Company name

Financiera de Occidente S.A. (“Fidosa”)

Project number

GU3764A-02

FI-2 operations are those where the risk potential is considered medium: the FI’s current or future portfolio consists of or is expected to consist of, business activities that have potential limited adverse environmental or social risks or impacts that are few in number, generally site-specific, largely reversible, and readily addressed through mitigation measures; or includes a very limited number of business activities with potential adverse environmental or social risks or impacts that are diverse, irreversible, or unprecedented.

E&S category

FI-2

Country

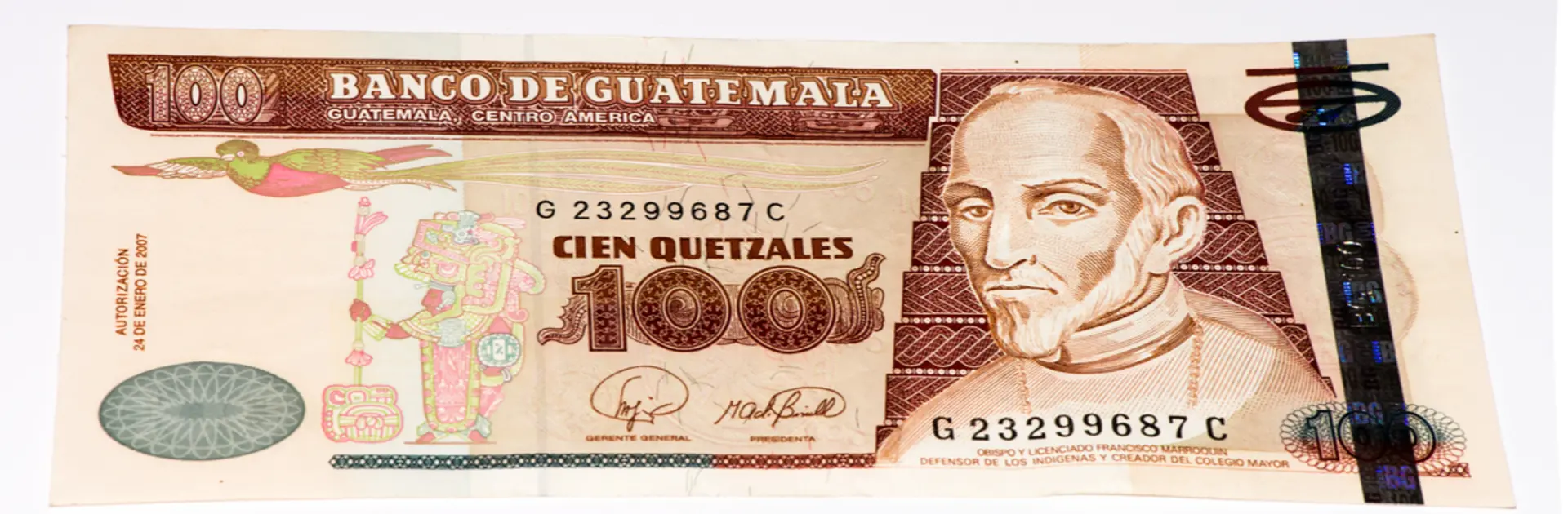

Guatemala

Sector

Financial Institutions

Status

Completed

Disclosed date

05/15/2014

Projected date at which a project will be put forward for the Board of Executive Directors’ approval.

Projected board date

06/24/2014

Approval date

09/02/2014

Signed date

11/07/2014

Sponsoring entity

N/A

Investment Operations Department Contact

Portfolio Management Division

Investment type

Syndicated amount

N/A

Financing amount

USD $ 6,000,000

Currency

USD

Project scope and objective

The project consists of a loan to Fidosa. The objective of this IIC operation is to support Fidosa’s efforts to increase its lending to small- and medium-sized enterprises in Guatemala for medium-term projects.

Fidosa is a Guatemalan financial institution founded in 1991. It focuses on placing trust, mortgage, and pledge loans with terms of more than three years. It has solid and well-regarded experience managing trusts, private pension funds, real estate projects, and other investment types that require specialized financial services. It also has well-regarded experience in investment banking, including debt and equity restructuring, feasibility studies, business valuation, securitizations, and business strategy consulting.

Fidosa is part of the Grupo Financiero de Occidente, a Guatemalan-owned group with which the IIC has had a business relationship for 15 years.

For information requests about the project.

Request informationLearn more about how we provide private-sector solutions in the region .

Contact information

For information requests about the project.

Request informationAlternatively, you may also use the following contact information :

Client Contact

N/A

PHONE NUMBER

N/A

POST OFFICE ADDRESS

N/A

For information requests about the project.

Request informationLearn more about how we provide private-sector solutions in the region .

Environmental and social review

IDB Invest conducts an environmental and social due diligence (ESDD) commensurate with the nature, scale, and stage of the project, and with its level of environmental and social risks and impacts. The ESDD will confirm the project E&S categorization and assess the project with respect to the client requirements in IDB Invest Environmental and Social Sustainability Policy. The results of the ESDD, including any identified gaps are described in the Environmental and Social Review Summary (ESRS) provided below. For projects approved as of 2016, any gaps with respect to IDB Invest's Environmental and Social Sustainability Policy at the time of the ESDD are addressed in the Environmental and Social Action Plan (ESAP) presented below, to comply with the date mentioned above.

ENVIRONMENTAL AND SOCIAL REVIEW

29.7 Kb