Sustainability in Agribusiness (2): Cultivating Good Governance Practices

The agribusiness sector is vital for the economic recovery in Latin America and the Caribbean (LAC), as it accounts for 5% of the region’s gross domestic product and employs 14% of its workforce. And yet it faces very specific challenges, including those related to family-owned businesses, that are little known by the general public.

In recent years, most agribusinesses within Latin America and the Caribbean (LAC) have experienced an increase in complexity, competitiveness, and market demands. Investors, creditors, end consumers, and stakeholders have stressed their requirements for rural businesses to implement or enhance governance processes as a fundamental factor for their success. Well-established governance practices are fundamental in assisting agricultural companies juggling the various factors relevant to this sector, such as productivity, technology, logistics, commercial policies, and environmental regulation.

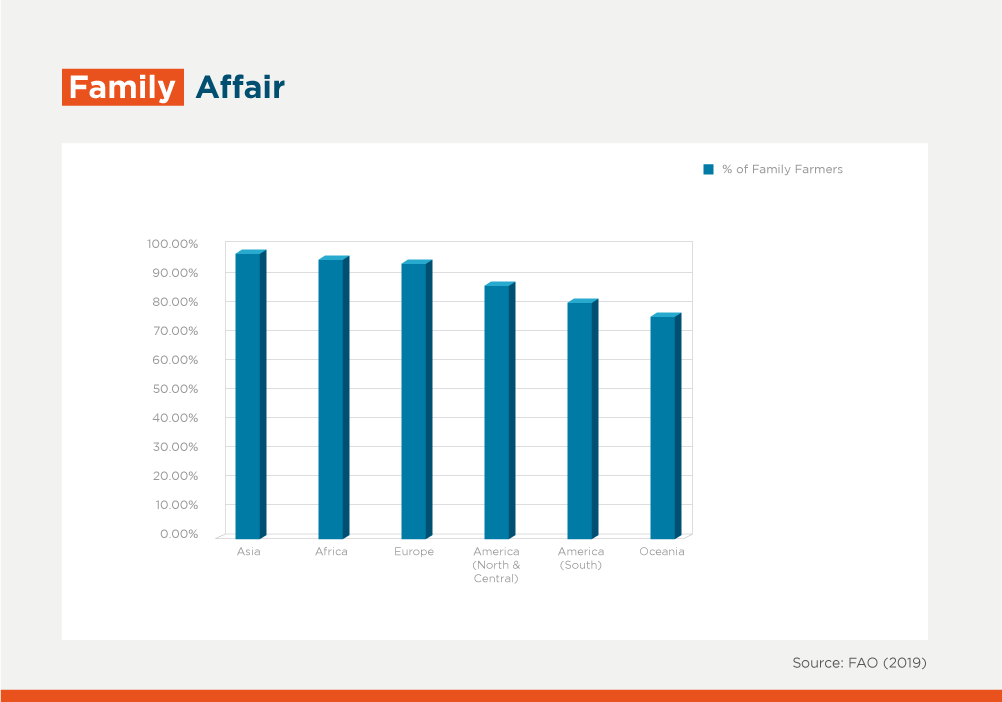

On a broader level, corporate governance provides the tools for organizing a company’s corporate structure, identifying and managing risks. But it must have the specific context in mind, since four of each five farms in the region are family-owned.

This means that formalizing the different roles of family members as shareholders, board members, and managers is key. However, the development of a sound governance framework in agribusiness has not been uniform: while, as a rule, the aspects concerning transparency and compliance have received increased attention by the market, the governance mechanisms regulating the internal relationships of power and the alignment of interests are still underdeveloped, posing a greater risk when the company faces a succession process.

As a rule, less than one third of family businesses make it to the second generation, and another half does not survive the next transition from second to third generation. This is mainly because these companies do not have a structure of pre-defined decision-making bodies, levels of authority, rules and agreements governing the management and ownership of the business.

Such frameworks are key to managing the inherent conflicts arising during a succession phase, including different perspectives about the future of the business, expansion of investments, allocation of profits, and appointment of family members to management positions. Succession issues are particularly important in agribusiness, as they may lead to the division of land, reducing productivity and make business less competitive and less resilient.

A capable board of directors is vital to navigating these complex scenarios, not only involving succession, but also sector-specific challenges. A properly formed board – diverse, knowledgeable, experienced – creates a better environment for discussing long-term strategy, bringing to the table relevant topics like innovation, climate, and gender diversity. Additionally, it tends to be aware of potential pitfalls particular to agribusiness such as commodity risk management. In family-owned companies, the board may also help to balance the rational and emotional dimensions of the decision-making process.

An increasing focus on quality and environmental impact, as well as on the concept of “product traceability,” are additional challenges for the sector. Good governance practices grant procedural transparency, bringing comfort to investors and end consumers, building the company’s reputation, and adding value to the business.

One company that can attest to the benefits of adopting good governance practices is Desdelsur. With a 6.6% national market share, it is the main pulse crop production, processing, and export company in Argentina and one of the largest exporters of steers – neutered male cattle – in the country’s northeast region. In 2019, the multigenerational family business approached IDB Invest in search of financial backing for its latest expansion plan and, in the process, embarked on a corporate governance improvement project.

“IDB Invest provided us with the technical expertise, institutional support and work plan needed to tackle governance aspects that required continuous dialogue amongst the family,” said José Macera, Desdelsur founder and CEO. “At first, we feared the changes would make us slow and more bureaucratic, but developing our governance turned our board into an efficient and productive body, capable of addressing complex issues in a strategic and nurturing way.”

Improvements to the Board’s dynamic have permeated into the organizational structure, enhancing communication, and fostering bold conversations about the future. “When managing the different aspects of a family-owned enterprise, it is imperative that the family be the one adapting to the business and not the other way around. Family must never become a bottleneck for growth or innovation,” advises Macera.

This frank and structured conversation is also facilitating Desdelsur’s generational transition. Macera noted that the younger generation has an enormous weight in the company: “I can let go because the dynamics and objectives have been set and they can take charge of the different areas in an orderly way, while I continue my involvement, not as intensively as before, but with my counsel and experience.”

The enhanced framework also allowed Desdelsur to quickly overcome the hurdles brought by the COVID-19 pandemic. “Surprisingly, having impersonal and highly formalized communications channels made it easier to keep in touch while following social distancing protocols,” Macera said.

Another unforeseen result of the technical assistance was an improved ability to supervise the company’s value chain, ensuring compliance with the sustainability and corporate responsibility standards required by foreign markets. “Because of the work we are doing with IDB Invest, top global players we did not know before are reaching out to us because they see Argentina’s agricultural potential and believe we can be the right partners for a venture,” Macera added.

By encouraging its agribusiness clients to upgrade their governance standards, IDB Invest helps them enhance their market leadership, facilitating access to better financing, and promoting the values of transparency, equitable treatment, corporate accountability, and long-term sustainability. In the words of José Macera: “People who go to IDB Invest in search of financing are going to find something much more valuable than a loan.”

LIKE WHAT YOU JUST READ?

Subscribe to our mailing list to stay informed on the latest IDB Invest news, blog posts, upcoming events, and to learn more about specific areas of interest.

Subscribe