Five Ways Impact Management Can Jump-Start Latin America & the Caribbean's Recovery

“Build back better” or “build forward better” — no matter how you phrase it, turning mounting investor interest in sustainable and impact investing into action is a must for any COVID-19 recovery scenario. Impact management is another key to making sure this push to action is done both effectively and with integrity.

The stakes are especially high for Latin America and the Caribbean, which in recent months has been the hardest hit region in the world by COVID-19. With only 8% of the global population, the region accounted for 34% of coronavirus-related deaths as of the end of September. The economic toll has also been devastating. The region’s real gross domestic product is expected to contract by 8% in 2020 and 2.7 million formal businesses are forecast to close in 2020, with unemployment reaching 44 million people — 18 million more than 2019.

Despite this grim reality, we have a real opportunity to reset the region’s development trajectory on a more sustainable, resilient, and inclusive path.

A number of advances on the broader impact management front have the potential to bring greater effectiveness and transparency for investors looking for opportunities to make an impact in Latin America and the Caribbean and, in turn, help mobilize private capital for the region to advance this path forward:

- 1. Clarifying what it means to invest for impact

Impact investors come in all shapes and sizes. We decide how to allocate our capital in different ways depending on our impact objective, as well as our risk and return expectations. Regardless of our approach, consensus is emerging around what common elements impact management should share.

The Operating Principles for Impact Management, which have over 100 signatories representing $340 billion in impact assets under management, lay out these common elements. As more investors commit to these principles and have their compliance independently verified, the more effective the impact investing market will become. And the more attractive it will become for newcomer investors.

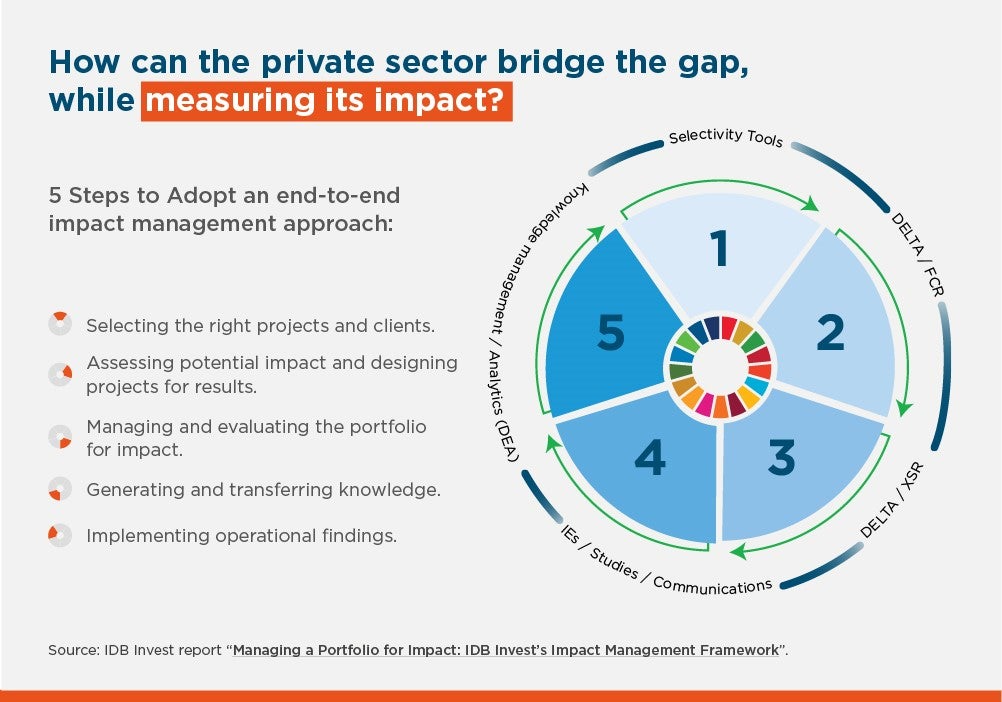

As an early signatory to these principles, IDB Invest believes essential elements of impact management systems include a “portfolio approach” that integrates financial and impact considerations in the investment process and an “end-to-end” focus on managing impact from deal origination to ex-post evaluation and learning. We talk about these and other aspects of our Impact Management Framework in our recent publication, “Managing a Portfolio for Impact.”

- 2. Breaking down silos

There is growing recognition among impact investors that the financial and impact considerations of investment decisions should not exist in silos. The Impact Frontiers collaboration, an initiative of the Impact Management Project, recently distilled four elements of integrated practice for impact investors to help them guide decision-making.

As part of this collaboration, we shared our 10-plus year track record of combining impact and financial contribution ratings to steer investment decisions, showing the practical benefits of an integrated approach for improving portfolio performance across both dimensions.

- 3. Monetizing impact

Along with other impact investors, we believe the market will eventually converge around the monetization of impact. In other words, investors will increasingly put a dollar value on the social and environmental impact expected from the capital they invest. That is why we have built monetization into our DELTA — Development Effectiveness Learning, Tracking, and Assessment — impact rating system by calculating a risk-adjusted social and economic rate of return for each investment.

Exciting things are happening on the monetization front. For instance, Harvard Business School’s Impact-Weighted Accounts Initiative is working on integrating the value of social and environmental impact, positive and negative, into companies’ financial reporting. The initiative’s recent analysis shows that the environmental cost generated by 252 of 1,800 firms was greater than their profits.

An approach like this, which paints a fuller picture of a company’s or investment’s net benefit to society, is just what we need to boost comparability and allocate impact capital more effectively.

- 4. Harmonizing sustainability reporting and impact metrics

Similar to internationally recognized financial accounting standards, the call for global standards in corporate sustainability reporting has grown louder, alongside the recent surge in sustainable investing. A step in the right direction, the big five framework- and standard-setting organizations have recently come together to provide joint market guidance on comprehensive corporate reporting.

As this plays out on the global stage, there is room to encourage more companies in Latin America and the Caribbean to strengthen sustainability practices and measure impact as a way to improve their operations while also attracting new investors. Financial incentives such as sustainability-linked loans — where debt costs depend on social or environmental targets being reached — are gaining ground in the region.

Just as the push for standardization is advancing in the corporate world, investors and development finance institutions are harmonizing metrics for how we measure impact in areas such as climate, gender, and job creation. We have been working together with other DFIs to align the harmonized indicators for private sector operations, or HIPSO, with the IRIS+ metrics — the most widely accepted system for measuring and managing impact. To date, over 90% of HIPSO indicators are now harmonized with IRIS+.

Even though the mechanics of how we decide to invest our capital vary, it all boils down to measuring what we measure in the same way. This helps us optimize deals and co-financing agreements, and better compare the results of our investments.

- 5. Managing for impact

Agreeing on standards for impact investing and impact measurement is key. However, our end goal is actually achieving concrete development results from our investments. As today’s COVID-19 pandemic has dramatically reminded us, the best-laid plans for our investments can be derailed by changes largely beyond our control.

So, going forward, we need to focus not only on investing for impact, but more importantly on managing our investments for impact. This means ongoing monitoring of investments to know when things are not going as expected and taking action to course correct.

Ultimately, monitoring and evaluating the performance of our investments — hopefully in increasingly comparable ways — will allow impact investors to build a stock of knowledge on what works (or works better). This will further strengthen our ability to effectively allocate resources for the good of Latin America and the Caribbean, and beyond.

(This piece was originally published by Devex)

¿TE GUSTA LO QUE ACABAS DE LEER?

Suscríbase a nuestra newsletter para mantenerse informado sobre las últimas noticias de BID Invest, publicaciones de blog, próximos eventos y para obtener más información sobre áreas específicas de interés.

Suscribirse