Addressing Climate Change while Building Resilience in Agriculture

Private sector mitigation interventions are needed worldwide to contain climate change. But that’s not enough: businesses located in highly vulnerable geographies and sensitive industries urgently need to invest in climate resilience to be better prepared to the changes that are already under way.

The good news is that adaptation is not only a must to preserve the livelihood of local communities and the strength of global supply chains, but also an opportunity to innovate, increase productivity and develop new business opportunities. Recognizing the dual need for mitigation and adaptation can unlock investments that foster synergies between the two responses to climate change.

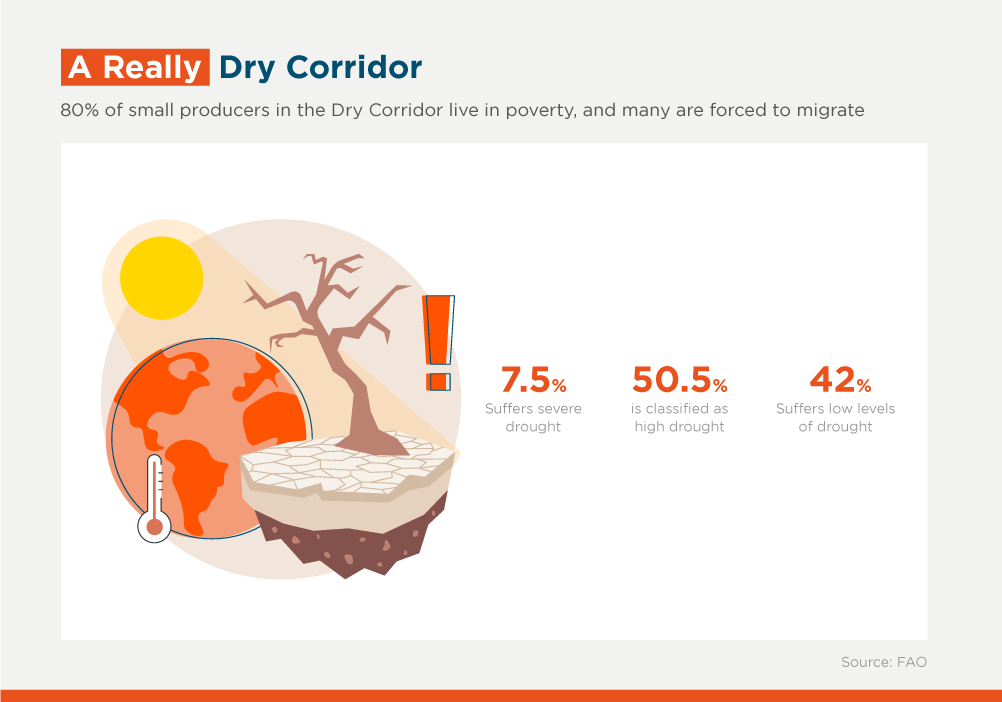

Take Central America as an example: it’s one of the world’s most affected regions by extreme weather, and host to the Dry Corridor, a strip of territory that stretches across Costa Rica, Nicaragua, Honduras, El Salvador and Guatemala, where more than 10 million people live and engage in agricultural activities, especially the small production of basic grains.

The countries in this region face long periods of droughts followed by intense rains that affect the livelihood and food security of local populations and supply chains at large. With more than 50% of the rural population in these countries living in poverty, they not only face higher vulnerability to climate change, but also have fewer means to deal with it. This creates a vicious cycle that leads to increased food insecurity, constrained access to drinking water, unproductive land management and poorer health outcomes that limit opportunities for the next generation.

Under these pressing conditions, businesses that depend on appropriate climate conditions to thrive, need to adapt their business models, not only to improve their performance, but also to preserve the areas where they operate. Taking a data-driven approach can help.

Let’s take water management in the agribusiness sector as an example. There are technological advances that allow for low carbon irrigation systems and practices that improve access and management of water. However, there are also barriers that are preventing broader adoption of these technologies: (i) companies don’t necessarily have access to the knowledge and expertise they need, (ii) water is a natural resource that is not adequately priced, and (iii) first movers face higher costs in terms of accessing and implementing the existing solutions.

IDB Invest works with agribusiness clients to scale solutions and prove innovative concepts for climate-smart water management that integrates mitigation and adaptation measures. This is achieved by complementing the financial offering with advisory services to address the limited access to knowledge and expertise, and blended finance to overcome the financial barriers created by mispriced externalities and market inertia.

An example of this is a 2019 transaction that IDB Invest closed with Nicaragua Sugar Estates Limited (NSEL). The financing package included a $25 million loan from IDB Invest, and a $12.5 million loan of blended finance funds from the Canadian Climate Fund for the Private Sector of the Americas – Phase II (C2F), which for the first time supported a project for the adoption of more efficient irrigation systems and resilient water management to optimize the use of natural resources.

In this case, advisory services were provided to identify, technically assess, and prioritize the most impactful and viable interventions to achieve a low-carbon and resilient production system considering future climate change projections and mitigation potential. The blended finance tranche offered the flexibility required in the financing to match the timing for implementation and ensured that the prioritized technologies and practices were adopted.

The NSEL transaction provides lessons that are relevant across industries and geographies, with high potential for replicability:

1. Data-driven decision-making that accounts for climate change is the only way to be ready for the future. Historical climate patterns are no longer enough to predict the future. It’s key for businesses that rely on water to understand the state of their water resources and the factors that compromise its future availability to adapt and mitigate risks.

2. Climate-smart management reduces natural resource consumption to a minimum. When it comes to water management, more efficient irrigation systems are not all a company can adopt to reduce its water footprint. Waterproofing irrigation canals reduces losses during water transportation and soil conservation techniques such as contour cultivation favor rainwater infiltration and improves moisture availability. Additionally, implementing energy efficiency measures in the design, maintenance and operation of the electricity distribution lines that feed the irrigation systems as well as groundwater pumping stations can contribute to significant greenhouse gas emission reductions.

3. Climate-smart management also safeguards natural resources. Companies can improve water availability by investing in reservoirs for capture and storage or taking advantage of existing canals introducing mini dams. They can also implement native forest conservation and restoration measures to help preserve priority groundwater recharge zones in the watershed whilst increasing carbon sequestration and preserving ecosystem services. These measures can be implemented in collaboration with the local communities and government by applying a payment for ecosystem services scheme.

4. By-products may be transformed into an additional revenue source. By applying a circular-economy approach, companies can take advantage of by-products from their operations to develop new sources of revenue to their business models. In the sugar industry, residual waters carry natural elements that increase soil productivity by more than 3x. If appropriately processed, residual waters can be transformed into biofertilizers for self-consumption or commercialization, generating additional income whilst also reducing methane emissions.

IDB Invest is committed to leverage its blended finance resources and advisory services to simultaneously address climate change mitigation and adaptation by piloting, replicating and scaling projects with innovative practices and business models that can lead the way to resilient and low-carbon agricultural production systems.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe