Five Challenges for Infrastructure Financing with Private Involvement

Financing for projects structured through public-private partnerships in Latin America and the Caribbean (LAC) depends on factors that, if not well managed, may hinder the development of large infrastructure projects in the region.

These factors include the complexity and depth of local financial markets; the incentives and mechanisms for investor diversification; the regulatory, standard and institutional environment for private investment; and underlying project and contract structures.

In the PPP Americas 2021 discussion paper 2021 “Financing Public-Private Partnerships”, IDB Invest and PPP specialists from the region analyze five major challenges to project financing and present the solutions implemented by some countries in the region.

i) Managing the foreign exchange rate risk and local currency financing. The effective management of the foreign exchange rate risk is seen as a major challenge for attracting foreign capital to finance projects in Latin America and the Caribbean, considering that most sources of infrastructure financing worldwide are in dollars (43%) or euros (17%). In order to manage and/or mitigate this risk, contractual or financial market solutions should be identified, making local currency financing available for projects that generate revenues in local currency.

ii) The role of development banks and agencies at the national and subnational levels. As public development banks in LAC have assets that account for about 25% of the regional GDP, their involvement in financing infrastructure projects may become indispensable to develop the market. These institutions are challenged with creating instruments to address existing market failures and mobilizing private financing resources for projects.

iii) Limits on the debt-to-capital ratio imposed by the Basel III agreement on international banking solvency. While these limits may affect the availability and conditions of financing through commercial bank loans, they also create an opportunity to develop alternative mechanisms and sources of financing and infrastructure with private involvement.

iv) Involvement of institutional investors in infrastructure financing. It is estimated that the 100 largest institutional investors worldwide owned $20 trillion worth of assets in 2019. However, infrastructure accounts for only 1.3% of their investment portfolio, according to the OECD. The best way to attract more institutional investors is by creating a conducive environment for investment in PPPs, having adequate regulatory provisions and contractual structures in place, and developing capital market-related instruments and tax incentives.

v) Secondary financing market. The possibility to recycle capital in the secondary equity and debt market offers an interesting opportunity to diversify investments. However, those transactions are not risk-free and may require greater regulation to safeguard project performance.

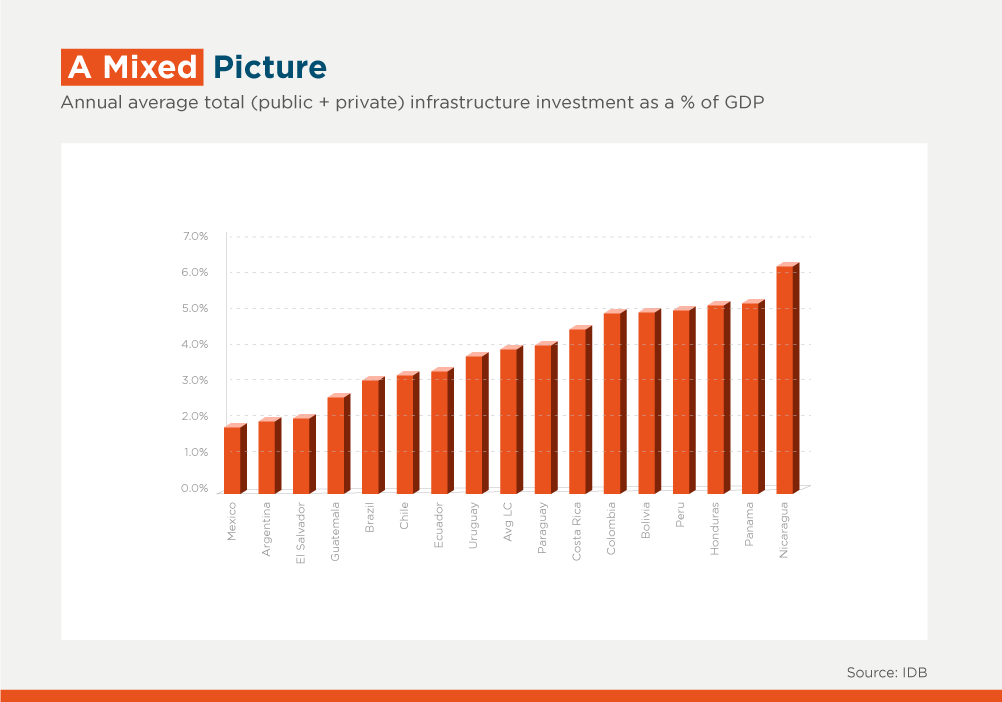

Finally, the impact of the COVID-19 pandemic on infrastructure financing cannot be ignored. According to the World Bank, the investment volume in infrastructure with private involvement in the region showed a 54% year-to-year decline; and these investments flows have always been markedly different from country to country.

While PPP contracts have been subject to compensatory measures, liquidity pressures on a number of operators have resulted in debt renegotiations and contract rebalancing. Not all contracts have met a similar fate, though.

To increase and improve PPP financing conditions, it is clear that the solutions are multidimensional and involve the public and private sectors. These can range from policy measures and regulatory changes to the development of market instruments or modifications in the forecasts at the project / contract level. Especially in the current context, multilateral and regional financial and development institutions have a transformative role in supporting the development and scaling of financial instruments that go beyond traditional debt to address market failures and mobilize resources in accordance with the requirements for this type of project in the region.

Get to know all the panels and plenaries available to you at #PPPAmericas2021and be part of this important conference in #LAC. On December 9 and 10, do not miss the live broadcast from the Palácio dos Bandeirantes, in São Paulo, #Brazil! Take advantage and secure your spot in PPP Americas 2021. Register here

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe