Broadband Boosts Business Performance and Access to Credit in Peru

Access to universal and meaningful broadband internet is a must for boosting economic growth and reducing the digital divide in Latin America and the Caribbean. It can also boost access to finance for the most excluded segment of the credit market: micro, small, and medium-sized enterprises (MSMEs).

In Peru, only about 9% of MSMEs have access to formal credit, greatly hindering their ability to grow, invest and create jobs. This gap is partly due to an information problem. The traditional credit screening approaches that banks use to assess loan applicants are not well-suited for MSMEs, many of which have limited or no credit history and insufficient collateral. Similarly, larger firms tend to have more publicly available information, or deeper digital footprints, that banks can use to inform lending decisions.

At the same time, fintechs—which have been growing rapidly in the region and in Peru—are increasingly using alternative data sources, such as digital transaction histories to assess borrowers with low or no credit scores. Connectivity is therefore critical for MSMEs to not only benefit from these advances on the fintech front, but also to enhance their ability to get loans from traditional lenders.

Evidence from a recent study in Peru shows that the expansion of broadband indeed leads to improved access to credit for MSMEs.

From 2014 to 2020, Peru deployed its national broadband network of fiber optic cables. The main network connected 180 of the country’s 196 provincial capitals, followed by the expansion of the private sector network, giving consumers and firms access to corporate and residential fiber, which is the fastest, most reliable and lowest latency broadband technology. In parallel, mobile broadband penetration has accelerated across the country, especially in the hardest-to-reach areas.

Based on a sample of nearly 22,000 formal firms (large and MSMEs), the study analyzes the impact of fixed broadband on a number of business performance and credit market outcomes for firms.

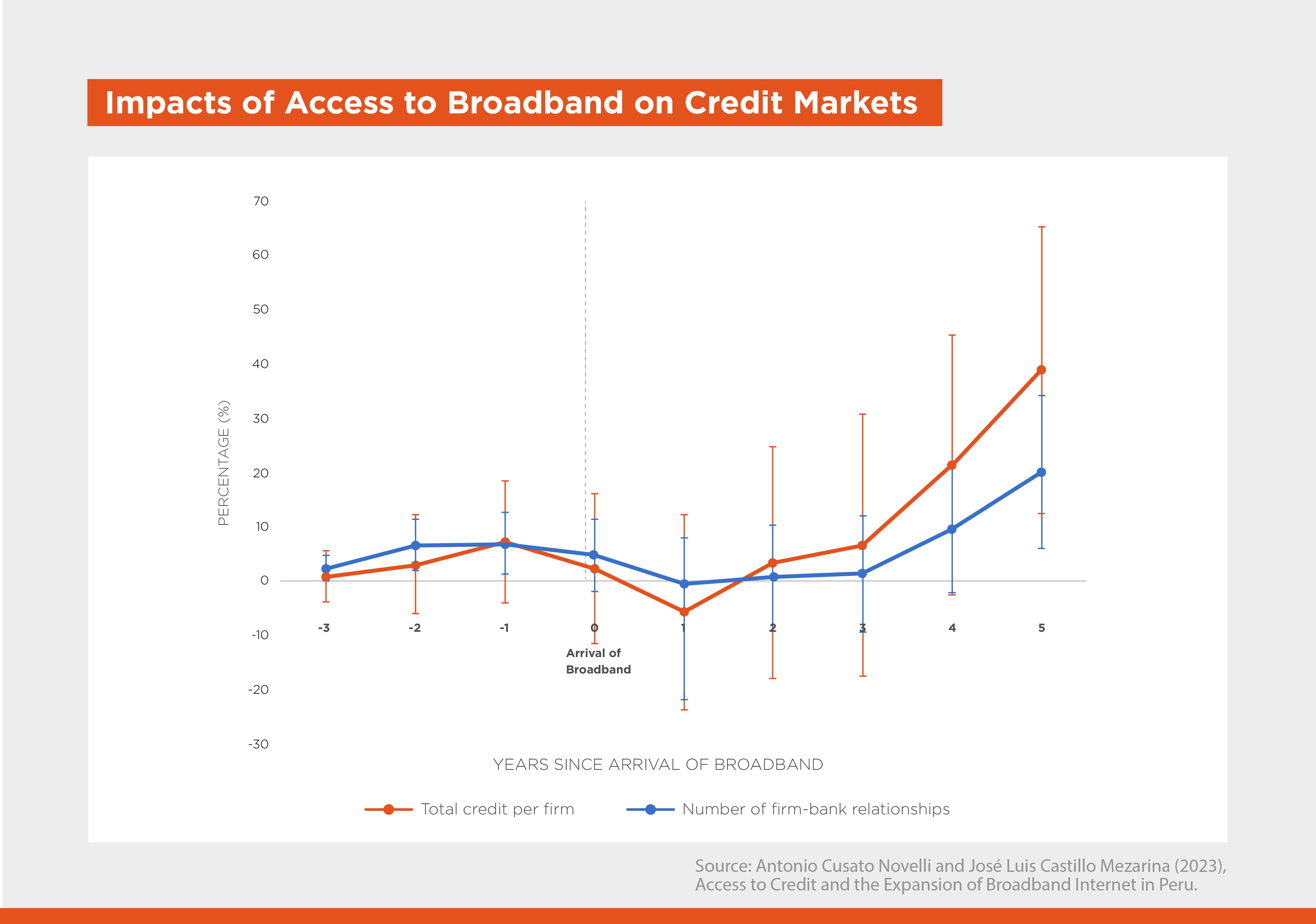

The results show that five years after the arrival of broadband, total credit per firm increased by 38%; the number of firm-bank relationships increased by 20%, signaling that firms are borrowing from more banks; and the number of loans per firm-bank relationship increased by 5%.

While these effects on credit took some time to materialize, the benefits of adopting new broadband technology on firm performance appeared earlier. In particular, firm sales increased gradually, peaking at year three after the introduction of broadband. There was also an uptick in firm productivity around the same time. The sequencing of these results makes sense; as companies adopt broadband, they gradually improve their performance, and then become more attractive to lenders.

Notably, the positive effects on total credit are driven by micro and small firms with the least credit experience. The study also shows that firms of all sizes were able to access loans from a larger number of banks, suggesting an increase in competition. Therefore, the arrival of broadband appears to have helped reduce the information problems that hold banks back from lending to smaller borrowers and also allowed firms of all sizes to “shop around” with multiple lenders.

*Note: Bars represent the 95% confidence interval of the point estimates.

Access to broadband also improved credit terms and conditions, and these improvements were driven by the demand side of the credit market (firms gaining access to the new technology). The study looked at the effects on average interest rates based on whether broadband only reached the bank’s location or also reached the firm’s location. The results show that interest rates dropped by 4 percentage points for those firms and banks operating in the same newly covered locations, as well as in cases where broadband only arrived at the firm’s location. In contrast, there were no effects on interest rates when the technology only arrived at the bank branch’s location.

Tackling the region’s huge MSME financing gap calls for action on many fronts. As these results illustrate, expanding broadband networks to reach more MSMEs can help them improve their businesses and in turn, their creditworthiness in the eyes of lenders. Continuing public and private sector investment in fixed and mobile broadband infrastructure and digitalization is therefore a critical piece of promoting financial inclusion and business growth in the region.

For more details, see the study by Cusato and Castillo, “Access to Credit and the Expansion of Broadband Internet in Peru”, which is part of IDB Invest’s Development through the Private Sector Series. The results of this study are also summarized in this DEBrief.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe