-it notes in gas stations along highways.

With luck, this leads to a load, and ideally a full truck. But even then, truckers need to cross their fingers, hoping that the client is genuine, the load secure, and that payment will be prompt. This makes logistics expensive, unsafe, and unreliable. More importantly, externalities are of titanic proportions, in terms of systemic inefficiencies, wasted resources and unnecessary greenhouse emissions.

The market depicted above is referred to as full truck load (FTL), and usually relates to long distance transport, as opposed to “less than truckload”, more prevalent in the “last mile” and urban areas. The FTL market consists of an ecosystem of trucking companies, drivers, brokers, shippers and truck-stops. More broadly, it includes gas stations, informal lenders and of course, millions of SMEs that depend on this service to distribute their products.

The FTL market is gigantic. It is also inefficient. Under the traditional off-line model, each shipper calls multiple brokers to find available trucks. Large shippers have limited access to small trucking companies, or carriers, while carriers struggle with driver security and limited working capital.

You may also like:

-

Sustainability, the vaccine for Latin America and the Caribbean economies

-

Food Waste is on the Menu as the Hospitality Sector Rebuilds

As with other large and inefficient markets, the potential for disruption is significant. This provides incentives for tech-enabled business models and start-ups to fill the void, often in the form of online marketplaces. The latter benefit from “network effects”, while creating a “flywheel” of ancillary opportunities and services. The more users join an online platform, the greater the ability to integrate more products and services, attracting even more new users, while driving other participants to join such platforms to avoid missing out.

An FTL online platform, once it achieves sufficient scale, can also create a virtuous cycle of new opportunities. Value added services for FTL platforms can include gas station benefits, truck maintenance, tire and fuel discounts. Also, as with many other online platforms, the potential for embedded financing solutions is compelling. These can include truck financing, maintenance services, freight insurance, digital wallets for truckers, and personal loans.

The real value is in an online platform’s ability to leverage technology and cause disruption through innovation. Besides allowing shippers and carriers to reduce frictions by booking and finding loads online, the vast amount of data that the platform generates permits the automation of price negotiations, as well as the digitalization and enhancement of processes previously handled manually.

FTL marketplaces can develop algorithms to enhance efficiency and improve decision making across different areas, from credit decisions, to tracking and tracing, to route optimization. This translates into a safer and more secure business environment.

In LAC, merchandise is mostly distributed by truck. Costs of transport and logistics make up over 40% of the final cost of goods supplied in a region with over 400 million SMEs. This problem is nowhere more evident than in Brazil.

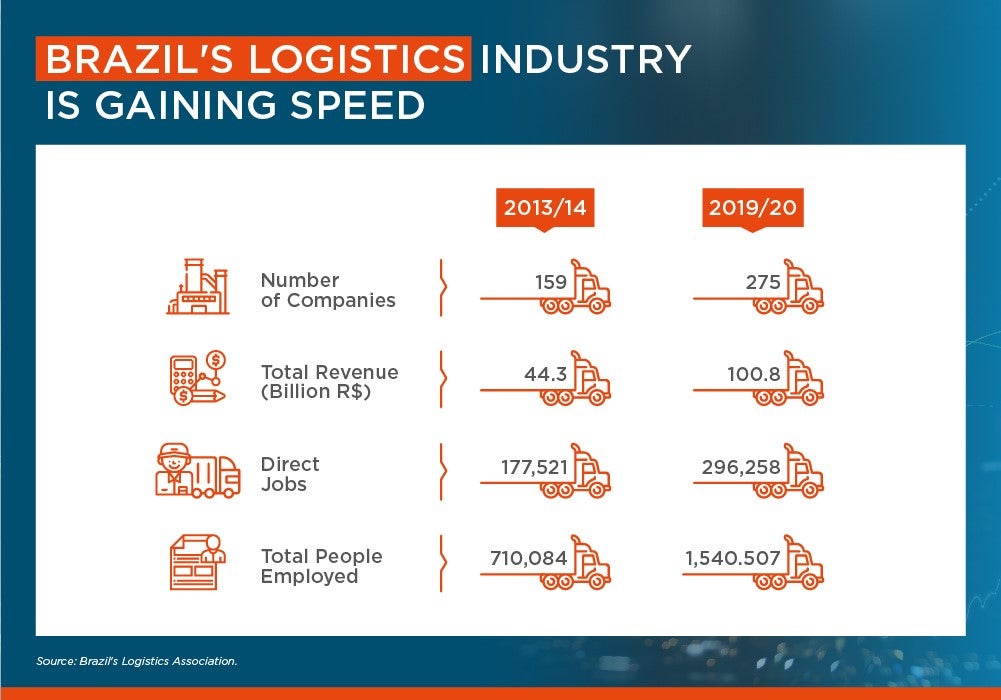

With a total addressable market of over $100 billion, Brazil is by far the largest FTL market in Latin America, and the third largest worldwide after the US and China. Brazil's offline trucking excess capacity is estimated to be a whopping 60%. The sector is highly fragmented, with each carrier, owning on average less than 3 trucks, and almost 98% owning less than 8 trucks.

Development Finance Institutions have reacted upon seeing the enormous impact of online platforms in general, and logistics platforms in particular. IDB Invest’s recent equity investment in FreteBras in Brazil is a clear example.

FreteBras is the first and largest FTL marketplace in Latin America, leveraging on the region’s adoption of smartphones and entrepreneurship to create a powerful and highly scalable business model. Besides promoting the efficiency and productivity of road transportation and logistics, IDB Invest also aims to improve truck driver formalization and reduce environmental externalities.

Further to its equity subscription, IDB Invest is mobilizing capital from the Clean Technology Fund, which is providing resources and incentives for implementing a carbon emissions tracking methodology for the company, which already in the first half of 2020 has helped prevent the emission of 7 million tons of CO2 by largely reducing idle capacity.

Let's bear in mind that online platforms have been undeniable enablers of the “Low Touch Economy”, which has been largely mobile and remote. This is critical in times of COVID-19. Smartphones and apps are now replacing in-person transactions at truck stops, reducing the physical exchange of cash, and minimizing direct in-person interactions.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe