Climate finance and Climate Investment Funds

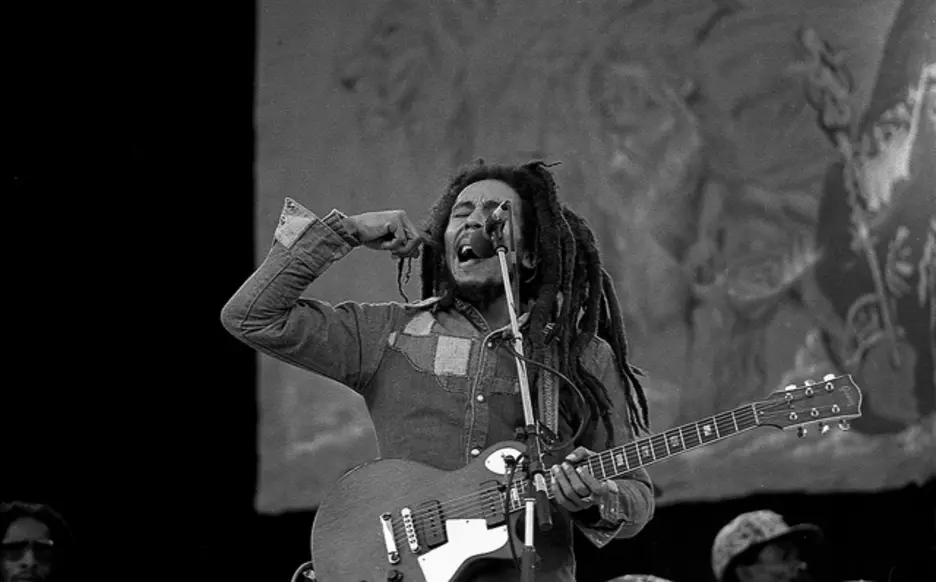

[caption id="attachment_1176" align="alignleft" width="512"] Photo credit: Creative Commons by Monosnaps[/caption]

Photo credit: Creative Commons by Monosnaps[/caption]

Sharing the stage with the charismatic minister, I also opened with a simple message. Since it would have been impossible to communicate everything about our 80 CIF projects valued at $750 million, the focus was one emblematic story.

It began after the 2009 financial crisis. At the time, global trade had come to a virtual stop, and economic activity had declined. Capital flight from developing economies was reducing liquidity dramatically, as investments in established industries were cancelled or postponed. However, these factors did not inhibit progress.

Concurrently, the government of Mexico was recognizing renewable energy’s significance. Fossil fuel production was declining, while electricity needs grew faster than GDP. So the government set ambitious targets to reduce GHG emissions 50% by 2050. With an unproven track record in the country, long-term commercial financing was a non-starter. At the time, Mexico had less than 200 MW of installed wind power. To prove its viability, a project of major scale had to be successfully built and financed. And the investment had to be private sector led without fiscal support.

A game changing partnership between Mexico, CIF, the IDB and other development finance agencies formulated a solution. And by 2010, the largest wind farm in Latin America and the Caribbean began operating: 250 MW.

If you fast forward to today, you will see the country has 2,000 MW of installed wind capacity and almost $4 billion invested. Ninety-five percent of the equity is funded by the private sector. By 2015, we can expect 3,600 MW, a whopping one thousand times 2005's. Forecasts for 2022, predict wind will create 11,000 jobs.

Uruguay, Chile, Peru, Colombia, Venezuela and Central American countries are now moving as well. Wind is developing a track record in the region as a commercially-viable, clean energy source that merits long-term financing. Working with CIF resources, we, at the IDB Group, seek to have the same transformational effect in solar, geothermal and energy efficiency.

Without donor resources like the CIF and dedication on behalf of multilaterals, who knows what would become of these technologies? Is it possible that they could still be stuck in pilot laboratories waiting on governments or venture capitalists weary of unknown risks?

The IDB Group will keep working with the CIF to promote more flexible access for smaller markets like the Caribbean. In early stages, vehicles like CIF and multilateral financing have a big role to play. Going alone on a smaller scale is still too costly for companies until markets mature and develop a track record of success. To do so, we work with businesses to monetize the environmental costs and internalize the benefits. The potential extends beyond renewable energy and energy efficiency to transportation, buildings and agribusiness.

So whether the Minister meant love for each other, our community, biodiversity or the generations to come, the actions are the same. So let’s get together and use the tools, and the love, we do have to act swiftly and decisively to minimize the impacts of climate change.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe