Let’s Not Lose This Window of Opportunity for Latin America and the Caribbean

Five years ago, IDB Invest became the private sector institution of the Inter-American Development Bank Group. A lot has been accomplished since 2016, but what matters now is how we address today’s challenges and meet this moment.

The pandemic has devastated Latin America and the Caribbean (LAC), threatening many of its earlier gains. As an example, about 62% of all jobs are now informal, up from 58% before the pandemic. About 65% of the poorest households had at least one job loss in the family. With governments coming under fiscal pressure, we are facing the real threat of another lost decade for the region.

In these difficult times, we need to work with the private sector: if there are tens of millions of workers, in the formal and informal sectors, including in micro, small and medium-sized enterprises (MSMEs), at greater risk of sinking into poverty, we need to focus our efforts on supporting and creating jobs. But we cannot forget the bigger picture.

We have the opportunity, and the responsibility, to build a green and inclusive private sector-led recovery. A path where we have difficult work to do when it comes to pushing regional integration, where we have a digital economy that is growing and creating jobs, where we must do an even better job in driving gender equality and inclusion, and where we need to be even bolder when it comes to climate action. This is the time for private sector solutions and investing for impact.

Take gender, a key theme for us in this Women’s Month. LAC has the world’s highest percentage of self-employed women. Yet, 70% of women-led small and medium enterprises that apply for a bank loan fail to secure one, according to market estimates. These enterprises are also burdened with higher collateral requirements, which lead to faltering growth.

This year, we are seeing a rising interest in impact investing in the region, and the market for sustainable investment solutions is rapidly expanding. LAC is uniquely positioned to lead in this space because our economies have a unique combination of high yields, significant capital needs and a social context that allows for more participation of women and young people, and climate action.

At Davos this year, there was consensus about the business moving to accept the stakeholder principle. The Business Roundtable, which includes CEOs of major companies, communicated a shift from its focus of bringing value to shareholders to a clear focus on stakeholders. There is a dramatic change in the mindset of global companies and institutional investors. We welcome this new mindset.

Impact investors want to have real, measurable impact, and Latin America and the Caribbean is the place where they can find this.

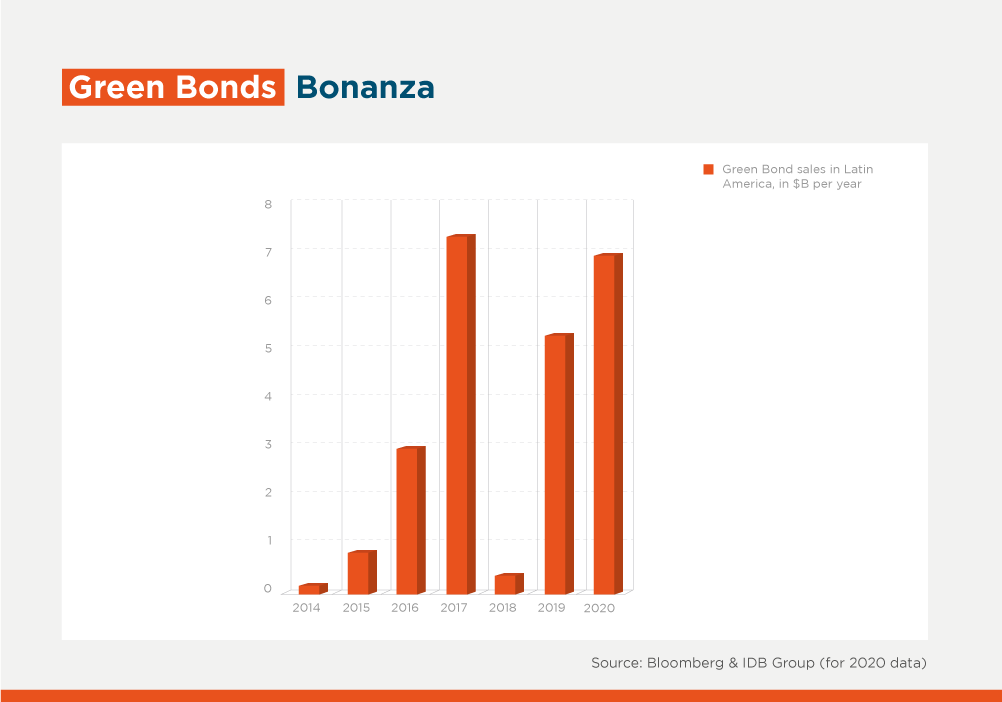

If we want to build back better, we need to keep looking for sustainable opportunities. We’ve been doing that over the last five years, with instruments such as green and social bonds, for example, the gender bonds launched by Banistmo in Panama and Davivienda in Colombia, and we expect to do much more.

In the Caribbean, we have been pushing an emerging solution that we call “digital umbrellas” – or systems to help bank customers protect themselves from the effects of the pandemic.

In Peru, the Internet para Todos project is helping to close the digital gap for eight million Peruvians living in remote areas, and has the potential to enable 100 million people across LAC gain access to the internet. This is a game changer for children needing to study in virtual classrooms during the pandemic.

Cheaper solar and wind power energy, which no longer need subsidies to be competitive, may kickstart a shift to low-carbon, resilient economies that could create over 65 million net new jobs globally by 2030.

After a year of uncertainty, where we have faced unprecedented challenges, the path forward is clear: the private sector must be the driver of the economic recovery in Latin America and the Caribbean – and it must be green and inclusive.

Over the next five years, IDB Invest, working hand in hand with IDB and IDB Lab, will help boost sustainable private investment to create jobs and build a more inclusive and resilient region. We are ready to lead. The clock is ticking.

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe