The Banking Sector's Strategic Role in the Green Transition

The role of banking has undoubtedly diminished on several fronts in recent years, such as online payments, trade finance and corporate transactions, to name a few. But there is one segment in which its role is not only important and growing, but also a sine qua non: sustainable development.

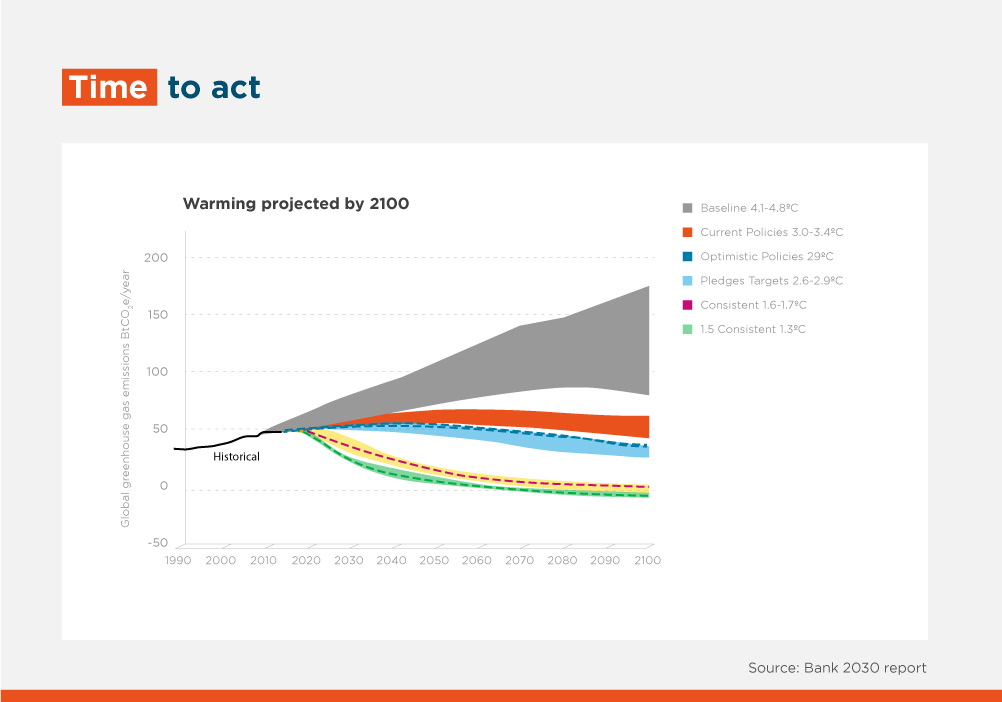

Financial institutions have a critical role to play in the process of decarbonizing economies. Without their help, it will be impossible to finance the estimated $1.5 trillion (roughly equivalent to 5% of the global GDP) needed to transition from a brown economy with high carbon dependency to a green economy, which would curb the polluting emissions that contribute to global warming. Only with the participation and drive of the banking sector will we achieve the goal of zero net emissions by 2050.

This is precisely the goal of the UN-sponsored Net Zero Banking Alliance (NZBA), which brings together major international banks and some Latin American and Caribbean banks under a commitment to align their lending and investment portfolios with zero net emissions by mid-century. NZBA currently comprises 74 institutions from 34 countries, representing 30% of global banking assets. This partnership, which will accelerate the implementation of decarbonization strategies, recognizes the vital role of banks in supporting the green transformation. The importance of this role has become quite evident in recent years with the birth and spectacular development of sustainable finance.

Green bonds are on track for another record in 2021: cumulative issuance now exceeds $1 trillion. This includes social and sustainable bonds; loans and bonds with incentives linked to the achievement of sustainable objectives (sustainability-linked loans & bonds); green facilities... For consumers, banks also offer products ranging from green mortgages and eco-loans to purchase electric vehicles, to investment and pension funds linked to sustainable investments. The range is increasingly wider and more innovative.

But the process of decarbonizing the economy is still just beginning. The road ahead is long and anything but easy. It will require major changes in all companies, sectors, and economic and social stakeholders. It requires changing habits, energy systems, infrastructure, transportation, production systems, agriculture...everything. And it requires commitment from everybody. No industry or company can escape this challenge.

It’s better to be proactive rather than waiting for banks—for reasons such as reputation, regulation, capital requirements or market pressure—to cut off financing, as is starting to happen with some polluting energies such as coal and other fossil fuels. Waiting for the end can be traumatic. It is better to start going through the different stages sooner rather than later, which have their own challenges, but also opportunities. Companies and sectors that have enjoyed certain competitive advantages in the past may be left without them and fall behind if they do not address the necessary changes. And companies and sectors that were thought to be irrelevant may find themselves with growth opportunities they never would have imagined. There is a blank book for everyone to write their own history.

Banks are not exempt from risk if they make the wrong move. Regulators and supervisors, concerned about the impact that climate risk may have on economic and financial stability, are subjecting banks to stress tests to measure their climate resilience to possible adverse or extreme events.

In other words, banks are under increasing scrutiny to reduce their exposure to polluting companies and sectors. There are even talks of penalizing investments in brown assets, which could become stagnant and see their real value significantly eroded or even become obsolete, with more capital consumption.

There are many economic, financial, and regulatory arguments for banks to push harder for sustainable finance. However, many lenders continue to take a short-term risk or corporate social responsibility approach to climate change. Most still have a passive attitude, as opposed to the proactive mentality required for sustainable transformation, as stressed by the Bank 2030: Accelerating the transition to a low carbon economy report prepared by the University of Cambridge Institute for Sustainability Leadership (2020).

The leap will take place when we all internalize that the process of decarbonizing economies is irreversible and requires companies to actively commit to changing their business models if they want to preserve their future returns and maintain their social license to operate. Understanding and reporting on long-term climate-related risks and opportunities in a transparent manner will undoubtedly have an impact. The best quantification of the financial impact of climate risk takes into account the two possible risks involved in the journey: physical risk—associated with the climate change process itself—and transition risk, associated with initiatives to slow down the process. Putting numbers to these financial derivatives of climate risk will increase the banking sector's appetite for financing operations aligned with a low-carbon future.

The road is long and involves a learning curve in which we will find banks that are starting out, driven by regulation and/or market pressure; banks that are already in the transition zone, that have become aware of the reality and model and manage risk by being an active part of the financial flow towards sustainability; and banks that have internalized their important role as production model facilitators and have embraced change for the planet, not only through their own specific actions, but also through their own social purpose: to efficiently finance the resources needed to move towards a clean and sustainable economy. When the latter have mastered the banking map, we will be better prepared to nimbly navigate the road and successfully reach our destination.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe