IDB Invest Cultivates Caribbean Fund Managers to Mobilize Private Capital

The Caribbean has the potential to become a dynamic hub for business and investment. With the right financial structures in place, the region’s vibrant entrepreneurial ecosystems and untapped opportunities offer favorable conditions for sustainable growth. For this reason, IDB Invest has launched a program to cultivate homegrown fund managers that mobilize investment to drive development across the Caribbean.

Institutional investors have long cited challenges such as small and fragmented economies, weak institutions, and environmental vulnerabilities as reasons for limited engagement in the Caribbean. Yet these very challenges present unique opportunities for high-impact investment.

In response, IDB Invest launched its Caribbean Impact Manager Program, an initiative that cultivates homegrown fund managers specializing in private equity, private debt, and venture capital.

A New Chapter: The Caribbean Impact Manager Program

The Caribbean Impact Manager Program is IDB Invest’s strategic effort to grow the region’s private capital system by cultivating a new generation of local fund managers – through capacity building, investment, and ecosystem building. This initiative is aligned with the IDB Group's ONE Caribbean program, a regional approach to promoting sustainable development.

Strategic Capacity Building

We organize an annual masterclass to help emerging fund managers become ready for institutional investors. The first cohort of over 50 participants from 30 aspiring fund managers across 15 countries graduated from a three-day tailored training in Kingston, Jamaica. At the same time, we launched the IDB Invest Caribbean Fund Manager’s Toolkit – an open-source, DIY manual for emerging fund managers in the region. Building on the momentum, the next masterclass is set for the first half of 2026 in Barbados.

From Training to Investment: Seeding the Future

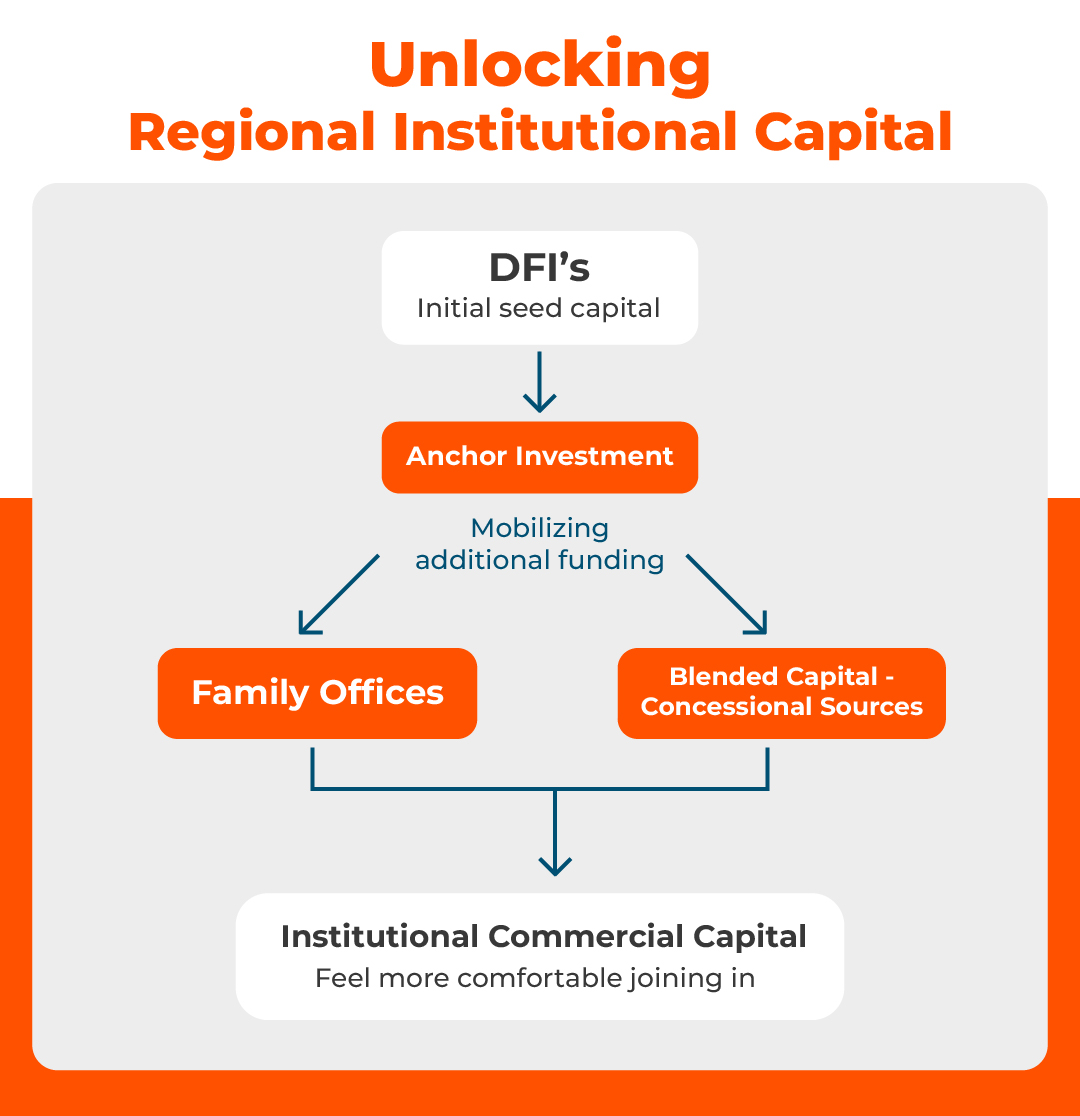

Training is just the starting point. Through the Caribbean Impact Manager Program, IDB Invest also makes anchor investments – early, cornerstone commitments to the most promising funds. While development finance Institutions (DFIs) can plant the initial seed capital, mobilizing additional funding is essential to complete rounds of capitalization.

A central part of this effort is unlocking regional institutional capital. Advancing this requires working closely with regulators to enable local pension funds to invest across the Caribbean. It also means partnering with mission-driven family offices and concessional funding sources to complete the capital structure by incorporating catalytic, first-loss blended capital. Engaging these funds, which are initially willing to take higher risks, helps other investors feel more comfortable joining in.

The recent $94 million first close of the Caribbean Community Resilience Fund (CCRF) is a perfect example of regional capital mobilization to maximize impact. Managed by Sygnus Capital and anchored by IDB Invest, the CARICOM Development Fund, philanthropic investment organization Allied Climate Partners, the Caribbean Development Bank, local pension plans, and several family offices, CCRF is harnessing blended finance to invest in regional climate and economic resilience companies, projects, and platforms. CrossBoundary also acted as an advisor to Sygnus Capital.

Despite a challenging fundraising environment, the combination of a strong manager, an innovative structure, and a committed group of anchor investors enabled the fund to mobilize support from regional pension funds, philanthropic institutions, and family offices. This achievement is a powerful example of what’s possible when vision is backed by action. Encouragingly, a healthy pipeline of next generation fund management talent is already taking shape.

Building the Ecosystem: One Step at a Time

A key pillar of the IDB Invest Caribbean Impact Manager Program is ecosystem building, which leverages close cooperation with other IDB Group windows, including the public-sector arm, IDB, and its innovation arm, IDB Lab. In partnership with local industry associations – such as the Caribbean Alternative Investment Association (CARAIA) – and other regional partners, IDB Invest hosts the regional IDB Invest Caribbean Series and collaborates with public-sector institutions. Spearheading efforts to modernize the region’s investment regulation and harmonize legal investment structures creates more opportunities for private investment.

Our commitment to the Caribbean is unwavering. We’re laying the groundwork for a resilient, sustainable private capital sector – step by step, initiative by initiative.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe