Microinsurance: The New Frontier for Financial Resilience in Latin America and the Caribbean

Technological innovations that provide insurance to low- and middle-income individuals open up possibilities to enhance the economic stability of families and small and medium-sized enterprises (SMEs) in the face of unexpected events.

Today, an insurtech—a company that uses digital technologies to modernize, streamline, and personalize insurance services—can use satellite imagery to verify and assess crop damage claims in remote areas, eliminating the need for personnel to visit. These efficiencies not only reduce operating costs and accelerate claims payments, but also expand insurance possibilities for small farmers, who are increasingly exposed to adverse economic situations caused by climate events.

The potential of the insurtech ecosystem in Latin America and the Caribbean extends beyond agriculture, encompassing segments such as health, income loss, life, funeral, and property insurance. Realizing this potential requires greater coordination and concentrated efforts among key stakeholders.

To address this need, the FinnLAC Forum 2025, held in Miami on November 4–5, represents a strategic space to foster coordination and collaboration among insurtech ecosystem actors. The Forum will convene key developers of innovative microinsurance solutions, investors, traditional insurers, regulators, and other stakeholders interested in expanding access to risk protection through affordable policies.

The Impact of Insurtech in the Region

The insurance penetration rate in Latin America and the Caribbean grew substantially in recent years, increasing by 15.5% in 2022 and 17% in 2023. Despite reaching 3.1% of the region’s gross domestic product (GDP), this figure is still far below the global average of 7% of GDP.

The regional protection gap, estimated at $301.3 billion, represents a significant growth opportunity for insurtechs. By leveraging artificial intelligence, machine learning, and digital platforms, these companies are optimizing processes such as risk assessment, policy issuance, and claims management, making insurance more accessible and payments easier for users.

This dynamism is clearly reflected in the sector’s investment growth: Insurtech funding in Latin America and the Caribbean reached $121 million in the first half of 2025, surpassing the total investment for all of 2024.

Currently, around 500 insurtech companies operate in the region. While some of them offer insurance directly, nearly half are focused on providing technological solutions to established insurers, helping develop customized products for traditionally underserved segments.

Efforts to attract investment to the insurtech sector are key to its development. For this reason, IDB Invest supported the Mundi Ventures Latam Fund with $5 million in 2024 to finance innovative initiatives in insurance for vulnerable populations and SMEs.

IDB Invest’s strategy includes supporting microfinance institutions such as Fundación Génesis Empresarial in Guatemala. This organization promotes the development of rural communities and microenterprises not only through credit lines, but also vital services such as medical microinsurance, business policies, and technical assistance plans. These services cover specific needs such as crops affected by pests, temporary disabilities due to accidents or illness, and home assistance.

The Microinsurance Market in Latin America and the Caribbean

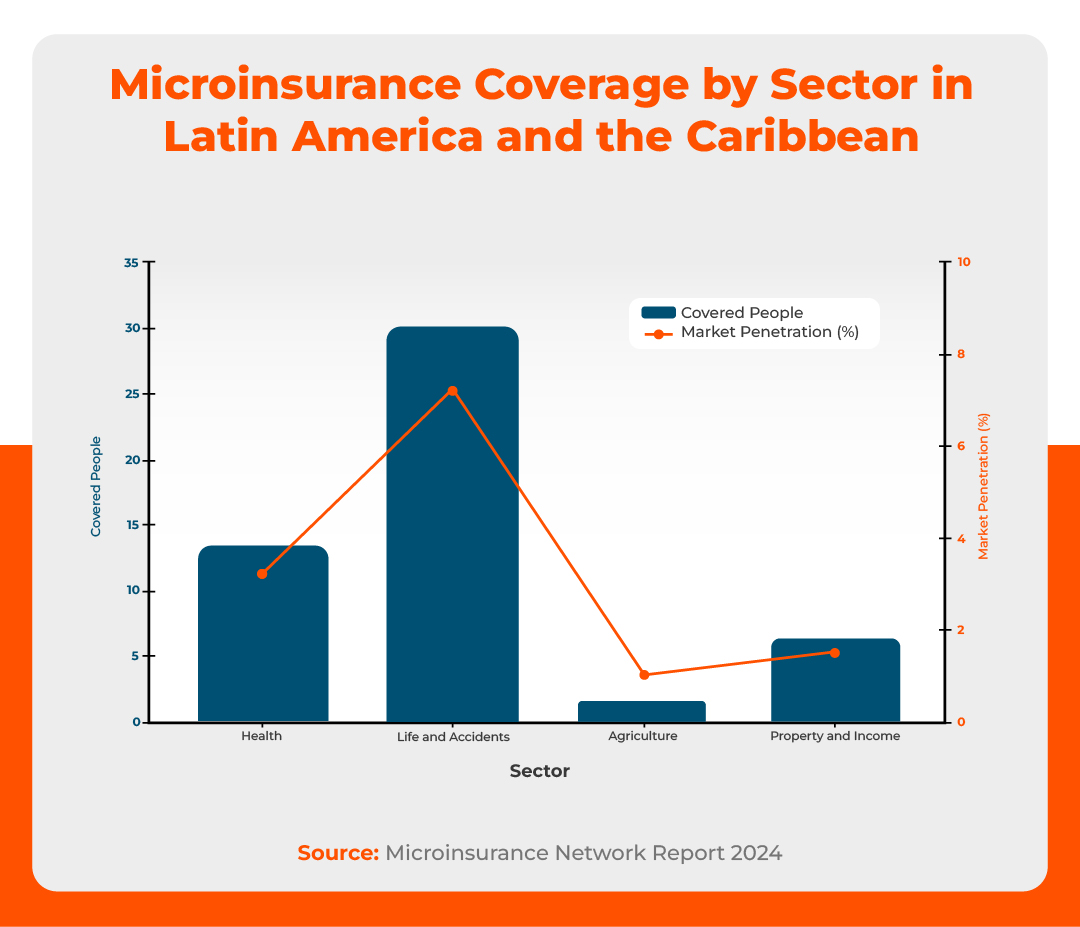

Insurtechs are driving global growth in insurance, increasing the number of people covered by microinsurance from 331 million to 344 million. In Latin America and the Caribbean, microinsurance is estimated to benefit 37 million people—still less than 10% of the potential market, according to the 2024 Macroinsurance Network report.

Life and accident microinsurance are the most in demand in the region, followed by health, property, income, and agricultural insurance. Agricultural insurance, despite a 38% subsidy level, has a penetration rate of just 1%.

Microinsurance strengthens the economic resilience of low-income households and SMEs, especially those most exposed to climate risks.

Insurtechs are already transforming the insurance sector by delivering innovative digital solutions, forging partnerships with traditional insurers, and developing products tailored to historically underserved populations.

The next step is to accelerate this transformation and leverage spaces like the FinnLAC Forum 2025 to foster greater collaboration across the insurtech ecosystem. Closing the protection gap requires more than just technology—it demands strong partnerships that generate impact and improve lives.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe