First Sustainable Bond in Central America, A Regional Trailblazer

After some time without visiting the country, what caught my attention when I recently returned to Costa Rica was a renewed focus on green financing.

In this blog we have talked quite a bit about sustainability, but we haven't talked enough about how necessary it is to extend sustainability commitments throughout the region, something that may seem easy but is an arduous road to travel.

Something I noticed from my first conversation with Michelle, co-author of this blog and Sustainability Manager at Banco Promerica Costa Rica, was that she recognized the value of sustainable finance as a fundamental part of our banking operations, but she also knew of the effort required to close a green financing operation in the capital markets. I believe her exact words were that "this takes years, commitment from our shareholders, and a lot of work from the team... I'll tell you all about it".

In Costa Rica, I evaluated potential IDB Invest operations with our clients and partners in the private banking sector in the country. By taking part in this I was able to learn more about the work done by Promerica—a champion in the small and medium enterprise (SME) segment, and the first Central American private bank to issue a sustainable bond in 2021.

This operation paves the way for the region's financial sector to align itself with the latest trends in international finance and refine the environmental and social impact assessment of its operations. For, at the end of the day, sustainability is also a journey on which companies progress and evolve.

Banco Promerica Costa Rica is fortunate to have been born with sustainability coded into its DNA, and it is in this fundamental aspect that we see common ground and an opportunity to create synergy with IDB Invest. When the main shareholder in Banco Promerica imagined and designed the pillars of the bank's strategy on a paper napkin, one of them was that financial institutions should have a positive impact on the communities we serve.

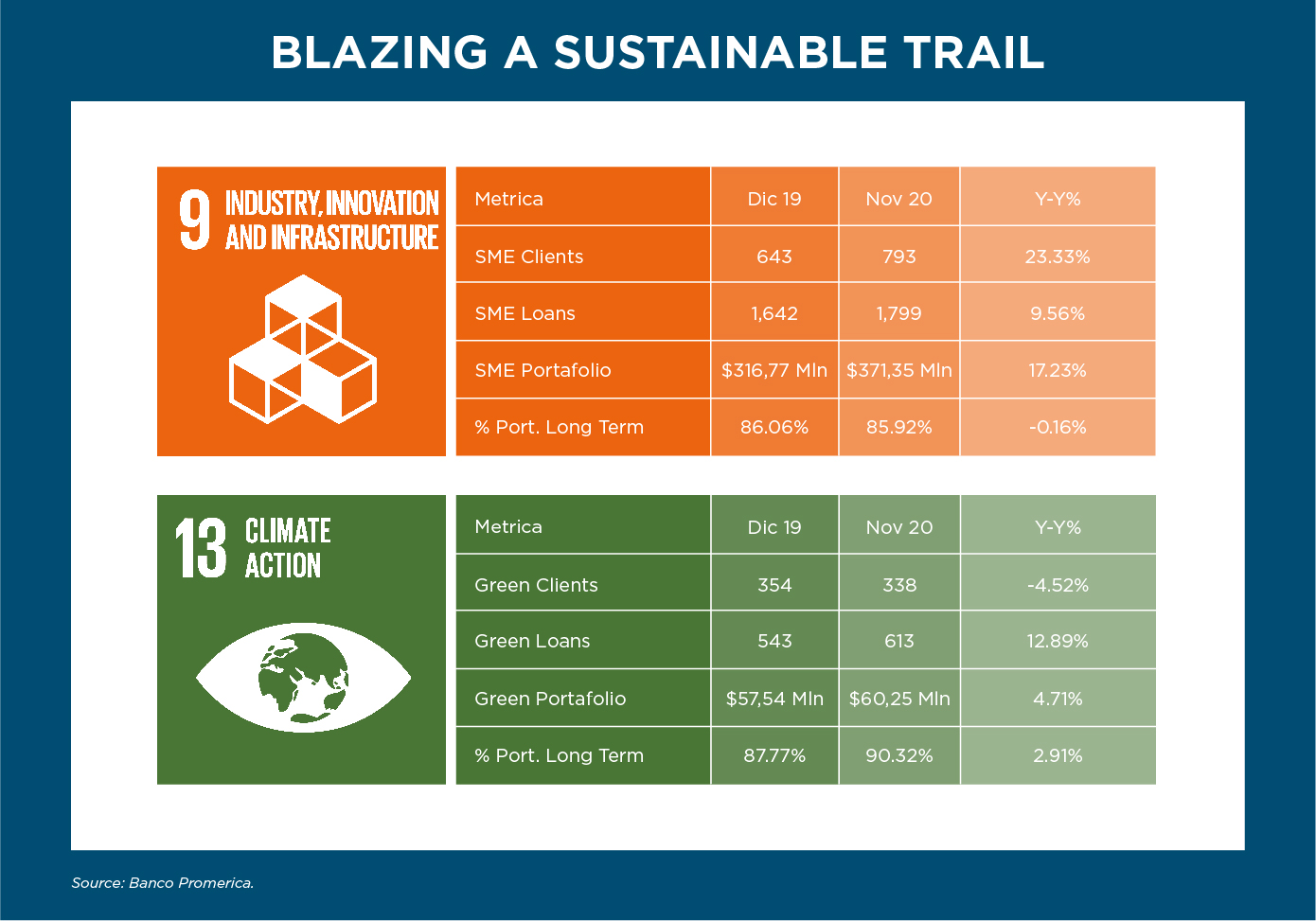

With the support of senior management, we have been strengthening the sustainability strategy in the bank's key operations, i.e., its credit portfolio. It should be noted that the portfolio has not stopped expanding in recent years, and in 2019—before the current crisis—it reported double-digit growth.

After many discussions, we identified the core elements that would let us chart the path to structure, issue and, in the case of IDB Invest, provide a partial guarantee to the bond issue.

These elements are: that the financial institution positions sustainability as a strategic pillar of its business, providing strategic alignment to the Sustainable Development Goals and the Paris Agreement; that it has systems in place to identify and manage social and environmental risks relevant to the country and the business segments it serves; and that it has a strategy, organizational structure, and capabilities to create and identify investment portfolios that contribute to sustainability.

One might think, "Well, good talk." What about the facts? Let's watch Promerica preach by example: the bank has installed solar panels in eight of its branches and has set out on the road to becoming emission-neutral; also, its employees volunteer in the communities where they are present. This attitude extends to the operations themselves: the bank's systems allow labeling credit operations through an impact measurement system called PROSOS.

It should be noted that the social dimension has been well-developed in the bank for a long time, given its focus on the SME segment. This made it easier, with the help of IDB Invest, to identify points for improvement when structuring the bond, including determining impact indicators for each project that will receive part of the money collected, as well as developing processes to collect information from clients.

On the other hand, work has also been done to design a social, green, and sustainable bond program framework for current and future issues, including an independent opinion from Vigeo Eiris—an international provider of ESG services and research for investors and organizations. The trail has been blazed and progress will be much easier from now on.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe