Addressing Climate Risk: Five Steps to Get Started

With COVID-19 coming at a time when some were already eschewing the term “climate change” for “climate crisis,” it's clear that we're in for an interesting next few decades.

The pandemic has given us all a crash course in dealing with crises, showing how complex the implications of a global challenge are and how long lasting its effects may be. However, it has just been a sneak peak into what a man-made global disaster that disproportionately impacts the poor and vulnerable can cause.

Managing the associated risks has lasting consequences on the global economy and experts highlight the need to think strategically about our medium and long-term path to recovery.

You may also like:

- Your Business is Next in Line for Internet-of-Things Disruption

- How Can Latin America Attract Foreign Investment in Times of COVID-19

- Climate Change is a Threat to Economic Growth and to Reducing Income Inequality in Latin America and the Caribbean

In many respects, the climate crisis shares all these attributes. Dealing with it has shown to be a tricky task. It sparks controversial discussions: in politics, business or at home. Truly making sense of complex crises is hard; knowing how to navigate and gauge risks can be even harder.

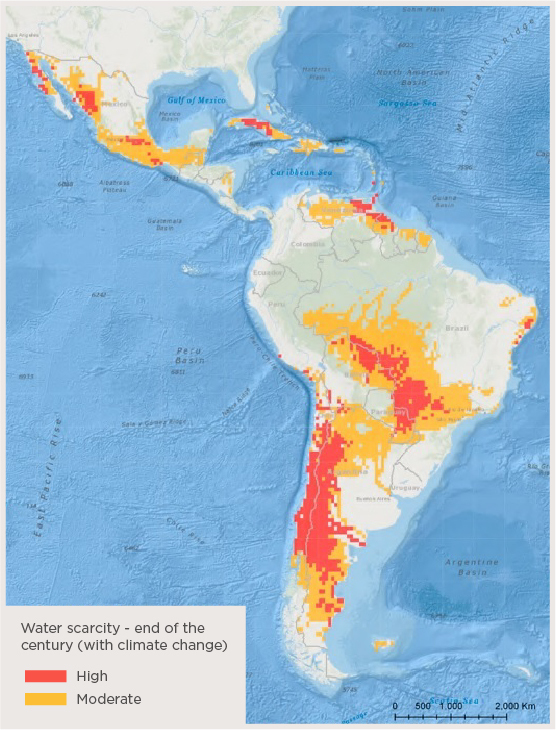

Climate change is, in the words of Kelly Levin with the World Resources Institute, a “super-wicked problem.” As an example, think of the future of water management under climate change. This map, used in IDB Invest’s Climate Risk Assessment (CRA) methodology, shows the parts of Latin America and the Caribbean most likely to suffer water scarcity by the end of the century.

The good news is that we can make the problem a little less wicked one step at a time. To illustrate our own experience with tackling this issue, here are five lessons we have drawn from creating the new CRA:

1. Get started

Seriously, get started. Twelve-hundred and fifteen of the largest global companies report over $1 trillion at risk due to climate-related impacts, with many of them likely materializing in the coming five years. Seeing if there are no-regret opportunities to adapt to climate change or profitable ways to mitigate it (e.g. energy efficiency) makes business sense today.

2. Break it down and prioritize

Climate-related risk is a function of hazard, exposure and vulnerability. Not everything needs to be assessed at once. A first high-level exposure screening can help gauge which level of detail is required and might save you time down the road. Consider using the risk taxonomy of the Task Force on Climate-related Financial Disclosures to structure the assessment. Depending on the sector and your location, the regulatory risk of carbon pricing might require deeper analysis than the potential risk of sea level rise or vice versa and this is where such an analysis of vulnerability comes in. Start with some elements that are material to your business and build on that.

3. Start simple, sophisticate later

Low-tech solutions can go a long way. For instance, you can start with qualitative assessments and move to quantitative ones after. Looking at projects, assets or investment through a climate risk lens in the first place helps understand the effects of climate change and design measures to enhance resilience or lower the impact.

4. Iterate. Iterate. Iterate

Climate risk assessment and management is a work in progress. As science evolves on predicting physical climate impacts and building increasingly sophisticated scenarios, and as governments shape the transition to low carbon economies, agility in corporate climate risk assessment is key. Looking at multiple scenarios helps span the realm of possible futures wide open to design strategies to cope within this spectrum.

5. Acknowledge cross-cutting themes

The climate crisis, similarly to the COVID-19 one, is essentially a multiplier. It can exacerbate existing inequalities, hit vulnerable populations so much harder. It touches a multitude of themes in the social, environmental and economic sphere. For instance, climate shocks, such as natural disasters, have significant economic effects that are likely to reduce economic growth and to worsen inequality. From worker health and safety, to water and biodiversity, to supply chains, climate change is truly transversal. Hence, looking at linkages and trade-offs of climate risks to other issues material for the sector makes the analysis more meaningful.

Right now, we have an opportunity, as stressed by the World Economic Forum with its Great Reset initiative. We need to prepare for a long crisis scenario, by managing and mitigating climate-related risks now. COVID-19 took us by surprise: it is up to us if climate risks will, too.■

LEARN HOW IDB INVEST CAN OFFER YOU SOLUTIONS HERE.

SUBSCRIBE AND RECEIVE RELATED CONTENT |

| [mc4wp_form] |

¿TE GUSTA LO QUE ACABAS DE LEER?

Suscríbase a nuestra newsletter para mantenerse informado sobre las últimas noticias de BID Invest, publicaciones de blog, próximos eventos y para obtener más información sobre áreas específicas de interés.

Suscribirse