Three ways banks can attract millennials

71% of the millennials in the United States would rather go to the dentist than listen to what banks are saying, according to the Millennial Disruption Index, while 35% of the banks in Latin America feel they are not meeting the needs of this generation, and 71% admit they are unable to rapidly adapt to technological advances, according to a study done by the GMix program of Stanford University and Technisys. However, in upcoming years this age group will be the main source of consumers and labor. Millennials represent close to 30% of the population in Latin America and the Caribbean. For more than half of them, only innovative companies will be successful. In effect, four out of every ten believe that the private sector is the true driver of innovation, according to a survey conducted by Deloitte. For this reason, banks in the region are looking for new formulas to attract them: 1. Chile: Collaborative spaces The millennials are the “BRICs” of the age groups: due to their size, they can disrupt the economy, particularly the banking industry, according to Scratch. In Chile, banks are betting on collaborative spaces to approach this generation. Thus, was born Work/Café, a space open to the general public for working, holding meetings, and using free Wi-Fi and that already has six locations in the country. The Santander Group’s wager includes a cafeteria with discounts for clients, executives specializing in financial advice, and ATMs for cashing checks, making deposits, and transferring funds. Another characteristic sought by millennials is flexibility. Thus, these branches add four hours to traditional banking hours in Chile, remaining open for 18 hours, Monday through Thursday. Work/Café also gives talks in order to keep capturing clients constantly. [clickToTweet tweet="35% of the banks in #Latam feel they are not meeting the needs of the millennials" quote="35% of the banks in Latin America feel they are not meeting the needs of the millennials" theme="style1"] 2. Brazil: 100% virtual In Latin America and the Caribbean, 55% of the population buys products via the Internet and 90% of millennials are digital banking clients. For this reason, a Brazilian bank made the decision to be the first 100% digital bank. Banco Original developed a website, applications for mobile telephones, tablets, and even Smart TVs to reach its public on line and close its branches. To avoid in-person visits, this Brazilian bank developed a site with services for personal, commercial, and agribusiness banking. In addition, it developed Bot Original, a service enabling interactions via Messenger and even on Facebook, with a robotic system of instantaneous responses for clients. 3. Mexico: On-line support for SMEs One of the region’s largest financing gaps is experienced by small and medium enterprises (SMEs); this gap is estimated at between $210 billion and $250 billion. However, for more than half of the region’s millennials, a venture is one of the most important achievements. Thus, the banking system is seeking ways to facilitate access to financing for SMEs given that applications for financing for companies of this type still require in-person visits in many countries. Bankaool, Mexico’s first 100% on-line bank, developed financing tools for SMEs. Clients can apply for and receive financing for their businesses in a more streamlined and expeditious way. This has also allowed the bank to carve out a niche within the financial industry based on its work generating inclusive businesses. Innovative wagers continue to flourish in the region and in the rest of the world, from applications for different financial operations and the use of biometric profiles, to the development of products for women’s banking. They all seek a positive effect on returns, efficiency, and the consumer’s experience. It is thus essential to continue looking for strategies that make attracting millennials possible since, as John D. Wright once said, “Business is like riding a bicycle. Either you keep moving or you fall down.” Now we need to see what the banking sector’s next move will be in the region. Subscribe to receive more content like this! [mc4wp_form]

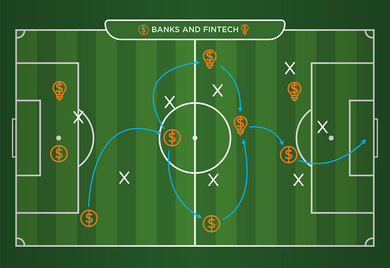

What can Messi, Neymar and Suarez tell us about banks and fintech companies?

On May 26, 2013, a tweet from FC Barcelona confirmed that the 21-year-old Brazilian striker Neymar Jr. had accepted a multi-million dollar contract to join five-time Ballon d’Or winner Lionel Messi in the Catalonian soccer team. Fourteen months later, the same club hired the Uruguayan star Luis Suarez. A couple of weeks later, Barcelona’s legendary player Johan Cruyff suggested that the new hiring could ruin the team: “The three of them are too individual; I can't see how Barça intends to continue playing…” Fintech firms, the emerging financial service sector of the 21st century, are flourishing across Latin America and the Caribbean with no exception. The Inter-American Development Bank and Finnovista have identified more than 700 Fintech firms in 15 out of 18 countries in the region. Bullish observers believe the emergence of Fintech companies represent the end of traditional banks; the skepticals claim Fintech firms are not meant to last. Though it is difficult to anticipate how tech innovation will shape financial intermediation in the future, market participants have more to win in a collaborative “ecosystem”, rather than playing a zero-sum game. Business opportunities are huge for all participants and every player has something to bring to the table. The field for FIs and Fintech firms in the region Credit still represents, on average, less than 45% of the gross domestic product (GDP) in Latin American and Caribbean countries, well below the average 150% in developed countries. For example, in Argentina, one of the richest countries in the region, credit represents less than 15% of GDP. On top of this, half of the adults in the region do not have a banking account and, in some countries, such as Nicaragua or Peru, this ratio hits three out of four citizens. Cash continues to be the most used mean of payment in the region with 90% of utilities paid in cash, according to some studies. [clickToTweet tweet="Credit represents less than 45% of the GDP in #Latam and #Caribbean countries" quote="Credit represents less than 45% of the GDP in Latin American and Caribbean countries" theme="style1"] However, the region benefits from a huge advantage: technology adoption is incredibly fast. Mobile penetration reaches 70% of the population, comparing relatively well with the 84% enjoyed by Europe, the world’s most developed continent mobile-wise, according to GSMA. On top of this, Latin America is expected to be the second fastest growing mobile market in the next five years, setting the perfect platform for fintech companies’ growth. Fintech firms’ biggest assets are their accessibility through digital and mobile channels, their agility and velocity to adjust to a changing environment, and their capacity to maximize the customer experience. According to Capgemini, almost 70% of costumers would refer their fintech service provider to a friend, but roughly 45% to their bank. On the contrary, though the gap is closing, traditional banks take the lead when talking about trust. 60% of consumers completely trust their banks, no matter the quality of the service, indicates the study. In the same line of thinking, although fintech companies are gradually diversifying their funding sources, banks have a wider reach in terms of access to capital and cheap and stable retail deposits. And banks also benefit from the regulators’ blessing. A new game strategy for Latin America and the Caribbean At the Inter-American Development Bank Group (IDB Group), we believe collaboration should be the rule and not the exception. That’s why, in the context of the 2017 Mobile World Congress, we launched FINCONECTA, a 10-month program dedicated to create the first interconnected ecosystem of solutions between financial institutions and leading fintech firms to foster the exponential growth of the financial industry. The results will be announced in the FOROMIC 2017, to be held at the end of October in Buenos Aires. [clickToTweet tweet="1 out of 3 #banks operating in #Latam are already partnering with #fintech companies" quote="One out of three banks operating in Latin America are already partnering with fintech companies" theme="style1"] “Messi knows that the players around him make him a better player, and he makes his mates better too,” affirmed former Barça’s head coach Luis Enrique in an interview. In the last three seasons, Messi, Neymar, and Suarez have scored more than 300 goals by playing together. According to a study conducted by PWC, one out of three banks operating in Latin America are already partnering with fintech companies, and more than 80% expect to be doing business together in the next three to five years. The ball is rolling. It’s time to let banks and fintech firms play together and consumers will be as happy as Barcelona’s fans. You can also see more on the impact of the fintech revolution in Latin America and the Caribbean on this full report. Subscribe to receive more content like this! [mc4wp_form]

Can banks serve the Women’s Market without sidelining men?

If a bank makes targeted efforts to better serve women customers, does this necessarily mean men are shortchanged? Global experts at the recent Global Banking Alliance for Women (GBA) All-Stars Academy in the Dominican Republic agreed with a resounding “no”.

Why is additionality key for private sector development finance?

To meet the ambitious targets laid out by the Sustainable Development Goals (SDGs), it is necessary to accelerate collective action, coordination, and resource mobilization across the public and private sectors. Public sector resources alone are not sufficient to bring development finance from the “billions to trillions” required to achieve the SDGs.

What is a future flow securitization and what are the benefits?

Imagine that you represent an operationally strong company in a small or island country. You have helped it grow a business line specifically linked to the export of an essential product (oil or copper, for example) or the processing of financial transfers from abroad (credit cards, remittances, etc.), and see promising projections for the future. In addition, you want to diversify your current funding sources, which come from more traditional sources like commercial banks or nonfinancial institutions. Did you know that the existing and future cash flows of your business could be used to obtain another source of financing? This is how the securitization of future flows works, a little-known alternative with multiple benefits for the companies of Latin America and the Caribbean. A future flow securitization allows an enterprise (bank or corporate) to monetize existing and predictable cash flows expected to continue over the ordinary course of your business. The flows generated by the company are used to pay the debt service to the investors on the financing. Some examples of future flows from assets that are used in capital markets include: 1) Future financial flows like payments on receipts from international credit cards (Visa, MasterCard, American Express, among others), family remittances, and payments of foreign direct investment; and 2) Future flows of companies such as payments for exports of aluminum or zinc, or dollar-denominated payments from the sale of airline tickets, and other items. Generally, future flow securitizations in foreign currency involve the creation of a special purpose vehicle (SPV) in a jurisdiction different from that of the company that is the originator of the flows. The originator, through a true sale, backed by a legal opinion from an accredited law firm, sells ownership of the future flows to the SPV. The establishment of an SPV outside the country of the originator company allows the investors to mitigate some risks such as convertibility and transfer risks. In many cases, this reduced risk materializes when an international risk rating is obtained for future flow financing that is higher than the rating for the company itself (which entails a reduction in the cost of financing). In other words, both companies and investors benefit. The following graph presents a diagram of flows in a future flow financing transaction: What are the advantages of future flow financing? Long-term financing: The terms tend to be longer than the financing from commercial banks. They can be between five and ten years. Recently, IDB Invest approved the subscription of a note to be issued by the future flows program of the Federación de Cajas de Crédito y Bancos de los Trabajadores (Fedecredito) for $15 million with a seven-year term. Diversified funds platform: Facilitates the creation of a financing platform that allows multiple issuances, provided the minimum debt coverage and flow growth requirements are met. This allows for the participation of multiple institutional investors over time. Impact on development in small and island countries: The ability to mitigate certain sovereign risks in these transactions allows investors to invest with greater security in activities that produce an impact on the development of the region. In 2013, Banco Industrial Guatemala issued a ten-year bond, in which the IDB Group acquired $150 million, to increase access to financing for micro, small, and medium-sized enterprises, with a special focus on rural areas and women-led businesses in Guatemala. Securitizations of future flows are a source of alternative funding that can help to enhance your company’s growth, improve risk management in your company, and expand the base of funding sources to include international institutional investors. If you want more information, we invite you to visit our webpage on capital markets solutions. Subscribe to receive more content like this! [mc4wp_form]

How Fintech Can Help Nanks Tackle Deforestation

Big data and geospatial technology are making it easier for banks to decrease risk when financing projects with potential environmental impacts. How? Our guest author, Luiz Amaral, Global Manager of WRI’s Global Forest Watch Commodities has the answer.