Sustainability, the vaccine for Latin America and the Caribbean economies

Latin America and the Caribbean (LAC) is home to 8% of global population but accounts for 40% of global coronavirus-related deaths. The disproportionate impact of the pandemic in the region creates both uncertainty and opportunity to build back better.

The coronavirus crisis has underlined two urgent imperatives for our countries. The first one is inclusion. Gaps in healthcare access and quality as well as working conditions, such as telework and insurance, for vulnerable groups, such as women, indigenous peoples and small businesses, run wide and are leading to societal imbalances and inefficiencies. Women, for example, are disproportionately represented in the informal sector with 33% participating informally compared to 7% men. The second is the environment. Climate change is like the eternal pandemic, and its impacts on agribusiness, tourism and transport return worse every year. There will be no long-term recovery to this crisis unless these dual challenges are addressed, and sustainable investments offer one concrete solution.

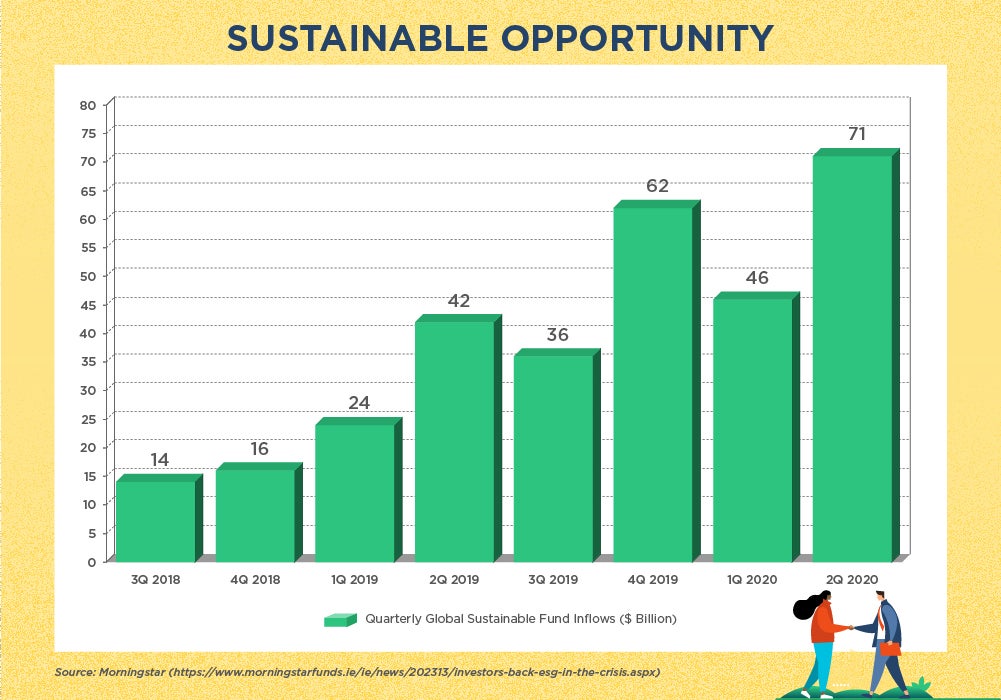

Since the beginning of COVID-19, sustainable investment funds have experienced a steady increase in investment inflows and better-than-average returns. The assets indicated as following ESG (Environmental, Social, and Governance) principles may soon represent 44% of global assets under management, according to a JP Morgan research. This suggests sustainable investment funds are providing increased hope to active managers battered by an exodus of capital toward more passive products. Such funds attracted net inflows of $71.1 billion globally between April and June this year, pushing assets under management to a new high of just over $1 trillion, according to Morningstar.

Better corporate governance and stronger supply chain management suggest why such funds outperformed their benchmarks. In the first four months of 2020, while the pandemic upended markets, the S&P 500 ESG index beat the S&P 500 index. For our region, this type of investment has the potential to generate growth, inclusion and environmental protection.

Multilaterals like IDB Invest seek to lead the evolution in sustainable investing from an avoidance mentality focused on mitigating negative social costs of investments to an intentional mentality, focused on trying to achieve financial and social returns, as we underlined in a recent webinar on the subject. We say multilaterals protect to promote. Development banks not only seek to protect their project’s communities and environment, they aim to promote social inclusion and resiliency that contribute to the UN Sustainable Development Goals. Additionally, their impact becomes exponential when they mobilize third-party resources. This current moment highlights great urgency to work with investors to de-risk transactions and crowd-in additional capital from local and international markets.

Investors come to us given our local knowledge of the region coupled with our high ESG standards and risk management as well as steps to measure development impact. This includes IDB Invest’s end-to-end Impact Management Framework, which provides standardization that promotes greater clarity, credibility and comparability across investments.

You may also like:

- Sustainable Energy and Infrastructure As Components of Economic Recovery

- How Can Latin America Attract Foreign Investment in Times of COVID-19

- Addressing Climate Risk: Five Steps to Get Started

These elements converge into IDB Invest’s sustainable investment approach, which led to the financing of recent projects. In the Chimbote Bypass in Peru, we are financing 356 km of the Panamericana Norte en Perú (Red Vial 4). Our $30 million loan attracted $320 million additional development dollars from local and international banks.

Before that, we purchased a gender bond by Davivienda in Colombia. This financing structure offers performance-based incentives for the origination of loans to women-led and operated small and medium enterprises.

Lastly, in Honduras’ textile sector, we supported the reignition of the local economy by providing Elcatex textile business with a $96 million loan to increase operations with SMEs in its supply chain, with a particular focus on identifying opportunities for women suppliers.

These examples highlight how international financial institutions deploy accumulated knowledge, standards and capital to play a critical counter-cyclical role in the private sector’s recovery. Sustainability may be just the cure for local and international capital that seeks both a return and a chance to support regional development.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe